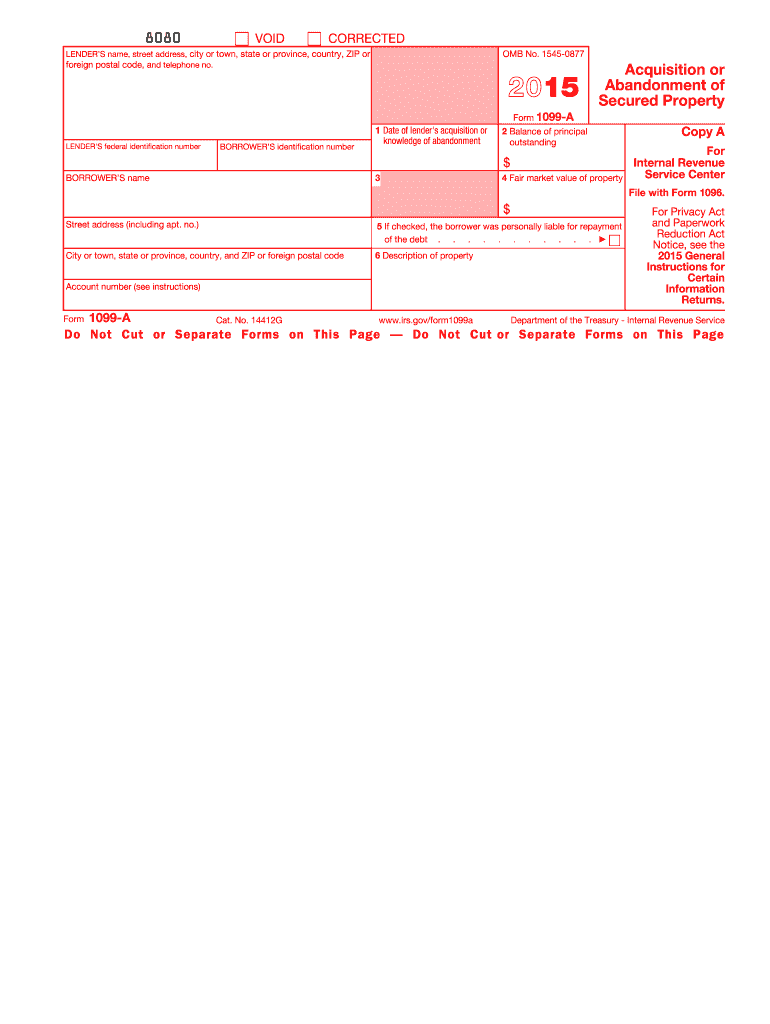

Definition and Purpose of the 1099-A Form

The 1099-A form is a tax document used by lenders to report the acquisition or abandonment of secured property. This form is essential for individuals who have undergone foreclosure or have transferred property back to the lender in satisfaction of a loan. It provides the Internal Revenue Service (IRS) with information on the property's fair market value and the outstanding debt at the time of acquisition or abandonment. Understanding this form is crucial for accurate tax reporting and compliance.

Key Components of the 1099-A Form

- Borrower's Information: This includes the borrower's name, address, and taxpayer identification number.

- Lender's Information: Similar details about the lender, who is typically the bank or financial institution.

- Property Details: The description of the secured property, including its address and type.

- Acquisition Date: The date on which the property was either acquired by the lender or abandoned.

- Fair Market Value (FMV): The FMV of the property at the time of the acquisition helps in determining the taxable gain or loss.

- Outstanding Debt Amount: This indicates the total amount owed on the property at the time of acquisition.

How to Use the 1099-A Form

When a borrower receives a 1099-A, it is essential to accurately report the information on their tax return. The data from the form impacts the determination of capital gains or losses resulting from the property acquisition or abandonment.

Reporting Tax Implications

- Capital Gain/Loss Calculation: The fair market value and outstanding debt inform the calculation of any capital gains or losses. If the FMV of the property is higher than the debt forgiven, the borrower may need to report that as income.

