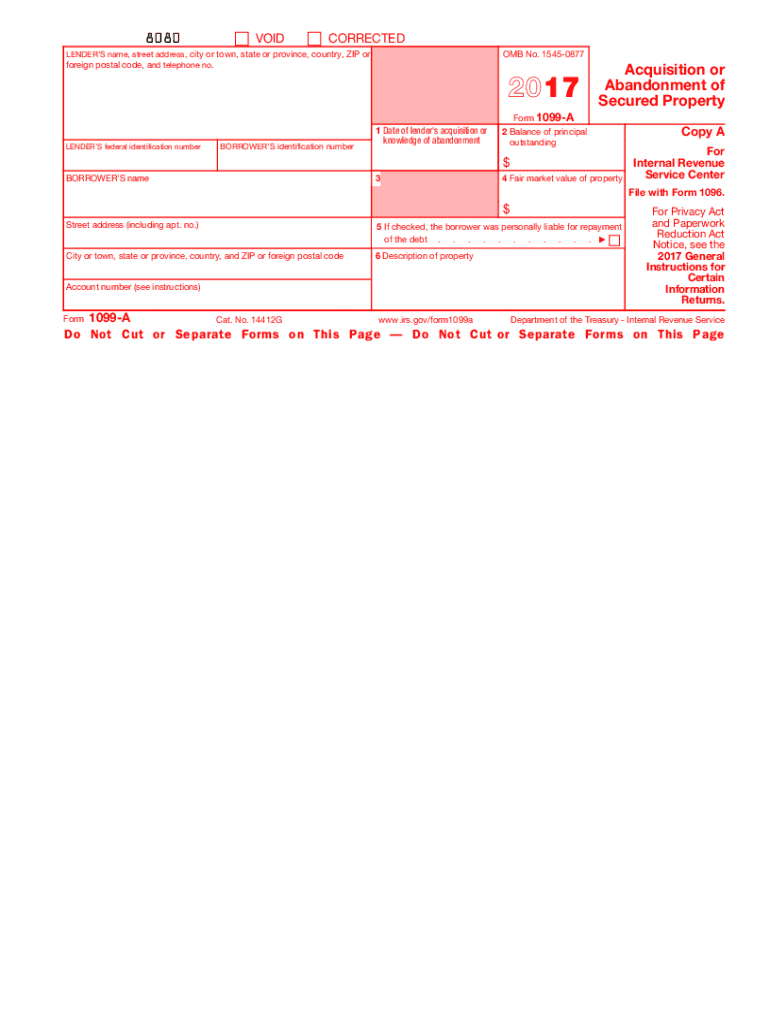

Definition and Meaning of the Form

A form refers to a specific type of information return used by the Internal Revenue Service (IRS) to report various types of income received throughout the year, not considered wages. This federal form is crucial for self-employed individuals, freelancers, and certain businesses that may have paid out money to independent contractors or other non-employees. The term "1099" refers to a series of forms, with the 1099-MISC being one of the most widely utilized variants for reporting miscellaneous income.

The form helps the IRS ensure that individuals report all income accurately and comply with tax obligations. It includes various data points, such as the recipient's name, address, taxpayer identification number, and the total amount of income paid out. The information serves as a guide for individuals to report their earnings during the tax year and aids in the IRS's efforts to monitor income reporting across the nation.

How to Obtain the Form

To obtain a form, individuals and businesses can access it primarily through two means: online resources and traditional mail. The IRS provides free access to all tax forms, including various 1099 variants, on its official website. This process allows users to download, print, and fill out the form as needed. It's important to ensure that you are using the correct version for the reporting cycle, as forms may differ slightly from year to year.

Additionally, businesses that are required to issue 1099 forms to contractors, vendors, or freelancers must ensure compliance by obtaining these forms before the tax deadline. Many accounting software programs, such as QuickBooks and TurboTax, also facilitate the generation of 1099 forms within their platforms. Users can input necessary data directly into the software to create and print the forms efficiently.

Key Elements of the Form

Understanding the key elements of the form is essential for accurate reporting and compliance.

- Payer Information: This section includes the name, address, and taxpayer identification number (TIN) of the individual or entity making the payment.

- Recipient Information: Similar to the payer's section, this part lists the name, address, and TIN of the individual receiving the payment.

- Income Amount: This box reports the amount of income paid to the recipient during the tax year. Various categories exist, such as non-employee compensation and rents.

- Federal Income Tax Withheld: If applicable, this box indicates any federal tax withheld from the payments made.

- Box Numbers: Each box on the form serves a specific purpose, and it is vital to input amounts in the correct locations to avoid errors.

Both payers and recipients should verify that the reported information accurately reflects the earnings and payments made during the year. Ensuring the correctness of these entries can prevent complications, including potential audits or penalties from the IRS.

Steps to Complete the Form

Completing the form involves several steps:

- Gather Necessary Information: Collect the payer's and recipient's information, including names, addresses, and TINs.

- Choose the Right Form: Ensure you have the correct version of the 1099 form based on the income type you are reporting.

- Fill Out the Form: Input the gathered information accurately into the appropriate fields, ensuring that income amounts are recorded correctly.

- Check for Errors: Review the completed form for accuracy, ensuring all necessary data is included and correctly formatted.

- Distribute Copies: Send Copy A to the IRS and provide Copy B to the recipient by the appropriate deadlines.

- File Electronically or by Mail: Depending on your preference and the number of forms being submitted, choose the suitable filing method. For electronic submissions, consider using approved software to ensure compliance with IRS requirements.

Following these steps carefully helps in filing the form without error, ensuring legal compliance and accurate reporting of income.

IRS Guidelines for Reporting with the Form

The IRS sets forth guidelines that must be adhered to when reporting income via the form:

- Filing Deadlines: The deadline for submitting 1099 forms is typically January thirty-first for recipient copies and February twenty-eighth for paper submissions to the IRS, with an extension to March thirty-first for electronic filing.

- Type of Income Reported: Payers must report any miscellaneous income payments made to independent contractors and certain other non-employee income.Notably, payments exceeding $600 in a year require a 1099 form.

- Penalties for Non-Compliance: Failure to file the required forms or filing them late can result in penalties, which may vary depending on the level of tardiness or the nature of the error.

- Form Variants: Different variants of the 1099 form are available to cover various types of payments, including the 1099-MISC (miscellaneous income), 1099-INT (interest income), and 1099-DIV (dividends), among others.

Adherence to these guidelines ensures compliance with federal tax laws and facilitates accurate income reporting by recipients, aiding in the prevention of discrepancies during tax filings.

State-Specific Rules for the Form

While the form is a federal requirement, state-specific rules may apply, necessitating an understanding of regional regulations:

- State Income Tax Reporting: Some states require a copy of the 1099 form to be filed alongside state tax returns, while others may have separate reporting requirements.

- State Tax Withholding: If state income tax is withheld from payments reported on the 1099 form, this must be reflected accurately on the form, ensuring recipients can report it on their state tax returns.

- State-Specific Forms: Certain states may have their versions or additional forms that need to accompany the 1099 filing, so it's essential to consult state tax agencies for guidance.

Awareness of these state-specific rules prevents penalties and ensures compliance with both local and federal regulations regarding income reporting and taxation.