Definition and Meaning of the 2 Form

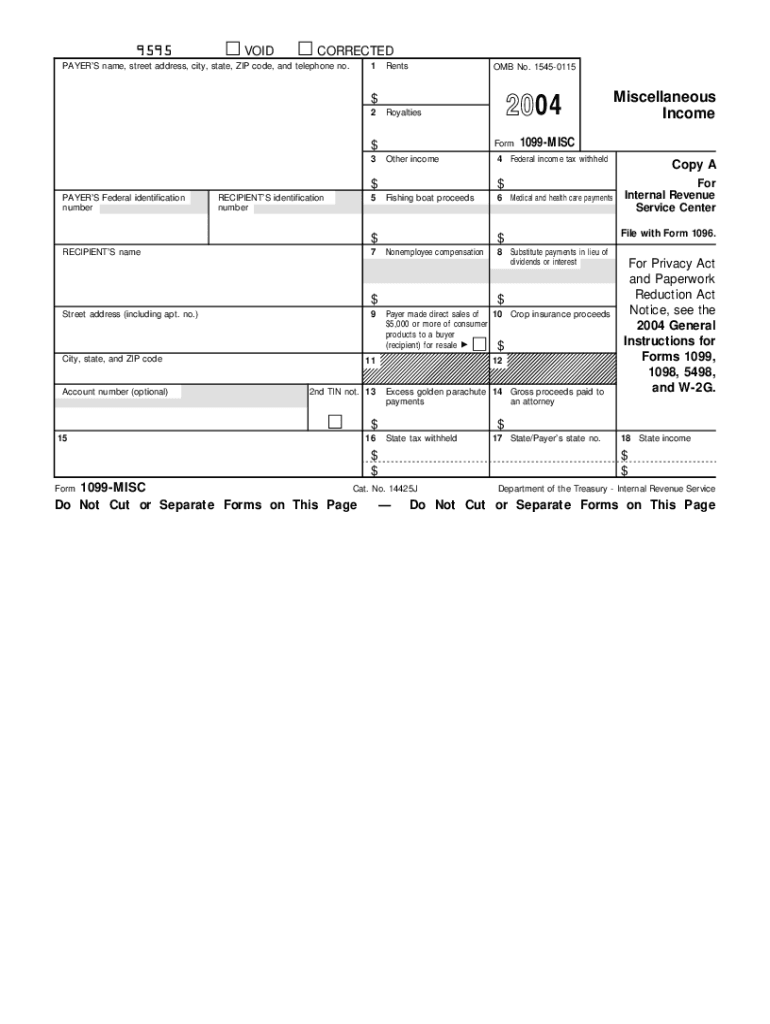

The 2 form, a critical document for tax reporting, served essential functions in documenting various types of income outside regular employment. This included details such as nonemployee compensation, rents, and royalties. The form was pivotal for income tracking and reporting, ensuring that both taxpayers and the IRS had accurate records of non-wage income.

How to Use the 2 Form

Utilizing the 2 form required understanding its specific fields and the type of income it represented. Primarily, this form was sent by businesses to independent contractors and freelancers to inform them and the IRS about the income paid out over the tax year. For instance, if a freelancer earned more than $600 from a single payer, that payer was required to issue a 1099 form to both the freelancer and the IRS.

Completing the Form

To complete the form accurately, individuals would fill out various sections detailing:

- The payer’s information, including name and address.

- The recipient’s details, such as name, address, and taxpayer identification number.

- Specific income amounts under predefined categories, like nonemployee compensation.

Steps to Complete the 2 Form

Completing the form efficiently required a step-by-step approach:

- Gather Necessary Information: Collect details from payee records, including taxpayer identification numbers and total income.

- Enter Payer Information: Fill in the payer's business name, address, and identification number.

- Input Payee Details: Include the recipient's name, address, and taxpayer identification.

- Report Income: Clearly document income in relevant sections, ensuring amounts are reflected accurately.

- Review and Submit: Double-check for errors before submission to maintain accuracy and compliance.

Legal Use of the 2 Form

The 2 form was legally required for reporting purposes in specific circumstances. Businesses needed to issue this form to independent contractors if payments surpassed $600 within a year, ensuring transparency and tax compliance. Incorrect or delayed filing could result in penalties, underscoring its legal significance.

Key Elements of the 2 Form

Understanding the core elements of the form was crucial for correct usage. These included:

- Payer and Payee Information: Essential for identifying the entities involved in the transaction.

- Payment Amounts: Specified in separate boxes to represent distinct income types.

- Tax Withholding Details: Noted for certain payments requiring federal tax withholding.

Filing Deadlines and Important Dates

Timely filing was critical to avoid penalties. The 2004 form had specific deadlines:

- Issuer Deadline: Payers had to send the 1099 form to the recipient by January 31 of the following year.

- IRS Submission: The form must be submitted to the IRS by February 28 if filed on paper, or by March 31 for electronic filing.

Penalties for Non-Compliance

Failure to comply with filing requirements could result in substantial penalties:

- Late Filing: Penalties escalated based on delays, from $50 to $270 per return, depending on lateness.

- Intentional Disregard: If ignored purposely, fines could exceed $550 per incomplete or incorrect form, reflecting the importance of adherence.

Form Submission Methods

Submission methods highlighted the choice between traditional and modern practices:

- Online Submission: Offered efficiency and convenience via IRS e-file systems.

- Mailing: Required the use of official IRS forms, ensuring receipt by the IRS by applicable deadlines.

Important Terms Related to the 2 Form

Familiarity with key terminology was essential for proper utilization:

- Nonemployee Compensation: Payments to individuals not classified as employees.

- Taxpayer Identification Number (TIN): Critical for identifying those involved.

- 1099-MISC: A specific variant of the 1099 series historically important for miscellaneous income.

Understanding these elements and adhering to guidelines provided clarity in tax situations, facilitating accurate record-keeping and reducing the risk of errors during tax filing.