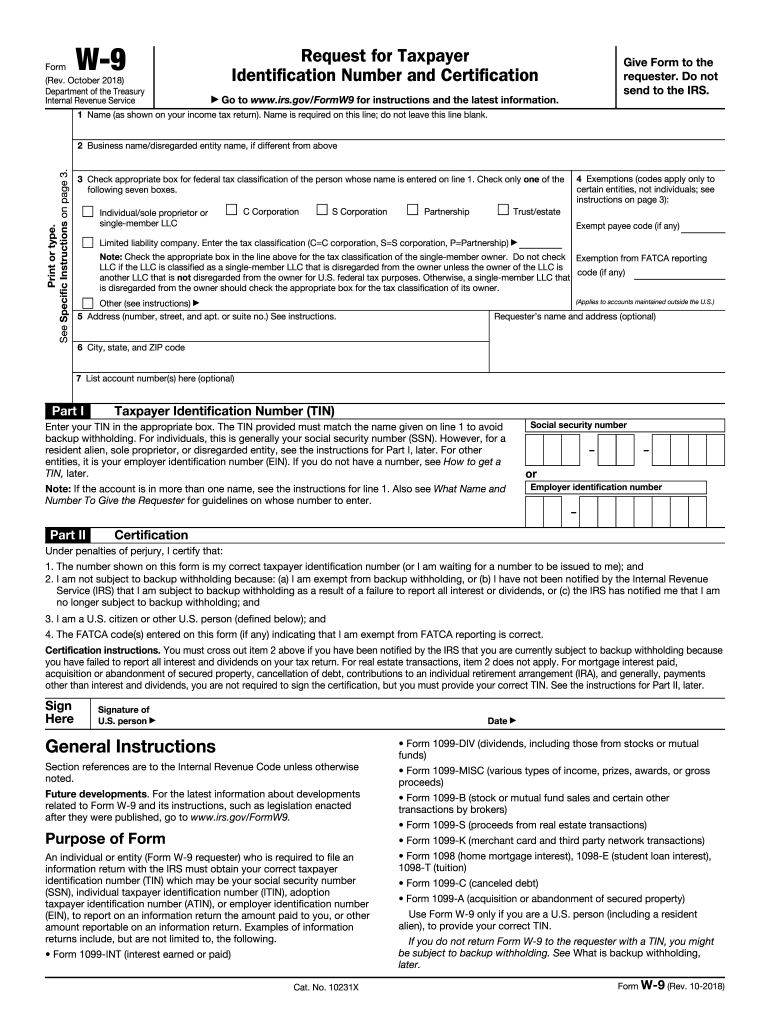

Definition and Meaning of the W-9 Form 2022

The W-9 form, officially titled "Request for Taxpayer Identification Number and Certification," serves a pivotal role in the U.S. financial landscape. Its primary purpose is to collect a taxpayer’s identification number (TIN), which is required for tax reporting obligations. This form is predominantly used in transactions involving independent contractors or freelancers, attributing earnings correctly to the taxpayer. To ensure contracting entities have essential tax data, the W-9 captures critical details like name, address, and TIN. Without accurate completion, it heightens the risk of penalties and potential complications with the Internal Revenue Service (IRS).

Key Elements of the W-9 Form 2022

The 2022 iteration of the W-9 form encompasses specific fields designed to streamline tax reporting:

- Taxpayer Identification Number (TIN): A crucial element, the TIN could either be a Social Security Number (SSN) for individuals or Employer Identification Number (EIN) for businesses.

- Personal Information: Name and address fields facilitate verified legal and contact information for the concerned taxpayer.

- Federal Tax Classification: This section demarcates the taxpayer’s classification, be it individual/sole proprietor, corporation, partnership, or a different entity type.

- Certification: Signature section authenticates the accuracy of the data and compliance with IRS mandates concerning backup withholding and FATCA reporting.

How to Use the W-9 Form 2022

Utilizing the W-9 effectively requires understanding its facilitation in financial dealings. Typically, when a taxpayer receives payment that necessitates IRS reporting—such as over $600 for independent contracting work—they are obliged to fill out and submit a W-9 to the payer. The information on the W-9 helps the payer complete the 1099 form at year-end, documenting payments made. A notable point is that completing a W-9 doesn’t automatically result in tax withholding unless dictated by backup withholding requirements.

