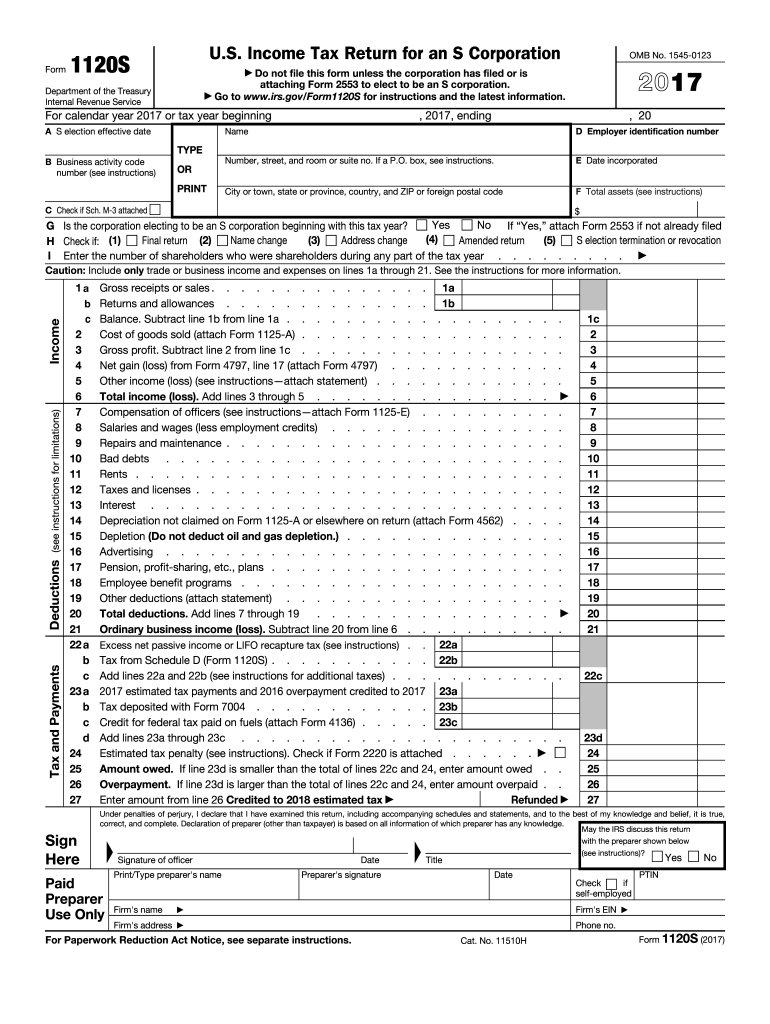

Definition and Meaning of the 1120S 2017 Form

The 1120S 2017 Form serves as the U.S. Income Tax Return for an S Corporation. This document is pivotal for businesses that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Its purpose is to report the income and deductions of the S Corporation for the tax year 2017. This form is distinct from other corporate tax filings as it excludes double taxation, which is typical for C Corporations. The filing serves as the formal method for documenting financial activities and tax liabilities specific to the S Corporation structure.

Steps to Complete the 1120S 2017 Form

-

Gathering Required Information:

- Business name, address, and Employer Identification Number (EIN)

- Details of income, cost of goods sold, and deductions

- Information about shareholders and their ownership percentages

-

Completing the Income and Deduction Sections:

- Report gross receipts or sales, less returns and allowances

- Include total income from various sources and total deductions

-

Filling Schedules:

- Schedule K: Shareholders’ pro rata share of income, deductions, credits, etc.

- Schedule L: Balance sheet per books at the beginning and end of the year

-

Reconciliation of Income:

- Match net income with books and records

-

Final Review and Submission:

- Check calculations and ensure no missing information

- Sign and submit to the IRS by the due date

Key Elements of the 1120S 2017 Form

- Corporate Information: Basic details like the company’s EIN, address, and date of incorporation

- Income and Deductions: Comprehensive sections for detailing gross income, total deductions, and net income

- Shareholder Information: Information about each shareholder’s share of the income, credits, and deductions

- Schedules: Includes detailed listings such as Schedule K for shareholder distributions and Schedule L for assets and liabilities

IRS Guidelines for the 1120S 2017 Form

The IRS provides specific instructions for accurately completing the 1120S 2017 Form. These guidelines highlight eligibility criteria, filing deadlines, and detailed instructions on where and how to report various income and deductions. Businesses must adhere to these guidelines to ensure compliance and avoid potential penalties. Critical areas include ensuring the S Corporation status is valid by having already filed Form 2553 and understanding evident discrepancies addressed in IRS notices.

Filing Deadlines and Important Dates

The 1120S 2017 Form has a specific deadline for submission, typically the 15th day of the third month after the end of the tax year (usually March 15 for calendar year filers). Corporations can apply for a six-month extension using Form 7004 if additional time is needed. Missing these deadlines may result in late filing penalties and increased scrutiny.

Required Documents for the 1120S 2017 Form

Businesses will need to prepare and collect various documents to complete this form accurately:

- Financial statements: Income statement and balance sheet

- Records of shareholder distributions

- Statements showing any credits or deductions

- Previous year's tax return for comparison

Form Submission Methods

The 1120S 2017 Form can be submitted through several channels:

- Online: Using the IRS e-file system which provides a secure and efficient method

- Mail: Paper filing the form directly to the applicable IRS address

- Tax Preparation Software: Programs like TurboTax and QuickBooks that support electronic filing

Penalties for Non-Compliance

Failing to file the form on time or provide accurate information can result in penalties. The IRS imposes a per-shareholder, per-month penalty for late filing. Additionally, incorrect or incomplete returns could lead to fines or more frequent audits. Understanding and adhering to compliance requirements are crucial for maintaining the S Corporation's good standing with tax authorities.