Definition and Meaning of the 1099 Form 2020

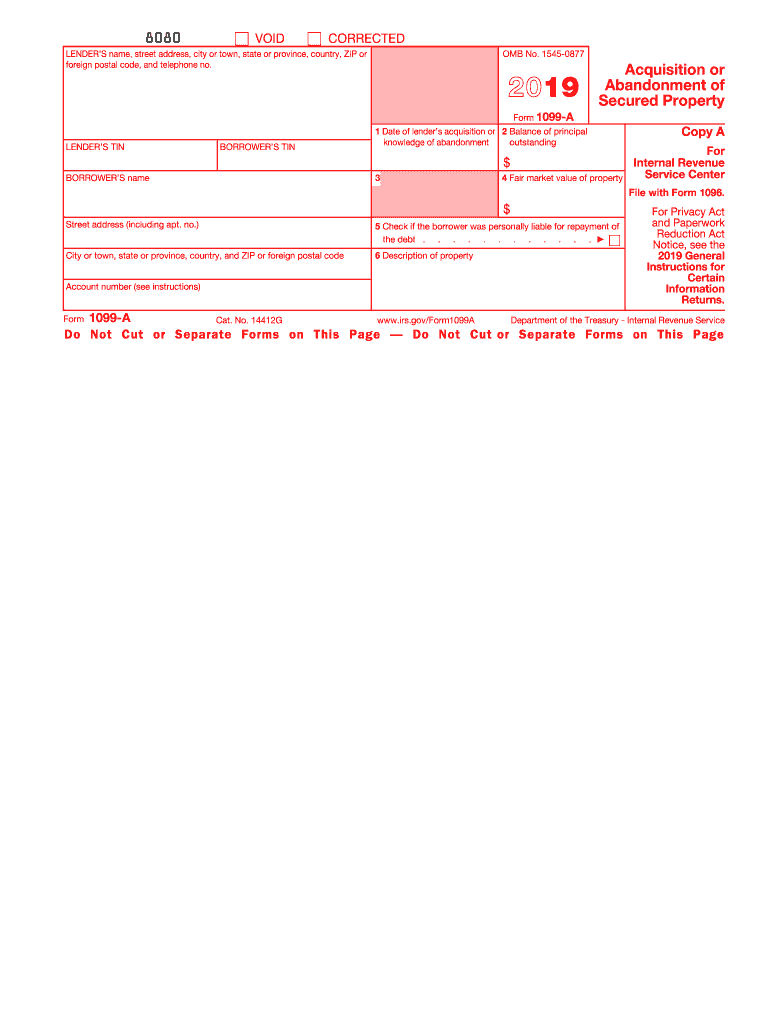

The 1099 form 2020, officially known as the "Information Return," is a tax document used in the United States to report various types of income received by an individual or business that is not classified as wages or salary. The form is particularly vital for freelancers, independent contractors, and other self-employed individuals who receive payments from clients or businesses. The 1099 series comprises multiple variants, such as the 1099-MISC and 1099-NEC, but they all serve the primary purpose of documenting income for tax reporting purposes.

The 1099-MISC form specifically was commonly utilized to report miscellaneous income, while the 1099-NEC was reintroduced in 2020 for reporting non-employee compensation. This distinction is crucial for accurate reporting and compliance with IRS regulations. Understanding the implications attached to the 1099 form 2020 is essential for anyone who earns income outside of traditional employment channels, ensuring appropriate reporting and tax obligations are met.

How to Use the 1099 Form 2020

Using the 1099 form 2020 involves several steps that ensure accurate reporting of income. First, it is essential to determine which type of 1099 form you need, depending on the nature of the income. For instance, use the 1099-NEC for non-employee compensation paid to independent contractors and the 1099-MISC for rental income or other miscellaneous payments.

Once you have identified the correct form, gather the necessary information about the recipient, including their name, address, and taxpayer identification number (TIN). This data is crucial for accurately filling out the form. As the issuer, you must complete the relevant sections, indicating the total amount paid during the tax year.

