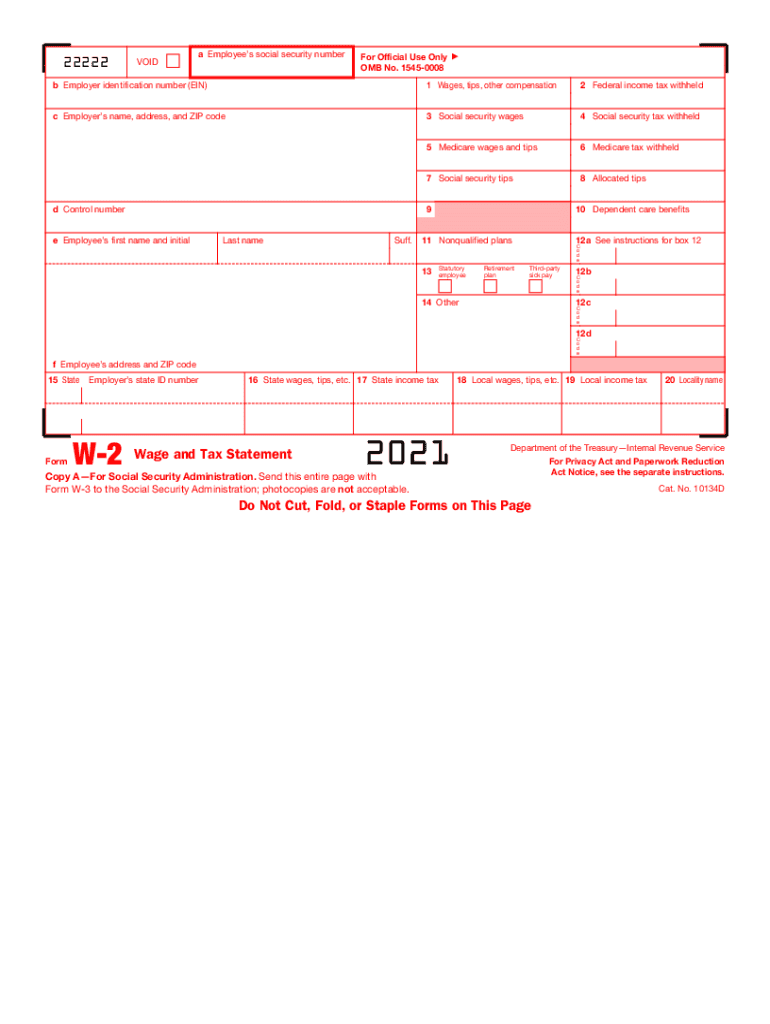

Definition and Meaning of the W-2 Form 2021

The W-2 Form, also known commonly as the Wage and Tax Statement, is a critical document used in the United States for tax filing and informational purposes. It is provided annually by employers to both the Internal Revenue Service (IRS) and employees. The primary function of the W-2 is to report the wages paid to employees and the taxes withheld from their salaries throughout the year. For the 2021 tax year, the W-2 form aggregates this pertinent financial information, aiding in the accurate preparation of individual tax returns.

Key Information Included on the W-2 Form

- Employee Earnings: Displays total wages, tips, and other compensation paid to an employee.

- Federal Taxes: Details amounts withheld for federal income taxes over the year.

- Social Security and Medicare Taxes: Specifies contributions made toward Social Security and Medicare.

- State and Local Taxes: If applicable, highlights amounts withheld for state and local taxes.

- Benefits and Deductions: Includes contributions to retirement plans or any other benefit plans.

How to Use the W-2 Form 2021

The W-2 Form is an essential component of tax preparation for employees. Once received, employees must use the information provided on the form to accurately file their federal and state income tax returns. Here is a typical process on how the form can be utilized effectively:

- Verify Information: Ensure accuracy of all personal and financial details.

- Incorporate Into Tax Filing: Input relevant data from the W-2 into tax filing software or directly onto IRS and state tax forms.

- File Taxes: Use the compiled information to complete federal and state tax returns.

- Maintain Records: Retain the W-2 for personal records and as proof of income should any questions arise from the IRS.

Obtaining the W-2 Form 2021

Employers are responsible for issuing W-2 forms to employees by January 31 following the tax year, which would be January 31, 2022, for the 2021 fiscal year. If employees do not receive their W-2 by mid-February, they should first contact their employer. Alternatively, they may contact the IRS for assistance in obtaining the form.

Other Methods of Access

- Digital Access: Many companies allow employees to access their W-2 through online payroll systems.

- Paper Copies: Employers may distribute physical copies through mail or in person.

Steps to Complete the W-2 Form 2021

Completing the W-2 involves several detailed steps, typically handled by the employer. Here's an overview of the process:

- Gather Employee Information: Collect full names, addresses, and Social Security numbers.

- Calculate Earnings and Deductions: Accurately compute total earnings and all taxes withheld.

- Distribute Copies: Provide each employee with copies B, C, and the appropriate state copy. Send copy A to the SSA.

- File Electronically or By Mail: Employers must file the form with the SSA. Electronic filing is often encouraged for larger businesses.

Who Typically Uses the W-2 Form 2021

The W-2 Form is used by both employers and employees:

- Employers: Required to issue W-2 forms to report wages and tax withholdings.

- Employees: Use this form as a basis to file their personal income taxes.

Workers classified as independent contractors receive a 1099 form instead of a W-2.

Key Elements of the W-2 Form 2021

The W-2 Form comprises several boxes that collect different financial data:

- Box 1-5: Total wages, Social Security wages, Medicare wages, and their respective withholding.

- Box 12: Additional compensation or deductions, such as certain benefits.

- Box 14: Clarifies other amounts not captured elsewhere, like union dues or other deductions.

Each section carries vital information, making it crucial to understanding employee taxation accurately.

Penalties for Non-Compliance

Non-compliance with W-2 form requirements can result in significant penalties:

- Failure to File Penalties: If an employer fails to provide a W-2 on time, the penalty can be up to $270 per form.

- Incorrect Information Penalties: Inaccurate or incomplete forms may result in further fines.

- Intentional Disregard: Higher penalties apply if the issuer knowingly fails to provide correct information.

Employers must adhere strictly to guidelines to avoid these repercussions.

IRS Guidelines for the W-2 Form 2021

The IRS provides comprehensive guidelines to ensure the correct filing of W-2 forms:

- Accuracy Checks: The IRS emphasizes verifying all entries for accuracy before submission.

- Electronic Filing: Employers submitting over 250 W-2 forms must file electronically.

- Record Retention: Employers should retain copies of W-2 forms and related records for at least four years after filing.

By following these IRS guidelines, employers ensure compliance and streamline the process of tax reporting.