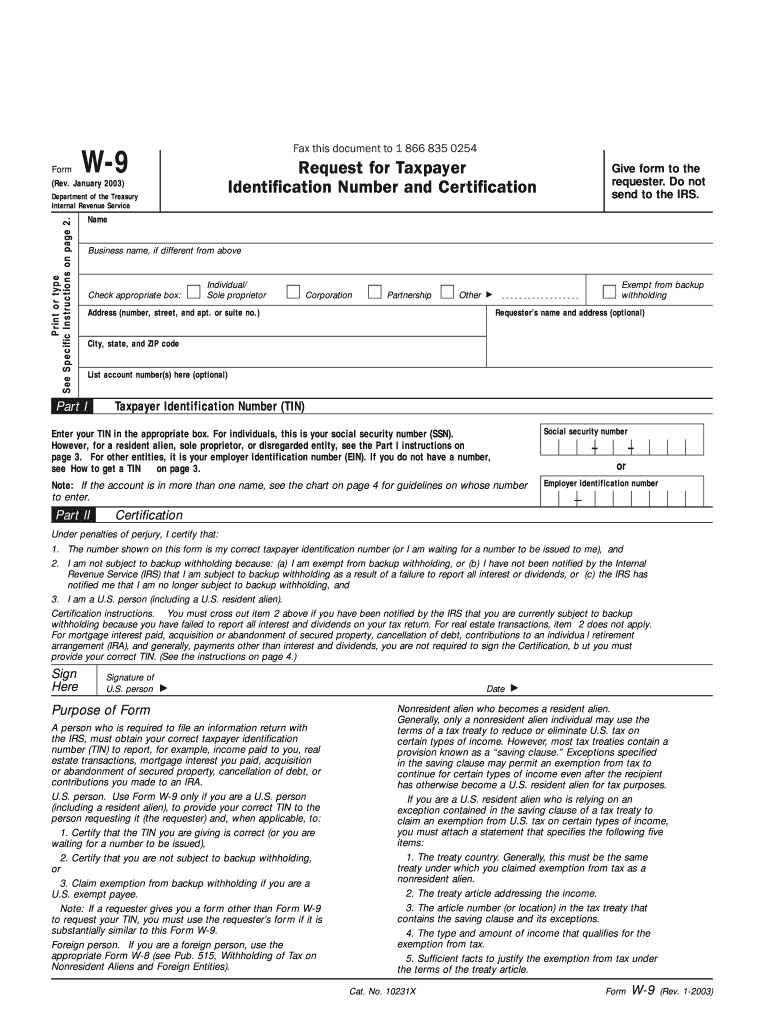

Definition and Purpose of the Blank W-9 Form

The blank W-9 form is an official document used in the United States by individuals and entities to provide their Taxpayer Identification Number (TIN) to another party. This form is crucial for tax purposes as it facilitates the reporting of income paid to contractors, freelancers, and other payees to the Internal Revenue Service (IRS). The information captured in the W-9 includes the name, business name (if applicable), TIN, and address of the taxpayer.

- The primary purpose of the blank W-9 form is to ensure correct reporting of income and tax-related information, thereby requiring individuals and businesses to provide accurate TINs.

- It serves as a certification that the information provided is truthful and that the taxpayer is not subject to backup withholding, under certain conditions.

How to Use the Blank W-9 Form

Understanding how to effectively utilize the blank W-9 form is essential for individuals and businesses that engage in transactions requiring tax information exchange. The process typically involves the following steps:

- Obtain the Form: Acquire a blank W-9 form, which can be easily downloaded from various resources online.

- Complete the Required Fields: Fill in personal information, including name, business name (if applicable), TIN, and address.

- Certification: Sign and date the form to certify the accuracy of the information provided.

- Submit the Form: Send the completed W-9 form to the requesting entity, such as a client or employer, ensuring that it is kept confidential before submission.

Using the W-9 form correctly is vital for compliance with IRS requirements.

Steps to Complete the Blank W-9 Form

Filling out the blank W-9 form requires attention to detail to ensure compliance. Here are the detailed steps:

-

Personal Information:

- Enter your name as it appears on your tax return.

- If applicable, include your business name.

-

Tax Classification:

- Select the appropriate classification from the provided options such as individual, corporation, or LLC.

- If you are exempt from backup withholding, specify your exemption code.

-

Taxpayer Identification Number:

- For individuals, provide your Social Security Number (SSN).

- Businesses will need to enter the Employer Identification Number (EIN).

-

Address Information:

- Fill in your current business or home address to ensure accurate receipt of tax documents.

-

Signature and Date:

- Sign and date to certify that the information is true to the best of your knowledge.

-

Submission:

- Depending on the requestor's instructions, submit the form electronically or by mail.

Following these steps ensures that you comply with IRS regulations and avoid potential penalties.

Who Typically Uses the Blank W-9 Form?

The blank W-9 form is widely utilized by various entities, including:

- Freelancers and Independent Contractors: They often provide the W-9 to clients to facilitate the reporting of income received.

- Businesses: Corporations and partnerships use the W-9 to collect and report TINs for vendors and service providers.

- Financial Institutions: They request W-9 forms from account holders to comply with tax reporting requirements.

- Real Estate Transactions: Individuals engaged in rental or property sales may need to submit a W-9.

Understanding who uses this form helps clarify its significance across different sectors.

Important Terms Related to the W-9 Form

Familiarity with the terminology associated with the blank W-9 form can aid users in completing the form accurately:

- Taxpayer Identification Number (TIN): This is a unique identification number assigned to individuals and businesses for tax purposes.

- Backup Withholding: A tax withholding requirement for certain types of payments if the recipient fails to provide valid TINs.

- Form Requestor: The person or entity that requests the recipient to fill out the W-9 for tax reporting purposes.

- IRS: The Internal Revenue Service, which governs tax regulations and requirements in the United States.

Knowing these terms can enhance comprehension and effective use of the W-9 form.

IRS Guidelines for Using the W-9 Form

Compliance with IRS guidelines regarding the blank W-9 form is essential to avoid issues with tax reporting. Key points include:

- The form must be filled out truthfully, with accurate TINs provided to ensure no penalties or audits arise from misinformation.

- The IRS doesn't require individuals to submit the W-9 directly, but the submitting entity must keep the form for their records and provide it to the IRS when necessary.

- There are no filing deadlines for the W-9 itself, but the information must be submitted promptly, indicating to payees when they should expect to report income.

Familiarity with IRS guidelines helps ensure the proper utilization of the W-9 form and compliance with tax obligations.

Penalties for Non-Compliance with W-9 Requirements

Failing to adhere to W-9 requirements can result in significant penalties:

- Backup Withholding Penalties: If a W-9 is not provided and a TIN is not on file, the paying entity may need to withhold a percentage of payments and report it to the IRS.

- Fines for Incorrect Information: Providing a false TIN or failing to report complete information may lead to fines imposed by the IRS.

- Audits: Inadequate documentation of who received payments can trigger IRS audits, resulting in additional scrutiny and potential penalties.

Understanding these penalties emphasizes the importance of accurate and timely completion of the W-9 form.

Examples of Common Situations Requiring a W-9 Form

Several scenarios typically necessitate the use of the blank W-9 form:

- Freelance Work: A graphic designer hired by a company must submit a W-9 to report income accurately to the IRS.

- Consulting Services: A business consultant providing services to a corporation will likely be asked for a W-9 so the corporation can report payments made.

- Real Estate Transactions: A landlord may request a W-9 from tenants to ensure accurate record-keeping for tax purposes related to rental income.

Recognizing these examples helps clarify the practical applications of the W-9 form in various professional contexts.