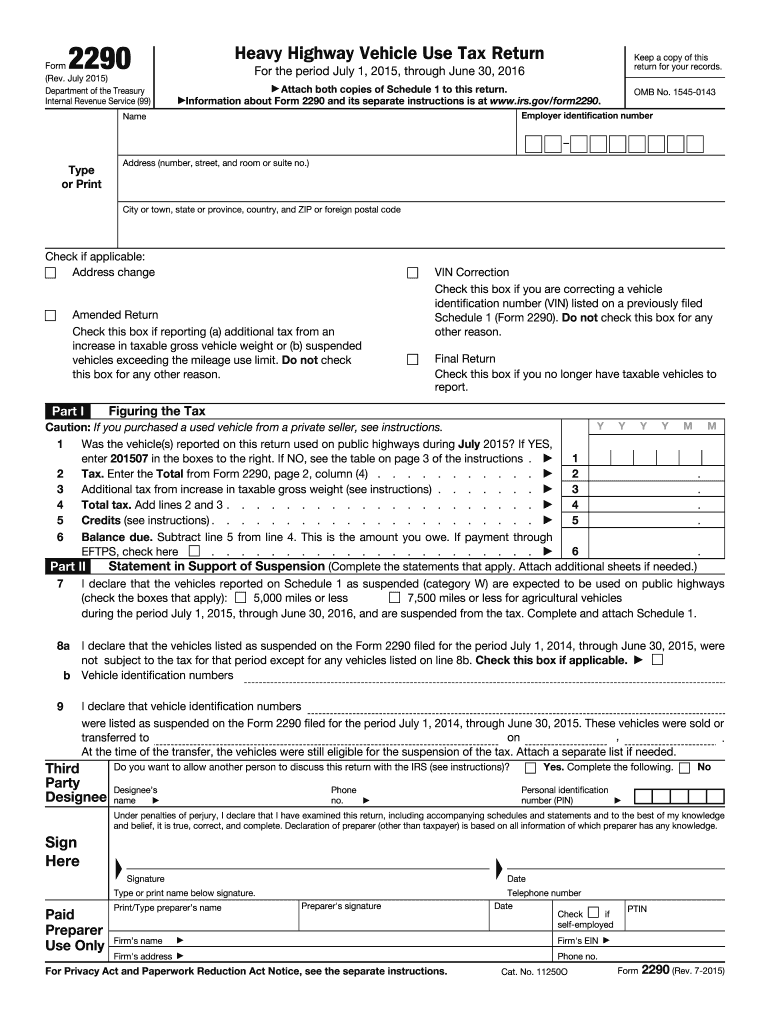

Definition and Purpose of Form 2

Form 2290, also known as the Heavy Highway Vehicle Use Tax Return, is a critical document used by owners of heavy highway vehicles to report and pay the federal highway use tax for the tax period from July 1, 2015, to June 30, 2016. This form is primarily for vehicles with a taxable gross weight of 55,000 pounds or more that are expected to operate on public highways. The tax helps fund highway construction and maintenance projects.

Key Features of the Form

- Tax Computation: Calculates tax based on the vehicle's weight and mileage.

- VIN Specifications: Requires the vehicle identification number for each truck.

- Schedule 1: Lists vehicles subject to tax.

- Payment Voucher (Form 2290-V): Accompanies payments when filed.

Steps to Complete Form 2

- Gather Necessary Information: Vehicle identification number, taxable gross weight, mileage, and business details.

- Calculate Tax Owed: Determine your tax based on the vehicle weight and the operational miles on public highways.

- Fill Out Form 2290 and Schedule 1: Ensure all vehicle details are accurately recorded, including VINs.

- Attach Payment with Form 2290-V: If applicable, include a check or money order.

- File the Form: Submit your completed form to the IRS via mail or electronically.

Special Considerations

- Amended Returns: File an amended return if there are changes to vehicle weight, usage, or tax determination.

- Exempt Vehicles: Identify exempt vehicles, such as those used exclusively for agriculture.

Filing Deadlines and Important Dates

The filing period for the 2015 tax year begins July 1 of each year. Payments are due by August 31, 2015, for vehicles used in July. For newly acquired or newly registered vehicles, the form is due at the end of the month following the month of first use.

Key Deadlines

- Annual Filing Deadline: August 31, 2015.

- New Vehicles: Last day of the month following the first month of use.

How to Obtain Form 2

You can access Form 2290 in several ways:

- IRS Website: Download a PDF version directly from the IRS official site.

- Authorized IRS e-file Providers: Use electronic filing services for quick and accurate submission.

- Local IRS Offices: Pick up a paper copy from your nearest IRS office.

Form Submission Methods

Form 2290 can be submitted in multiple ways:

- Electronic Filing (e-file): Highly recommended for quicker processing and for taxpayers with twenty-five or more vehicles.

- Mail: Send completed documents to the IRS office.

Submission Considerations

- Electronic Verification: Immediately receive a stamped Schedule 1 upon e-filing, required for vehicle registration.

- Mail Delays: Longer processing times, and a mailed receipt of Schedule 1.

Required Documents for Filing

When filing Form 2290 for the 2015 tax year, ensure you have the following documents:

- Vehicle Title: Verification of ownership and vehicle details.

- Completed Form 2290 and Schedule 1: With all pertinent vehicle information.

- Tax Payment Details: Either electronic payment confirmation or check/money order if applicable.

IRS Guidelines for Form 2

The IRS outlines specific requirements:

- Electronic Filing Requirement: Mandatory if filing for twenty-five or more vehicles.

- Audit Trail: Keep a thorough record of submissions and payments for at least three years.

- Amendments and Corrections: Allowed for changes in vehicle use or weight class.

Penalties for Non-Compliance

Failing to comply with Form 2290 filing requirements results in penalties and interest:

- Late Filing Penalty: 4.5% monthly of the unpaid tax up to five months.

- Late Payment Penalty: 0.5% monthly of underpayment.

- Interest Charges: Accrue on unpaid tax at the current federal rate.

Safeguard against penalties by ensuring timely and accurate submission of Form 2290.