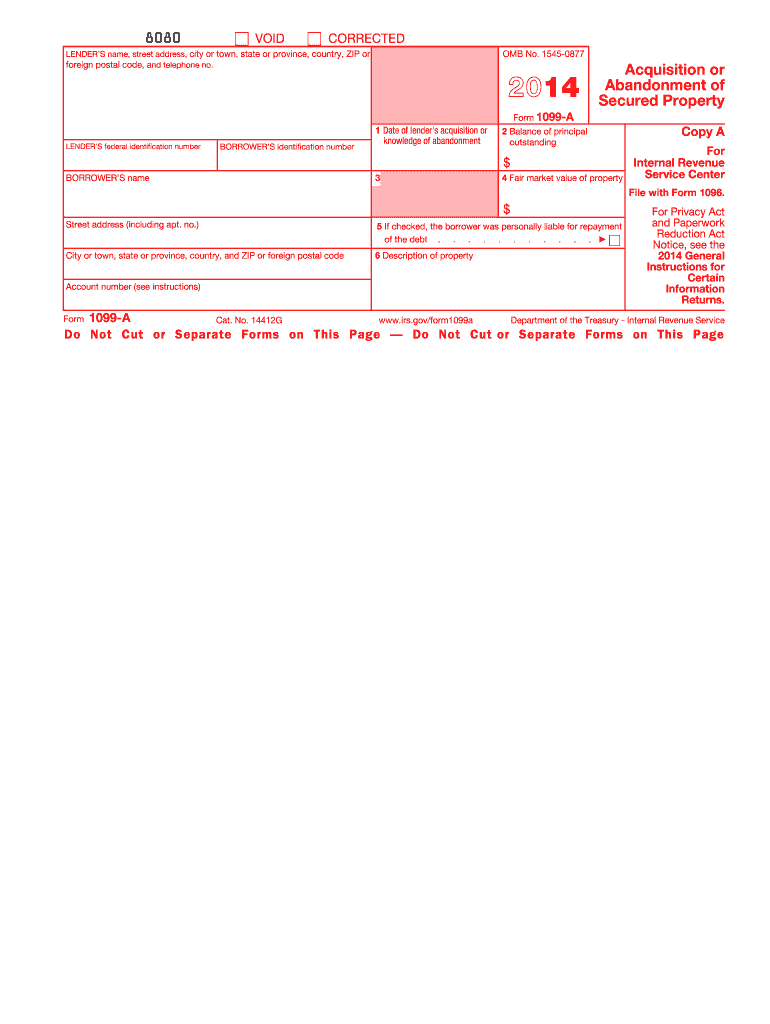

Definition and Meaning of Form 1099-A

Form 1099-A, also known as the Acquisition or Abandonment of Secured Property, is a tax form utilized primarily by lenders to report the acquisition of secured property during the year. It plays a significant role in related tax filings for both lenders and borrowers. The information reported on this form can greatly influence the tax liabilities of both parties involved, particularly when property is foreclosed or abandoned.

This form requires the lender to provide crucial details such as the borrower's taxpayer identification number (TIN), the balance of principal outstanding, the fair market value of the property at the time of acquisition, and whether the borrower was personally liable for the debt. Accurate reporting on Form 1099-A is essential for ensuring compliance with Internal Revenue Service (IRS) regulations and for preventing any potential penalties for improper filing.

Key Elements of Form 1099-A

- Lender Information: This section includes the lender's name, address, and TIN.

- Borrower Information: The borrower's name, address, and TIN are required for clear identification.

- Property Details: It includes the description of the property acquired and fair market value.

- Outstanding Balance: The balance of the principal outstanding is reported to indicate the financial obligations remaining at the time of acquisition.

- Liability Status: Lenders must indicate whether the borrower was liable for repayment of the debt associated with the property.

How to Use the 1099-A Form

Using Form 1099-A correctly involves several steps that ensure that all necessary information is accurately recorded and submitted. This form is primarily used when a lender acquires property through foreclosure or when a borrower abandons a secured property. Understanding how to use this form appropriately is crucial for compliance with tax reporting requirements.

Steps to Properly Use Form 1099-A

-

Determine the Need for the Form: Before filling out the form, ensure that the situation involves the acquisition or abandonment of secured property.

-

Gather Necessary Information: Collect all relevant data, such as the borrower's TIN, the fair market value of the property, and the outstanding balance of the loan.

-

Fill Out the Form: Accurately enter the required information in the respective fields of the form. Be meticulous to avoid errors that might lead to penalties.

-

Submit the Form: After completing the form, submit it to the IRS by the due date. Do not file online versions with the IRS due to scanning issues; only official paper versions are acceptable.

-

Provide Copies to Borrower: Send a copy to the borrower, as they may need the information for their own tax filings.

How to Obtain the 1099-A Form

Obtaining Form 1099-A is a straightforward process that can be completed through several methods, making it accessible for those who need it.

Methods for Acquiring Form 1099-A

- IRS Website: The IRS provides downloadable PDF versions that can be printed directly from their website.

- Order Official Forms: Lenders can order original printed forms directly from the IRS through the appropriate channels.

- Third-Party Software: Many accounting software programs and tax preparation tools offer digital versions of Form 1099-A, which can simplify the filling process.

Filing Deadlines and Important Dates

It is essential to be aware of key deadlines associated with Form 1099-A to ensure timely submissions and compliance with IRS regulations.

Key Filing Dates

- January 31: The deadline for lenders to provide borrowers with their copies of Form 1099-A.

- February 28: The deadline for lenders to file paper forms with the IRS.

- March 31: If filing electronically, the deadline extends to this date.

Failure to meet these deadlines can result in penalties, including fines determined based on the delay duration and number of forms filed.

Important Terms Related to Form 1099-A

Understanding key terminology related to Form 1099-A can help both lenders and borrowers navigate the complexities of this tax form effectively.

Definitions of Key Terms

- Secured Property: Property that is pledged as collateral against a loan, allowing the lender to take possession if the borrower defaults.

- Fair Market Value (FMV): The price that property would sell for on the open market between willing buyers and sellers.

- Acquisition: The act of a lender taking possession of secured property, usually due to foreclosure.

- Abandonment: A situation where the borrower relinquishes control of the secured property, typically without a formal conveyance of ownership.

These terms are vital for ensuring clarity when completing the form and for ensuring a mutual understanding between lenders and borrowers regarding their obligations.

Legal Use of Form 1099-A

Form 1099-A has specific legal implications, ensuring that the information reported aligns with IRS guidelines and protects the interests of all parties involved.

Compliance and Best Practices

- Accurate Reporting: It is crucial for lenders to provide precise information to avoid issues during audits or inquiries from the IRS.

- Record Keeping: Both lenders and borrowers should maintain copies of Form 1099-A for at least three years for potential future reference.

Understanding the legal framework surrounding Form 1099-A can mitigate the risks associated with improper reporting and ensure that all parties remain compliant with tax laws.