Importance of Precision

Attention to detail is paramount when completing the W-9. Errors in the taxpayer information can result in withholding issues or misallocated tax responsibilities. Moreover, because the W-9 discloses sensitive information, safeguarding against unauthorized disclosure is a significant consideration for both taxpayer and payer entities. Typically, W-9 forms are exchanged directly and securely between involved parties.

How to Obtain the W-9 Form 2022

Acquiring the W-9 form is straightforward, ensuring adherence to IRS protocols:

- Download Directly: The W-9 form is available for download on the IRS website.

- Software and Tax Platforms: Access via accounting software such as TurboTax or QuickBooks, which often include it in their document libraries.

- Direct Request: Payers may provide a copy if they request taxpayer information for reporting.

Use in Virtual Platforms

For digital transactions, using PDF editors like DocHub can facilitate online filling, ensuring rapid completion and submission. Digital handling of the W-9 is a practical solution, aligning with modern, paperless work environments.

Steps to Complete the W-9 Form 2022

Completing the W-9 form involves several precise steps:

- Enter Personal Information: Fill in the full name and business name if applicable.

- Select Federal Tax Classification: Tick the box corresponding to your tax entity type.

- Provide TIN: Accurately enter the Social Security Number or Employer Identification Number.

- Address Completion: Detail your current address for contact purposes.

- Certify the Form: Sign and date the form to attest the information’s truthfulness.

Compliance Assurance

Before submission, verifying each detail can avert errors leading to IRS penalties. Addressing all sections completely assures the payer of the taxpayer's compliance status, thereby avoiding backup withholding scenarios.

Importance of the W-9 Form 2022

The W-9 form holds critical importance in maintaining fiscal responsibility. It:

- Facilitates IRS tax reporting

- Ensures correct income reporting by both parties

- Mitigates backup withholding contingencies, which occur if exact TINs aren’t provided

Influence on Business Practices

In businesses heavily reliant on freelancers or independent contractors, the W-9 becomes a continual part of vendor onboarding and bookkeeping processes, thus influencing operational practices.

Who Typically Uses the W-9 Form 2022?

Several entities primarily engage with the W-9:

- Independent Contractors/Freelancers: To report self-employment income accurately.

- Small to Medium Enterprises: Document payments to contracted labor or consultancy engagements.

- Financial Institutions: For certain investment income reporting, establishing account tax residency status.

Differentiation from Other Forms

It differs from W-4, which governs employee withholding, by catering to independent income channels, thus highlighting its relevance across industries engaging non-employee services.

Legal Use of the W-9 Form 2022

The legal usage of the W-9 form is paramount for federal compliance:

- Authentication of TIN: Ensures financial transactions carry legal acknowledgment against potential audits.

- Backup Withholding Prevention: Accurately completed W-9 forms prevent default withholding scenarios.

- Adherence to IRS Guidelines: Maintains the integrity of payment reporting and taxation procedures.

Risk of Incorrect Information

Providing incorrect or fraudulent information on a W-9 can induce penalties, emphasizing the importance of exactness and honesty in disclosures.

IRS Guidelines for the W-9 Form 2022

The IRS stipulates specific guidelines for W-9 form processing, critical for accurate tax reporting mechanics:

- Submission Upon Request: The form is to be completed and submitted whenever requested by a payer for reportable transactions.

- Update Necessity: Taxpayer must submit a new form if changed circumstances affect information accuracy (e.g., change in business structure or TIN).

- Deadline for Payers: Payers often need the W-9 for timely 1099 issuance and IRS filing.

Instructions and Official Documentation

Referencing the IRS publication regularly helps taxpayers and payers remain compliant with current legal frameworks and regulations surrounding information reporting standards.

These blocks, through a thorough examination, provide a holistic view of the W-9 form, emphasizing its fundamental role in the domestic financial lattice while showcasing the utility, compliance, and submission dynamics therein.