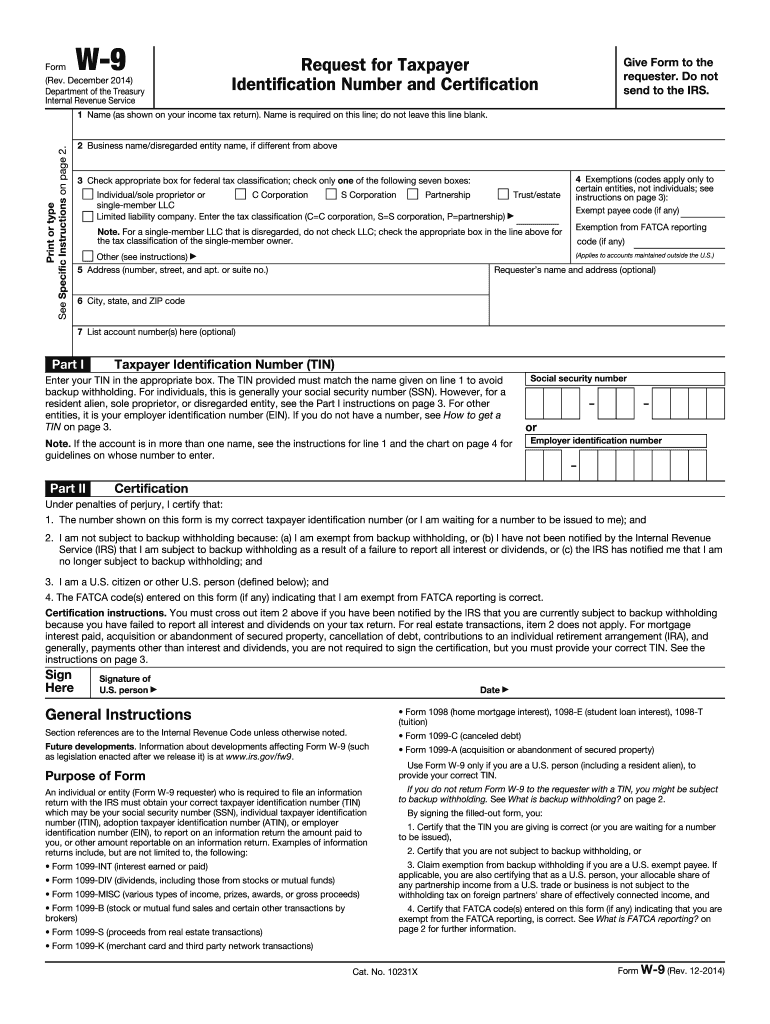

Definition & Purpose of Form W-9 2014

Form W-9 for 2014 is primarily utilized by U.S. taxpayers to provide their correct Taxpayer Identification Number (TIN) to entities required to file information returns with the IRS. The form plays a key role in preventing backup withholding on payments made to individuals or entities by ensuring that accurate TINs are provided. It is a crucial document for tax reporting, encompassing sections for personal details, tax classification, exemptions, and certification of accuracy. By preparing this form correctly, individuals and businesses can help ensure compliance with federal tax regulations and avoid any potential withholding issues.

How to Use Form W-9 2014

Using Form W-9 in 2014 requires clarity on its components and the contexts in which it might be necessary. This form should be filled out and submitted when requested by a client or company that will be reporting payments to the IRS. For instance, if you are an independent contractor, a client may need your W-9 to report payments under information returns like the 1099-MISC. It is vital to ensure that all information provided on the form is accurate and up-to-date to avoid complications during tax filing.

Key Steps in Using Form W-9 2014

- Complete Personal Information: Include your name as shown on your tax return, business name if different, and the appropriate tax classification.

- Provide TIN: This could be your Social Security Number (SSN) or Employer Identification Number (EIN), depending on whether you're an individual or a business entity.

- Certification: Sign and date the form to certify the information is correct under penalties of perjury.

Steps to Complete Form W-9 2014

Filling out Form W-9 requires careful attention to detail. Here's a step-by-step guide:

- Enter Your Name: Use your full legal name as shown on your tax return.

- Business Name or Disregarded Entity Name: If applicable, include your business name.

- Federal Tax Classification: Select the correct federal tax classification for your entity, such as Individual/Sole Proprietor, Partnership, Corporation, etc.

- Exemptions: Identify any exemptions such as from backup withholding or FATCA reporting if applicable.

- Address: Provide your mailing address to ensure accurate processing.

- TIN: Input your SSN or EIN.

- Sign the Form: Certify the form by signing and dating it, acknowledging that the information provided is accurate.

Key Elements of Form W-9 2014

- Name and Business Name: The taxpayer's legal name and any additional business name.

- Tax Classification: Tick the applicable box to reflect your legal status, such as corporation, partnership, LLC, or individual/sole proprietor.

- TIN: Your TIN is essential for the IRS to match records accurately.

- Exemption Codes and FATCA: Provide if necessary for your entity.

- Certification: An affirmation of the authenticity of the information given.

Important Terms Related to Form W-9 2014

- Backup Withholding: A situation where entities may be required to withhold tax from payments if the correct TIN is not provided.

- TIN: Taxpayer Identification Number, necessary for tax reporting.

- FATCA: Foreign Account Tax Compliance Act; relevant for individuals or entities with certain foreign financial assets.

- Disregarded Entity: A business entity without separate tax status from the owner.

Who Typically Uses Form W-9 2014

Form W-9 is predominantly used by:

- Independent Contractors: To provide TIN information to employers who will issue a 1099-MISC.

- Freelancers: Ensuring tax records are appropriately reported.

- Business Owners: When receiving income that will be reported to the IRS.

- Financial Institutions: Collecting TINs for accounts requiring IRS reporting.

Legal Use of Form W-9 2014

The legal framework around Form W-9 enforces the requirement of providing accurate taxpayer information, which aids in the prevention of tax evasion through strict IRS guidelines. Incorrect or false information on a W-9 could result in penalties or fines. The form serves as a preventive measure against tax non-compliance by verifying that payers have the correct details needed for annual tax returns.

IRS Guidelines for Form W-9 2014

According to IRS guidelines, it is crucial that information provided on Form W-9 is current and correct to avoid issues such as inappropriate backup withholding. Entities and individuals should ensure that they only submit the W-9 when officially requested to verify income reporting and compliance with tax obligations.

Common IRS Rules:

- Form W-9 must be completed when requested, or the payer might withhold a portion of your pay for federal taxes.

- The accuracy of the TIN is fundamental in preventing discrepancies in tax reporting.

- Timely submission by individuals to entities is essential to ensure smooth processing and compliance.