Definition and Meaning of the 1993 Form

The 1993 form, officially known as the "1993 Tax Year Return," serves as a crucial document used during the annual tax filing process. This form is primarily utilized by taxpayers in the United States to report their income, calculate their tax liability, and claim any potential refunds or credits. It includes various sections that capture pertinent financial information, including wages, dividends, and other income types.

Understanding the 1993 form is essential for accurate tax reporting, as it outlines the taxpayer's responsibilities and rights. Accurate completion of this form ensures adherence to the guidelines set forth by the Internal Revenue Service (IRS), thereby avoiding potential penalties. Moreover, the form contains specific instructions on how to report income from various sources, making it a vital reference for individuals and businesses alike.

This form is structured to accommodate different taxpayer scenarios, including individual taxpayers, self-employed individuals, and corporations. It offers a comprehensive approach to tax filing, denoting various deductions and credits taxpayers may qualify for, thus impacting their overall tax obligation.

How to Obtain the 1993 Form

Acquiring the 1993 form is straightforward. Taxpayers can obtain this essential document through several methods:

-

IRS Website: The IRS provides downloadable and printable versions of the 1993 form directly from its official website, ensuring that taxpayers can access the most current and accurate version.

-

Tax Preparation Software: Many popular tax preparation programs, like TurboTax and H&R Block, have integrated the 1993 form into their systems. Users can fill out the form electronically by inputting their financial data directly into the software.

-

Local IRS Offices: Taxpayers can visit their local IRS office to request a physical copy of the 1993 form. It's advisable to check the office's availability and hours before making a trip.

-

Tax Professionals: Consulting a certified tax professional or accountant is another effective way to obtain the 1993 form. They can assist not only in obtaining the form but also in completing it accurately.

These options ensure that all taxpayers have access to the 1993 form, facilitating a smoother tax filing process.

Steps to Complete the 1993 Form

Completing the 1993 form requires careful attention to detail and adherence to IRS guidelines. Here are the essential steps to accurately fill out the form:

-

Gather Required Documents: Before starting, compile all necessary documents, including W-2s, 1099s, and other income-related records. These documents contain crucial information that will be needed to fill out various sections of the form.

-

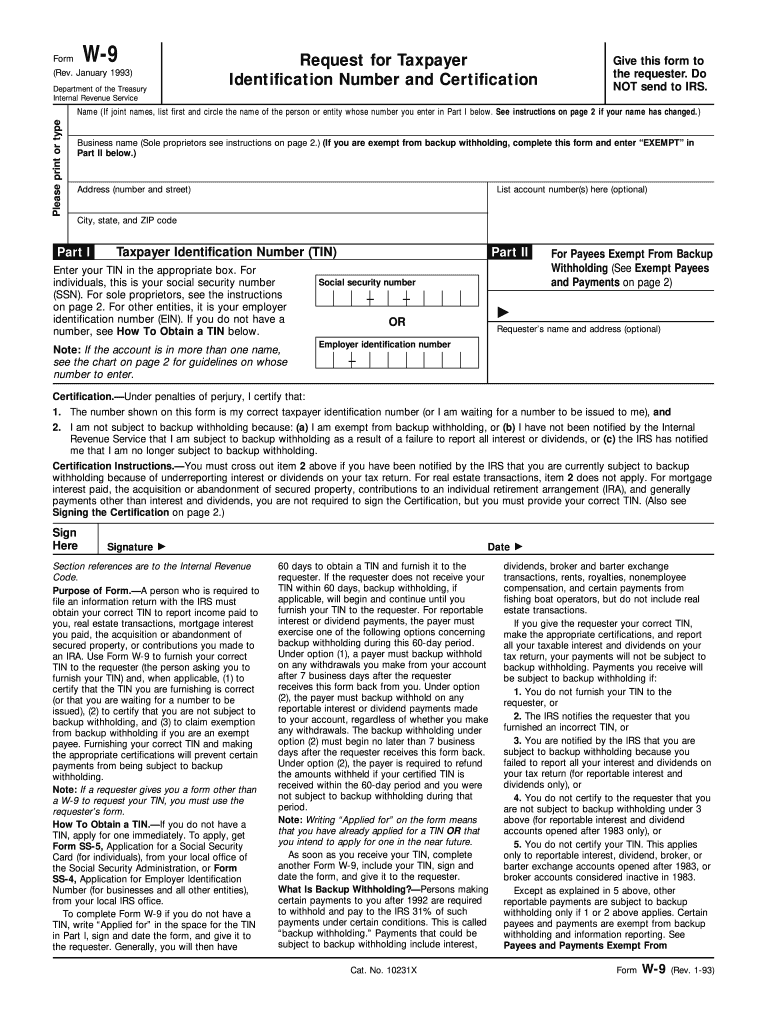

Fill Out Personal Information: Begin by entering personal information such as your name, address, and Social Security number. Ensure that this data matches the information on your official identification documents.

-

Report Income: Use the financial records gathered to report all sources of income. This section may include wages, business income, dividends, and capital gains. Ensure all figures are accurate and match the documents provided.

-

Deductions and Credits: Identify any deductions and credits applicable to your situation. Common deductions include mortgage interest, medical expenses, and charitable contributions. Enter these in their designated sections on the form.

-

Calculate Tax Liability: Follow the provided instructions to calculate your total tax liability based on the income reported and the deductions claimed. This step may require additional worksheets or calculations.

-

Review and Sign: After completing the form, review all entries for accuracy. Check for any discrepancies or missing information. Once everything is verified, sign and date the form.

Following these steps ensures proper completion of the 1993 form, helping to minimize errors and potential issues with the IRS.

Who Typically Uses the 1993 Form

The 1993 form is commonly utilized by a diverse range of taxpayers, each using it to meet their individual tax obligations. Typically, the following groups would need to complete this form:

-

Individual Taxpayers: Most individual filers, including those who are self-employed or have multiple income sources, will need to file the 1993 form to report their earnings accurately.

-

Small Business Owners: Small business owners and entrepreneurs use the 1993 form to report their business income and associated expenses, making it essential for those who file taxes as sole proprietors.

-

Corporations: Corporations, particularly those that must report income and expenses for the tax year, frequently file the 1993 form to comply with IRS regulations.

-

Non-Profit Organizations: Certain non-profits, which might be required to report their income from various sources, also find the 1993 form essential.

Understanding who typically uses the 1993 form is crucial for ensuring compliance with tax regulations and accurately reporting income.

Key Elements of the 1993 Form

The 1993 form consists of several key elements, each vital for comprehensive reporting and accurate tax processing:

-

Personal Information: This section captures essential data regarding the taxpayer and their dependents, including Social Security numbers, addresses, and marital status.

-

Income Reporting: Detailed sections are provided for reporting various income types, such as wages, interest, dividends, and business profits. Accurate reporting in this section is critical for calculating overall tax liability.

-

Deductions and Adjustments: Taxpayers can claim specific deductions, which reduce their taxable income. The form includes spaces for commonly claimed deductions, such as student loan interest and retirement plan contributions.

-

Tax Credits: This section allows taxpayers to claim available tax credits that can directly reduce the amount owed, enhancing the likelihood of a tax refund.

-

Signature Line: The form includes a space for the taxpayer’s signature, confirming the accuracy of the information reported and indicating acceptance of responsibility for the tax return.

These elements ensure the form captures all necessary information for the IRS to process the tax return efficiently.