- Disclosure on Tax Return: Use Schedule D and Form 8949 to report sales and other dispositions of capital assets. Transferring the information correctly from the 1099-A form ensures compliance with IRS regulations.

How to Obtain the 1099-A Form

Lenders are responsible for issuing the 1099-A forms to borrowers. If borrowers have not received this form but believe they are entitled to one, they should reach out to their lender or financial institution.

Steps to Acquire the Form

- Contact Your Lender: Inquire whether they have issued the form and confirm your mailing address.

- Check Online Accounts: Many lenders provide access to tax documents through their online banking platforms.

- Request a Duplicate: If the original form is lost, borrowers can request a duplicate from the lender to ensure they have accurate reporting.

Steps to Complete the 1099-A Form

Borrowers typically do not complete the 1099-A form themselves, as it is issued by the lender. However, understanding how to interpret and report its contents on their tax return is vital.

Understanding the Completing Process

- Verify Information: Ensure that all entries, such as names, addresses, and property details, are correct.

- Calculate Capital Gains/Losses: Use the data to determine any applicable capital gains or losses related to the acquisition or abandonment of the property.

- File with the IRS: Include the information from the 1099-A in the appropriate sections of the tax return to avoid discrepancies.

Why Should You Use the 1099-A Form?

The 1099-A form plays a significant role in tax compliance for individuals who have experienced a change in their property status. It is essential for accurately reporting income and understanding tax liabilities resulting from the acquisition or abandonment of secured property.

Importance of Accurate Reporting

- Avoid Penalties: Properly documenting all forms of income, including those reported on a 1099-A, helps avoid any potential penalties from the IRS.

- Tax Planning: Understanding the implications of the 1099-A form allows borrowers to plan for future tax liabilities or refund opportunities effectively.

Who Typically Uses the 1099-A Form?

Primarily, lenders issue the 1099-A form; however, it is also used by borrowers who have undergone foreclosure, loan cancellation, or similar circumstances involving secured property.

Common Users of the 1099-A Form

- Individuals Facing Foreclosure: Homeowners who lose their property due to foreclosure will typically receive this form.

- Investors: Those who hold real estate as an investment and have abandoned properties or dealt with foreclosure situations also utilize this form in tax reporting.

- ** Businesses with Secured Loans:** Companies that have financed properties and subsequently relinquished them back to lenders fall under this category.

Important Terms Related to the 1099-A Form

Understanding the terminology associated with the 1099-A form is critical for accurate reporting and compliance.

Key Definitions

- Secured Property: This refers to any asset pledged as collateral for a loan.

- Fair Market Value (FMV): The estimated price at which property would sell under normal conditions.

- Abandonment: This occurs when the borrower relinquishes all rights and claim to the property, often through foreclosure.

- Loan Forgiveness: A situation where a lender cancels all or part of a borrower's debt, potentially leading to taxable income.

IRS Guidelines for the 1099-A Form

The IRS provides specific guidelines on how the 1099-A form should be filled out, reported, and what implications it has for tax filings.

Compliance Overview

- Timeliness of Filing: Lenders must issue the 1099-A forms by January thirty-first of the following year after property acquisition or abandonment.

- Accurate Reporting: The IRS emphasizes the importance of accuracy in reporting as errors can lead to significant tax repercussions for borrowers.

Additional Considerations

- Record Keeping: Maintain copies of the 1099-A and related documents for at least three years, as the IRS may request proof during audits.

- Consulting Professionals: Tax professionals can provide further insights and assistance for complex situations involving the 1099-A form and its reporting.

Filing Deadlines and Important Dates

Timely filing is an essential component of the tax responsibility associated with the 1099-A form.

Key Dates

- Issuance Deadline: Lenders must issue the 1099-A by January thirty-first.

- Filing Deadline for Borrowers: Tax returns are typically due on April fifteenth, barring any extensions or exceptions.

- Requesting Extensions: If necessary, individuals can file for an extension to prepare their tax submissions accurately.

This structure provides a comprehensive overview of the 1099-A form, ensuring clarity and utility for individuals dealing with property acquisition or abandonment.