Following this, you must provide the completed form to the recipient by January 31 of the following year and file it with the IRS by the specified deadlines. This ensures both parties have a record of the reported income, preventing discrepancies during tax assessments.

Steps to Complete the 1099 Form 2020

Completing the 1099 form 2020 involves a series of precise steps to ensure compliance and accuracy.

-

Choose the Correct Form: Identify if you need the 1099-NEC or 1099-MISC based on the type of income.

-

Gather Recipient Information: Obtain the recipient's legal name, address, and TIN. This is crucial for proper identification.

-

Fill Out the Form: Complete the section for reporting amounts, including:

- Non-employee compensation (for 1099-NEC)

- Rents, royalties, or other types of income (for 1099-MISC)

-

Review for Accuracy: Ensure that all entered data is accurate and matches the recipient’s profile to avoid issues with the IRS.

-

Distribute Copies: Provide the recipient with their copy by January 31, and submit the form to the IRS. For the IRS, if filed electronically, the deadline is often later.

-

Retain Records: Keep a copy for your records, as this will assist you during the filing process and in case of audits.

Who Typically Uses the 1099 Form 2020

The 1099 form 2020 is primarily used by various entities that pay individuals or businesses for services rendered or other income types. Key users include:

- Freelancers: Independent contractors providing services who receive payments from clients.

- Small Business Owners: Businesses paying contractors, freelancers, or other non-employees for services.

- Landlords: Individuals or companies receiving rent payments or royalties.

- Dividends or Interest Recipients: Individuals receiving interest from banks or dividends from investments must report these through the 1099-DIV or 1099-INT variants.

Understanding the typical users of the 1099 form helps clarify which income types require reporting, ensuring compliance with IRS regulations.

IRS Guidelines for the 1099 Form 2020

The IRS provides extensive guidelines regarding the use of the 1099 form 2020, which are essential for proper compliance. Key points include:

-

Threshold Amounts: Generally, you must file a 1099 if you paid a recipient $600 or more for services in a calendar year. However, different thresholds apply for specific types of income, such as royalties or rents.

-

Filing Requirements: You can file 1099 forms either electronically or on paper, with electronic filing preferred by the IRS. It's crucial to meet the filing deadline to avoid penalties.

-

Corrections and Amendments: If errors are discovered after filing, follow IRS procedures for filing corrected forms using Form 1099-CORR.

-

Record-Keeping: Maintain complete records of each 1099 issued, including copies and related business income records for at least three years.

Adhering to IRS guidelines is critical for a smooth filing process and avoids potential penalties related to non-compliance.

Filing Deadlines for the 1099 Form 2020

Understanding filing deadlines for the 1099 form 2020 is vital for compliance. For the 2020 tax year, the critical deadlines are as follows:

-

Recipient Copy: You must provide the recipient's copy by January 31, 2021. This applies to forms 1099-NEC and 1099-MISC.

-

IRS Filing Deadline: If you file paper forms, the deadline to submit to the IRS was February 28, 2021, while electronic submissions were due by March 31, 2021.

Timely submission of the forms prevents potential penalties and ensures that the IRS has accurate records of income paid to independent contractors and other service providers.

Penalties for Non-Compliance with the 1099 Form 2020

Failing to comply with the requirements surrounding the 1099 form 2020 can lead to substantial penalties imposed by the IRS. Key aspects include:

-

Late Filing Penalties: The penalties imposed for filing late can range from $50 to $550 per return, depending on how late the return is filed. If filed more than 30 days late, the fine increases significantly.

-

Incorrect Information Penalties: Providing incorrect information on the form, such as the wrong TIN or income amount, can also attract penalties, particularly if the IRS detects discrepancies.

-

Failure to Provide Copies: Not providing the recipient with their copy of the 1099 can result in penalties as well, highlighting the importance of communicating with payees about their income.

Understanding these penalties emphasizes the need for accurate reporting and timely submission of the 1099 form 2020 to avoid unnecessary financial consequences.