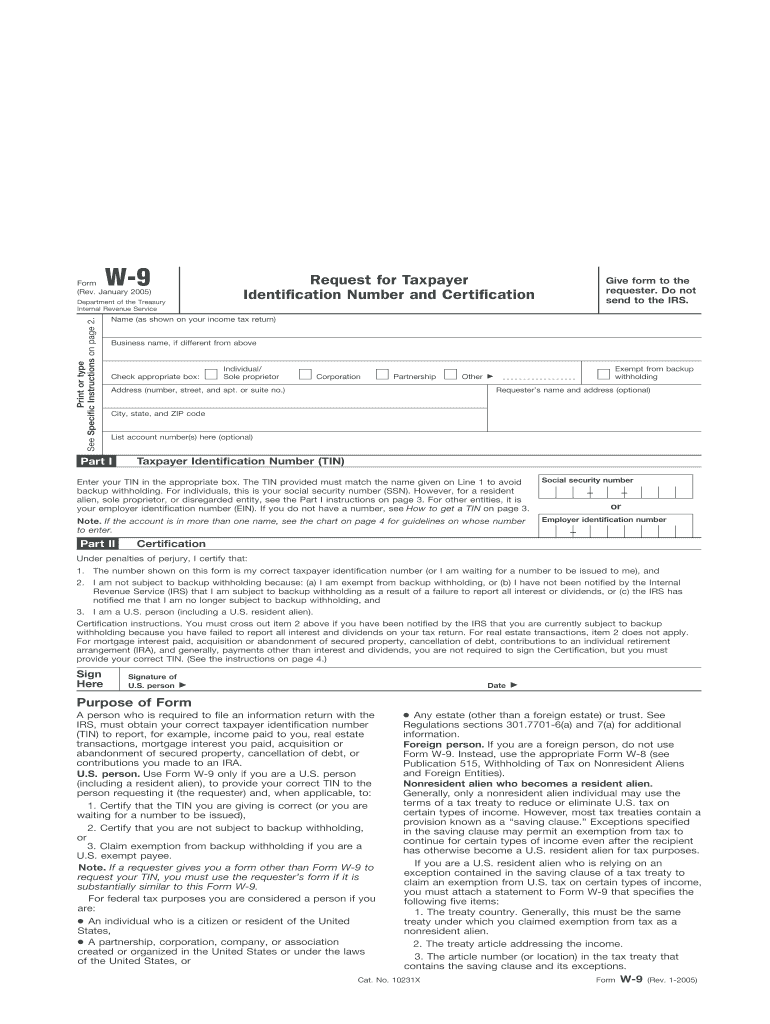

Understanding Form W-9: Definition and Purpose

Form W-9 is a critical document used in the United States for tax reporting purposes. It is officially titled “Request for Taxpayer Identification Number and Certification,” and serves as a means for individuals or entities to provide their Taxpayer Identification Number (TIN) to payers or requesters. This form is often utilized when a business or financial entity is required to report various types of income or other payments to the Internal Revenue Service (IRS). Specifically, Form W-9 is used in contexts such as freelance work, investments, and other forms of non-employee compensation where the recipient does not have taxes withheld by the payer.

Key Elements of Form W-9

When filling out a W-9, several components must be completed carefully to ensure accuracy:

- Name and Business Name: If applicable, write the individual’s full legal name or the business's official name.

- Taxpayer Identification Number (TIN): Provide either a Social Security Number (SSN) for individuals or an Employer Identification Number (EIN) for businesses.

- Federal Tax Classification: Identify the taxpayer's federal tax status, such as individual, corporation, partnership, limited liability company (LLC), etc.

- Exemption Codes: For certain entities, an exemption code might be required if they are exempt from backup withholding.

- Certification: This is a crucial section where the applicant must sign to certify the truthfulness of the information provided.

Each portion of the form is integral to its validity, serving to accurately inform the IRS about taxable income and expenditures.

Steps to Complete Form W-9

Completing a Form W-9 is a straightforward task if you follow the correct steps:

- Gather Required Information: Make sure you have the necessary personal or business details, including TIN.

- Fill Out Personal Details: Enter your name, business name if applicable, and tax classification.

- Provide TIN: Accurately write your SSN or EIN. Double-check this section to avoid errors that could affect tax reporting.

- Complete Tax Classification: Identify whether you are an individual, corporation, partnership, trust, or other categories as specified.

- Sign and Date: Ensure the form is signed to complete the certification. This final step verifies that the provided information is accurate and true.

By following these steps, individuals and businesses can ensure their W-9 form is accurately completed and ready for submission.

IRS Guidelines and Legal Use of the W-9

The IRS requires Form W-9 for an array of payments not subject to withholding taxes. It strengthens compliance by ensuring that income is reported accurately by both the payer and receiver. Adhering to IRS guidelines is crucial for legal and financial reasons:

- Certification of TIN: The IRS uses the W-9 form to verify TINs, which is essential for processing tax-related transactions.

- Backup Withholding: Firms and individuals can avoid unnecessary backup withholding if accurate TINs are provided.

- Legal Certainty: By ensuring compliance with IRS rules through accurate W-9 submission, entities avoid potential legal issues related to misreporting.

Understanding these guidelines ensures that one remains compliant with federal tax responsibilities.

Typical Users of Form W-9

Many individuals and businesses operate in scenarios where form W-9 becomes necessary:

- Freelancers and Contractors: Independent contractors operating without a formal employment agreement often need to submit a W-9 to their clients for tax reporting purposes.

- Financial Entities: Banks and investment firms often require a completed W-9 for tax reporting on interest and dividend payments.

- Company Operations: Corporations, LLCs, and partnerships engaging in the US economy regularly exchange W-9 information to meet IRS mandates.

Recognizing the need for a W-9 in various contexts helps prepare individuals and businesses for proper fiscal interactions.

Taxpayer Scenarios: When and How to Use Form W-9

The W-9 form is applicable in several situations across a broad spectrum of employment and financial transactions:

- Self-Employed Individuals: Solopreneurs providing services to multiple clients often require a W-9 for each contracting party.

- Investors: Individuals receiving dividends or interest from investments use the W-9 for correct TIN reporting to the IRS.

- Partnership Income: Partners in businesses structured as partnerships report their share of the income using a W-9.

These scenarios depict the versatility and critical nature of the W-9 in maintaining clear and compliant tax records.

Penalties for Non-Compliance and Mistakes on the W-9

Failure to properly complete or submit a W-9 can lead to complications:

- Backup Withholding: Incorrect or missing TINs can result in up to 24% of payments being withheld in backup withholding.

- Financial Penalties: Providing false information on the form can lead to monetary fines imposed by the IRS.

- Delayed Transactions: Mistakes or omissions can result in delays for payments and processing, affecting cash flow and financial operations.

Understanding these potential pitfalls emphasizes the importance of accuracy and timeliness when dealing with Form W-9.

State-level Considerations When Using Form W-9

Though Form W-9 is federally mandated, additional state-level considerations may apply:

- State-specific Exemptions: Some states may have unique rules around how and when W-9 forms are submitted.

- Record Keeping: Certain states might require longer retention of W-9 forms for tax compliance verification.

- Backup Withholding Variances: States can impose their own withholding requirements, which can affect overall compliance strategies.

Awareness of these nuances ensures that taxpayers are wholly compliant with both federal and state tax obligations.

By focusing on these specific areas, individuals and businesses can ensure they complete and use Form W-9 accurately, aligning with both legal requirements and tax efficiency strategies.