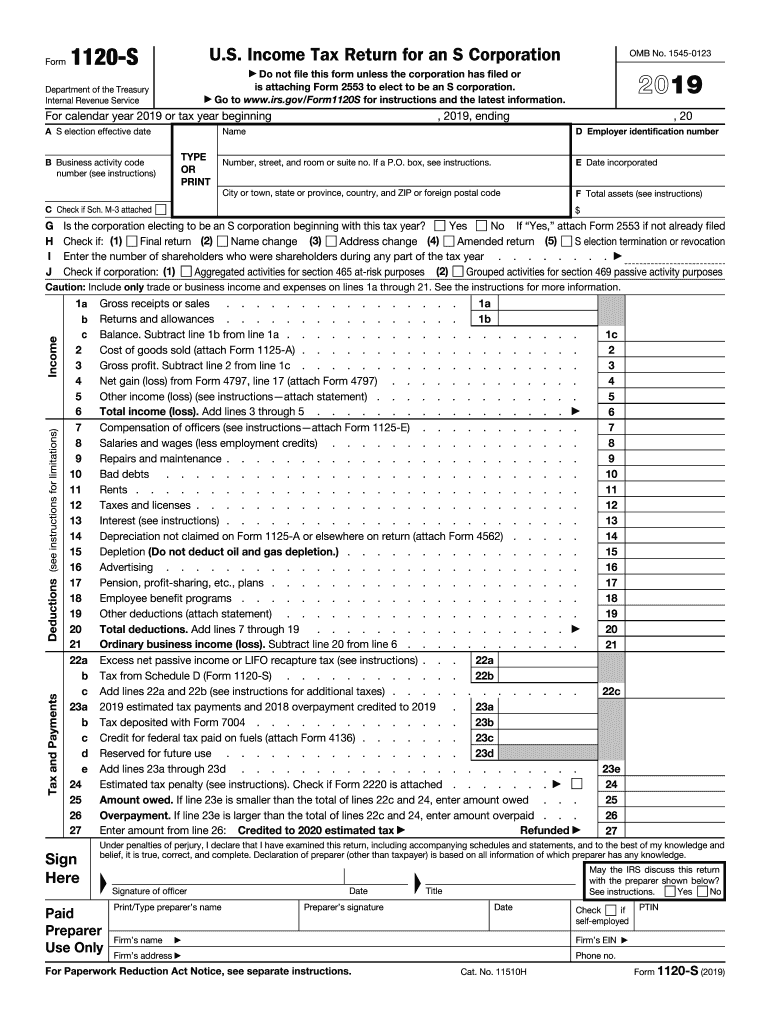

Definition and Purpose of the 2019 Form 1120

Form 1120 is the U.S. Corporation Income Tax Return for corporations. This form is specifically used by C corporations to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS). The 2019 version of Form 1120 includes sections that collect information such as corporate details, income statements, and details regarding any shareholders' investments. It is integral for corporations looking to comply with U.S. tax regulations and accurately report their financial activity.

How to Obtain the 2019 Form 1120

Corporations can easily access the 2019 Form 1120 through the IRS website, where downloadable PDFs are available. Alternatively, tax software providers such as TurboTax and QuickBooks offer the form integrated within their services, allowing for a more seamless filing process. For those preferring a physical copy, the form can also be requested or picked up at an IRS office.

Steps to Complete the 2019 Form 1120

-

Gather Necessary Documents: Before filling out Form 1120, ensure you have all necessary financial documents, including income statements, balance sheets, and documentation of any deductions or credits.

-

Enter Corporate Information: Fill in the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

-

Complete Income and Deductions Sections: Report all income sources, including gross receipts and sales, and subtract returns and allowances. Document any applicable deductions in the provided sections.

-

Record Tax and Payments: Calculate the corporation’s total taxable income after deductions and apply the appropriate corporate tax rate for 2019. Additionally, include any estimated tax payments made throughout the year.

-

Attach Required Schedules: Depending on the corporation's activities, you may need to attach various schedules, such as Schedule C for dividends and Schedule J for tax computation.

-

Sign and Submit: An authorized officer of the corporation should sign the form before submission. Ensure to meet deadline requirements specific to your filing method, be it electronic or via mail.

Key Elements of the 2019 Form 1120

- Corporate Information: Basic data on the corporation's identity.

- Income: Includes gross receipts and sales adjustments.

- Deductions: Lists allowable reductions in taxable income.

- Tax Computation: Determines total tax liabilities for the fiscal year.

- Signatures: Requires an officer’s signature for validity.

IRS Guidelines for the 2019 Form 1120

The IRS provides comprehensive guidelines on how to fill out Form 1120 correctly. These guidelines cover accounting methods, depreciation, foreign tax credits, and more. It is recommended that corporations review these guidelines closely or work with a tax professional to ensure accuracy and compliance.

Filing Deadlines for the 2019 Form 1120

The filing deadline for the 2019 Form 1120 was March 16, 2020, for corporations whose tax year is the calendar year. However, corporations can apply for an extension using Form 7004, which extends the deadline by six months. It is crucial to meet these deadlines to avoid any penalties.

Penalties for Non-Compliance

Corporations failing to file Form 1120 on time may incur penalties. The penalty for late filing is typically 5% of the unpaid tax per month, up to a maximum of 25% of the unpaid tax. Additional penalties may apply for significant underpayment of tax.

Who Typically Uses the 2019 Form 1120

This form is primarily used by C corporations, which are entities separate from their owners. Unlike S corporations or partnerships, C corporations pay income tax at the corporate level and any distributed dividends are taxed again as dividend income by shareholders.

Important Terms Related to 2019 Form 1120

- Gross Receipts: Total revenue from all business operations.

- Dividends: Distribution of profits to shareholders.

- Deductions: Allowable expenses that reduce taxable income.

- Schedule J: Part of the form used to calculate total taxes owed.

- EIN: Employer Identification Number used to identify the corporation.

Business Entity Types and 2019 Form 1120

The form is specific to C corporations. Other business structures, such as S corporations or LLCs, have designated forms like the 1120-S or Form 1065 respectively. Corporations need to ensure they are using the correct form to align with their entity type for proper tax reporting.