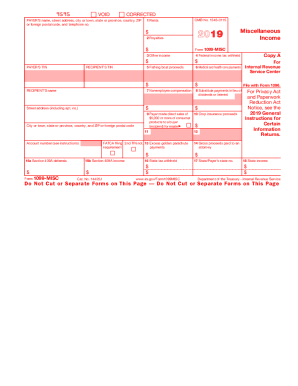

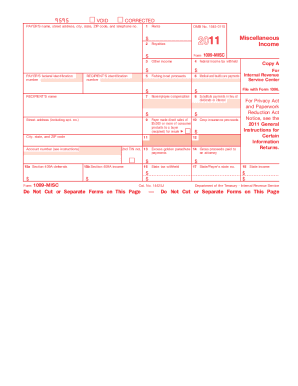

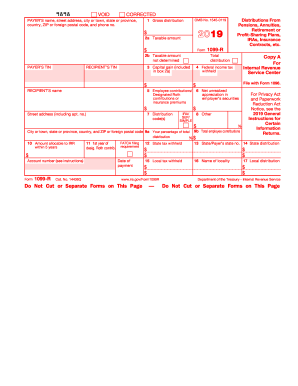

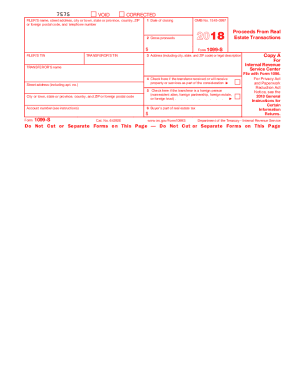

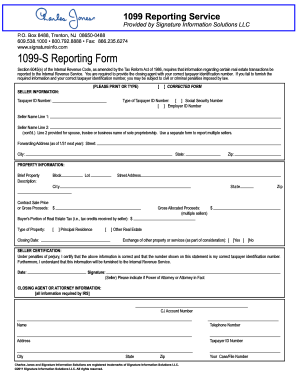

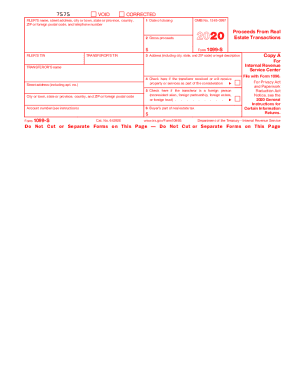

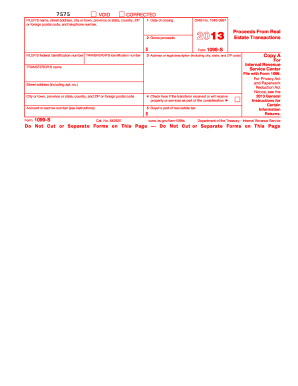

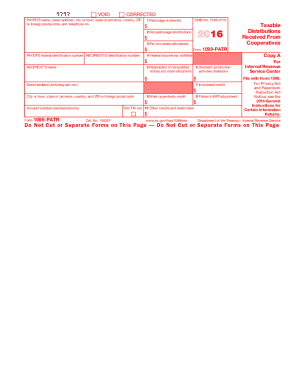

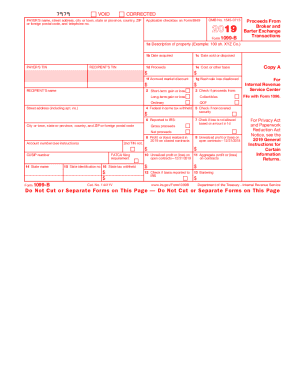

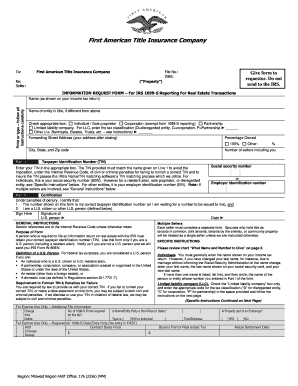

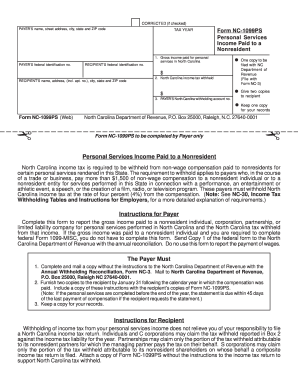

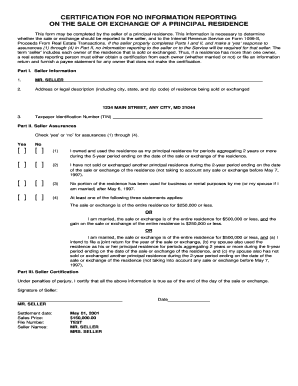

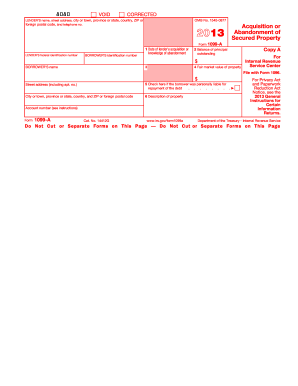

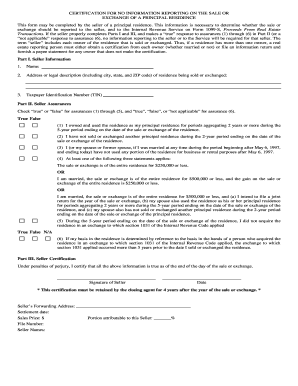

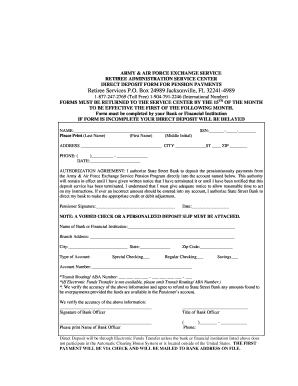

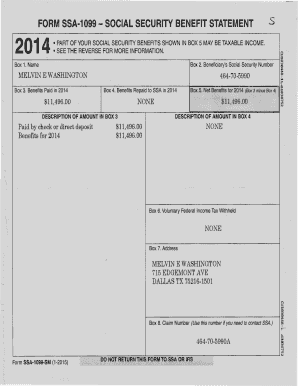

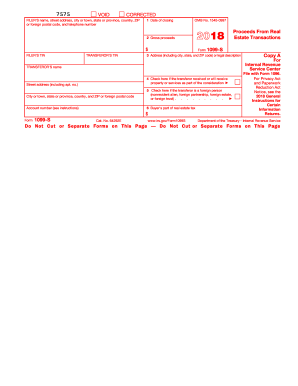

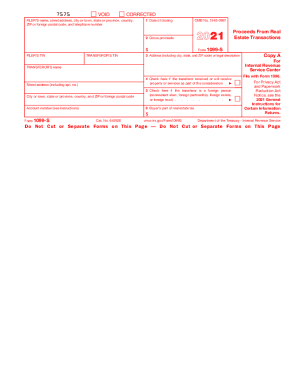

Preserve time and effort with our comprehensive library of industry-specific 1099 s Order Forms. Select from a variety of pre-made templates or customize your own.

Form managing consumes to half of your business hours. With DocHub, it is simple to reclaim your time and effort and improve your team's efficiency. Access 1099 s Order Forms collection and explore all form templates related to your day-to-day workflows.

Effortlessly use 1099 s Order Forms:

Speed up your day-to-day file managing with the 1099 s Order Forms. Get your free DocHub account right now to discover all forms.