Definition & Meaning

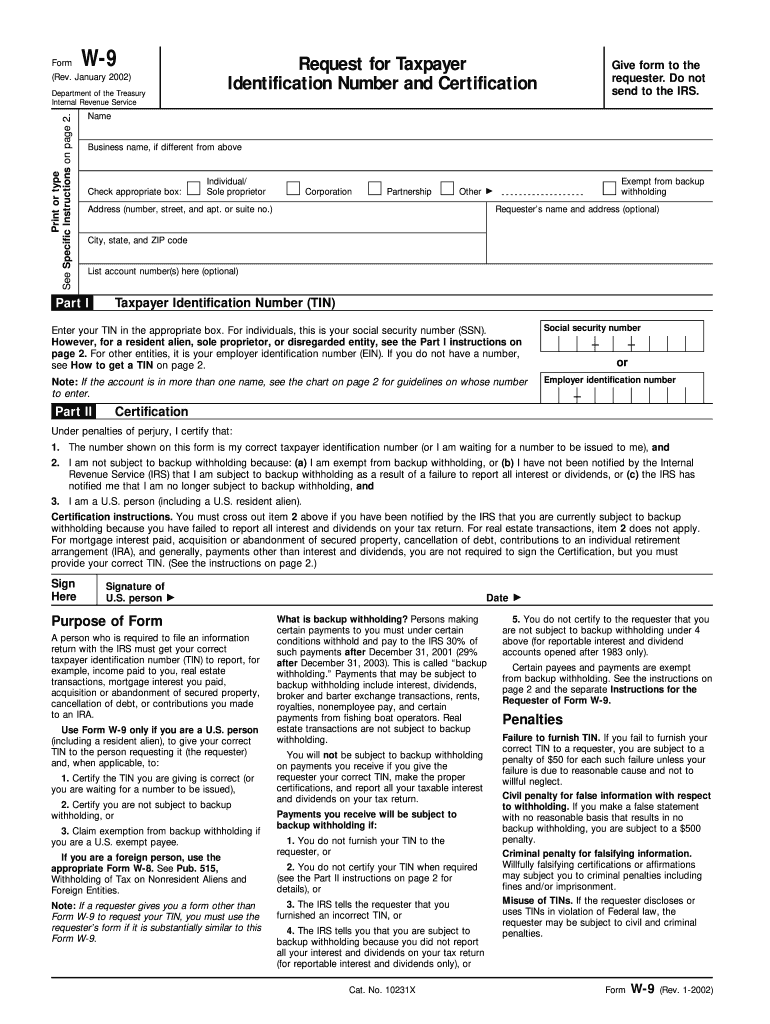

The W-9 form, specifically the "w9 rev 2002 form," is an official IRS document used by U.S. persons to provide their correct taxpayer identification number (TIN) for various financial activities. It serves as a request for taxpayer identification number and certification, vital for income reporting and other financial transactions. Understanding the purpose and structure of this form ensures accurate and compliant financial reporting.

Key Components of the W-9 Form

- Personal Identification: Includes areas for your name, business name (if applicable), and address.

- Taxpayer Identification Number: This crucial section requires a Social Security Number (SSN) or Employer Identification Number (EIN).

- Certification: Signature section to certify the accuracy of the provided information.

How to Use the W9 Rev 2002 Form

Mastering the use of the "w9 rev 2002 form" involves a straightforward approach:

- Request for Information: Entities request this form to record your TIN for IRS reporting.

- Completion: Fill out personal details, TIN, and certify the information.

- Submission: Return to the requester, ensuring they have the necessary data for filing purposes.

Situations for Use

- Independent Contractors: Often complete this form for clients.

- Financial Transactions: Required for brokerage dealings or real estate transactions.

- New Employment: Employers may ask for a W-9 to streamline payroll and tax records.

Steps to Complete the W9 Rev 2002 Form

Comprehensive steps are necessary to complete the "w9 rev 2002 form" accurately:

- Gather Information: Collect personal details and your TIN.

- Fill Personal Details: Input name, business name, and current address.

- Enter TIN: Carefully add your SSN or EIN in the designated area.

- Certification: Sign the form to confirm the information is correct.

Points to Remember

- Accuracy: Double-check all fields for correctness.

- Legibility: Ensure all details are clear and legible.

- Updates: Update any outdated information before submission.

Who Typically Uses the W9 Rev 2002 Form

A range of individuals and entities employs the "w9 rev 2002 form" regularly:

- Freelancers and Contractors: For invoicing purposes with clients.

- Businesses: To manage transactions and payments for non-employees.

- Financial Institutions: When setting up accounts and managing investments.

Use in Different Professions

- Consultants: Common requirement for project-based work.

- Real Estate Brokers: Used to manage commissions and fees.

- Service Providers: Critical for receiving payment from service contracts.

IRS Guidelines

The IRS provides specific guidelines for the "w9 rev 2002 form," ensuring compliance:

- Purpose: The form is strictly for obtaining TINs for reporting purposes.

- Penalties: Misreporting or refusing to submit the form can incur IRS penalties.

- Privacy: While the form requires sensitive information, it is primarily for IRS use and should be submitted directly to the requester.

Common Issues

- Backup Withholding: If incorrect, may result in mandatory withholding.

- Information Updates: Necessary for change in address or TIN.

Penalties for Non-Compliance

Failing to appropriately file or submit the "w9 rev 2002 form" entails consequences:

- Fines: Potential penalties for not providing accurate information.

- Backup Withholding: Incorrect forms may lead to withholding issues.

- IRS Audits: Increased scrutiny for non-compliance in providing required data.

Avoiding Penalties

- Timely Updates: Regularly update personal and tax information.

- Verification: Double-check details before submission to avoid errors.

Examples of Using the W9 Rev 2002 Form

Real-world scenarios highlight how this form functions effectively:

- Contract Work: A graphic designer working with multiple clients needs to provide a W-9 to each for tax purposes.

- Property Rental: An individual renting out properties is required to send tenants a W-9 to document monthly payments.

- Investment Income: Investors earning dividends from brokerage accounts must furnish this form to financial institutions.

Case Studies

- Freelancing Platforms: Used extensively on digital platforms for payment processing.

- Corporate Settings: Necessary for third-party vendors contracted by large companies.

Legal Use of the W9 Rev 2002 Form

Understanding the legal implications of the "w9 rev 2002 form" is critical:

- Tax Reporting: The primary legal purpose is accurate tax reporting to prevent fraudulent activity.

- Identity Verification: The form acts as a legal document for verification in financial transactions.

- Non-US Residents: Generally, non-residents should not submit a W-9 as it is U.S. person-specific.

Legal Considerations

- Form Integrity: Altering the form can lead to legal repercussions.

- Confidentiality: Entities handling W-9s must ensure data protection and confidentiality.

These blocks provide an in-depth look at various aspects of the "w9 rev 2002 form," balancing comprehensive content with usability and context, tailored to meet both informational and practical needs for users familiar with or new to IRS documentation processes.