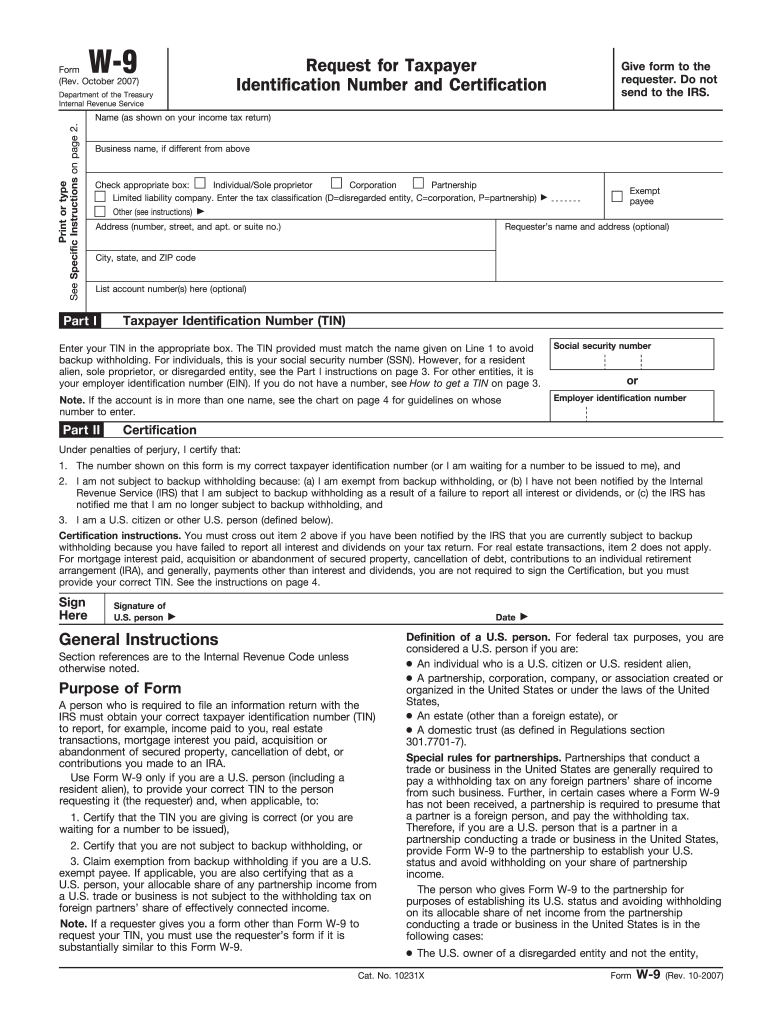

Definition and Purpose of the 2007 W-9 Form

The 2007 W-9 form is a crucial document that allows U.S. persons to provide their correct Taxpayer Identification Number (TIN) to entities that require it for income reporting purposes. Typically used by independent contractors, freelancers, and businesses, the W-9 form facilitates compliance with IRS regulations by ensuring that the correct TIN is supplied to those who will report income payments to the IRS. The completed form includes essential personal information such as name, business name (if applicable), address, and TIN, along with certifications related to tax withholding and exemption status.

The purpose is multi-faceted:

- Tax Compliance: Ensures taxpayers report the correct TIN to avoid penalties or backups in withholding.

- Income Reporting: Assists organizations in reporting payments to the IRS accurately.

- Verification of Identity: Acts as a safeguard to confirm the identity of the individual or entity receiving payments.

How to Obtain the 2007 W-9 Form

Obtaining the 2007 W-9 form is a straightforward process, as it is readily available through a variety of channels. There are a few primary methods to access this form for completion:

- IRS Website: The 2007 version of the W-9 form can be downloaded directly from the IRS website, ensuring that you have the official and most current version.

- Tax Preparation Software: Various tax preparation programs, such as TurboTax and H&R Block, often include access to the W-9 form, making it easier for users to complete and submit the necessary documentation.

- Accountants and Tax Advisors: Many accountants and tax professionals can provide the form to clients, often guiding them through the process of completion and submission.

Additionally, it is essential to ensure that you are using the correct version of the form, as using an old version may result in issues with compliance and acceptance.

Steps to Complete the 2007 W-9 Form

Completing the 2007 W-9 form involves several straightforward steps that ensure accurate information is submitted:

- Provide Personal Information: Fill in your full name and business name, if applicable. This should match the name registered with the IRS.

- Enter Your Address: Include a complete mailing address where you can receive correspondence related to tax matters.

- Input TIN: Enter your TIN, which can be your Social Security Number (SSN) or Employer Identification Number (EIN), depending on your status as an individual or business entity.

- Certification Sections: Review and complete the certification by checking the appropriate boxes and signing the form. This section confirms that the TIN provided is accurate and that you are a U.S. person.

- Submit the Form: Send the completed W-9 form to the requestor who needs it for their records.

By following these steps, you can ensure that the W-9 form is correctly filled out and submitted, minimizing the risk of errors or delays.

Who Typically Uses the 2007 W-9 Form

The 2007 W-9 form is commonly used by a variety of individuals and entities involved in different types of financial transactions. Key users include:

- Independent Contractors: Freelancers and self-employed individuals who provide services often need to complete a W-9 for clients or organizations that will issue a 1099 form at year-end.

- Businesses: Corporations and partnerships that require accurate tax information for vendors and contractors to report payments made to them.

- Real Estate Transactions: Individuals and businesses involved in real estate transactions may require a W-9 to report rental income or property transactions to the IRS.

- Financial Institutions: Banks and credit unions often request a W-9 form from account holders or loan applicants to report interest income.

Understanding the primary users of the form helps clarify its relevance in various transactions and ensures that those involved are aware of their tax obligations.

Important Terms Related to the 2007 W-9 Form

When dealing with the 2007 W-9 form, it is crucial to be familiar with specific terminology associated with its use. Understanding these key terms can help alleviate confusion and promote compliance:

- Taxpayer Identification Number (TIN): The number used by the IRS to identify taxpayers. This can be an SSN for individuals or an EIN for businesses.

- Backup Withholding: A tax withholding requirement that applies when a payee has failed to provide a valid TIN or has been notified by the IRS that they are subject to withholding.

- Certification: The declaration made by the individual completing the W-9, confirming that the provided TIN is correct and that they are a U.S. person.

- Form 1099: A tax form used to report various types of income other than wages, salaries, and tips, often generated based on the information found on the W-9.

These terms encapsulate essential concepts that relate to the use of the 2007 W-9 form, promoting a better understanding of its function and implications in tax reporting.

Legal Use of the 2007 W-9 Form

The legal framework governing the 2007 W-9 form is primarily dictated by IRS regulations, which dictate how taxpayer information is collected, reported, and utilized. Using the form legally encompasses several important aspects:

- Compliance with IRS Regulations: The W-9 form must be completed accurately to ensure compliance with federal tax laws and to avoid potential penalties related to improper reporting or TIN mismatches.

- Privacy Considerations: When submitting a W-9 form, the requestor must protect the personal information contained within to prevent misuse or identity theft. This falls under privacy and data protection laws.

- Record-Keeping: Recipients of a completed W-9 should keep records of the forms for tax purposes, maintaining the required documentation to substantiate payments reported to the IRS.

Understanding the legal implications of the W-9 form can help individuals and businesses navigate their responsibilities effectively while reducing the risk of challenges related to compliance.