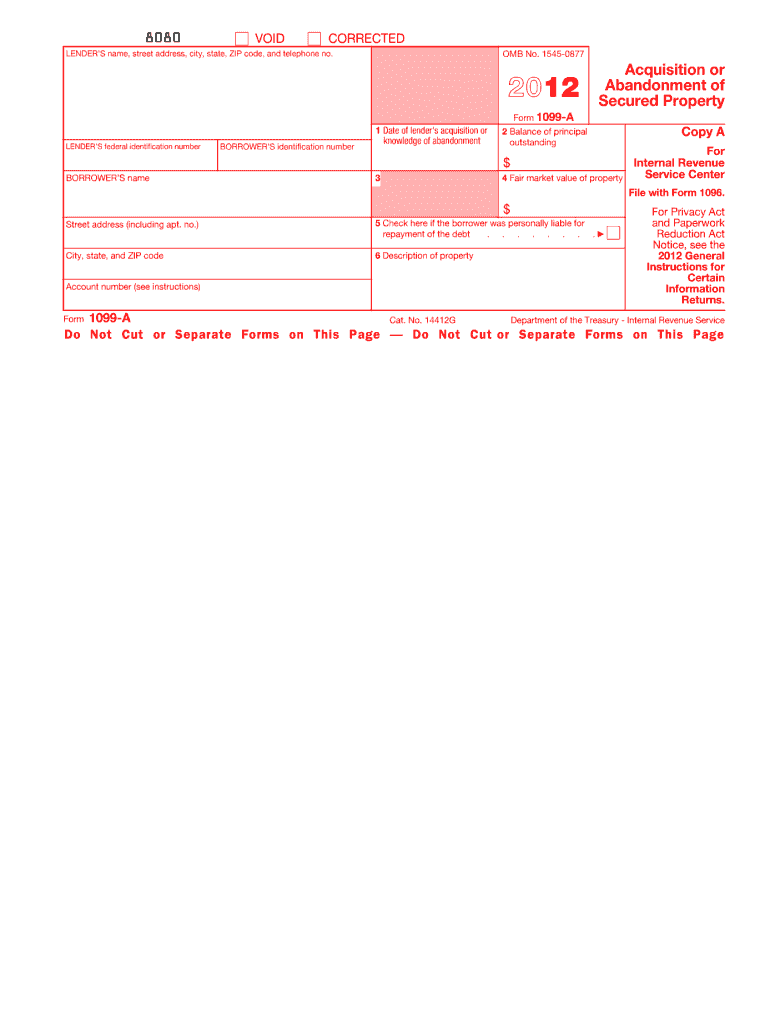

Definition & Meaning of Form 1099-A

Form 1099-A is a tax document utilized by lenders to report the acquisition or abandonment of secured property. This form is particularly important for borrowers who have had a loan that involved secured property, such as a mortgage on real estate. The information included in the 1099-A helps both borrowers and lenders understand the state of the secured property and its implications for tax reporting.

Key components of Form 1099-A include:

- Lender Information: Name, address, and taxpayer identification number of the lending institution.

- Borrower Information: Name, address, and taxpayer identification number of the borrower.

- Outstanding Debt: The remaining balance the borrower owed on the loan at the time of the transaction.

- Fair Market Value: The assessed market value of the property on the date of acquisition or abandonment.

The form serves as a communication tool between the lender and borrower, providing essential details that may have an impact on the borrower’s tax obligations and reporting requirements.

How to Use the 1099-A Form

Using Form 1099-A involves understanding how the information reported affects tax filings. The borrower who receives a 1099-A should carefully analyze the details provided, as these figures can influence the reporting of gains or losses on their tax return.

Steps to use Form 1099-A effectively include:

- Review the Information: Confirm that all details, such as the lender and borrower information, are accurate.

- Determine Tax Implications: Consult a tax professional if necessary, particularly to understand how the acquisition or abandonment of property influences taxable income.

- Report on Tax Return: Use the values from the 1099-A to complete the corresponding sections on Form 1040 or other appropriate tax documents.

When properly utilized, Form 1099-A can provide clarity on financial standing and help taxpayers navigate potential tax liabilities.

Steps to Complete the 1099-A Form

Completing Form 1099-A requires specific information to ensure compliance with IRS regulations. The following steps outline the process of accurately filling out the form:

- Collect Necessary Information: Gather all relevant details, including mortgage balance, property value, and contact information.

- Fill in Lender Details: Enter the lender’s name, address, and taxpayer identification number in the appropriate sections.

- Input Borrower Information: Provide the borrower’s name, address, and taxpayer identification number.

- Document Property Details: Indicate the outstanding debt amount and the fair market value of the property at the time of the transfer or abandonment.

- Check for Accuracy: Review the completed form to ensure all information is correct before submission.

By carefully completing the 1099-A form, both lenders and borrowers can ensure compliance and facilitate accurate tax reporting.

Key Elements of the 1099-A Form

Understanding the key elements of Form 1099-A is essential for both lenders and borrowers. These elements determine how the form is used and its implications for tax reporting.

Primary elements include:

- Lender Information: Essential for identification and accountability.

- Borrower Information: Critical for tax reporting purposes, ensuring the right individual is credited or debited.

- Outstanding Debt: Helps determine if there are any taxable consequences from the acquisition or abandonment of the property.

- Fair Market Value: Provides a metric for assessing any potential gain or loss occurring from the property transaction, vital for accurate tax calculations.

These elements collectively help in establishing a clear financial picture for both parties involved in the secured transaction.

Important Terms Related to Form 1099-A

Familiarity with terms related to Form 1099-A can enhance understanding and facilitate precise use of the form in tax reporting.

- Acquisition: Gaining ownership of secured property through lending or financing.

- Abandonment: The act of the borrower relinquishing any claim to the secured property, often leading to a discharge of debt.

- Fair Market Value (FMV): The property's value as determined by its potential sale price in an open market.

- Outstanding Debt: The remaining amount owed by the borrower to the lender at the time of the transaction.

Knowing these terms assists both lenders and borrowers in accurately interpreting and using Form 1099-A for tax purposes.

Filing Deadlines and Important Dates

Timely filing of Form 1099-A is crucial to avoid penalties and maintain compliance with IRS regulations. The following details outline important deadlines and dates associated with the form:

- Filing Deadline: Generally, Form 1099-A must be filed by January 31 of the year subsequent to the tax year in which the acquisition or abandonment occurred.

- Receiving Deadlines for Borrowers: Borrowers should receive their copy of the 1099-A no later than January 31 following the tax year.

Staying informed about these deadlines ensures that both lenders and borrowers can fulfill their reporting obligations and avoid any potential penalties imposed by the IRS.

IRS Guidelines for the 1099-A Form

The IRS provides specific guidelines for the proper use and reporting requirements associated with Form 1099-A. Understanding these guidelines is essential for both lenders and borrowers to ensure compliance.

Key IRS guidelines include:

- Filing Requirements: Lenders must file Form 1099-A for all applicable transactions involving the acquisition or abandonment of secured property.

- Accuracy of Information: The IRS requires accurate reporting of all relevant information to avoid misinformation and misunderstandings.

- Non-Filing Penalties: Failure to file the form timely can result in penalties for the lender, which can escalate depending on the duration of the delay.

By adhering to IRS guidelines, both lenders and borrowers can ensure accurate and responsible reporting related to secured properties.