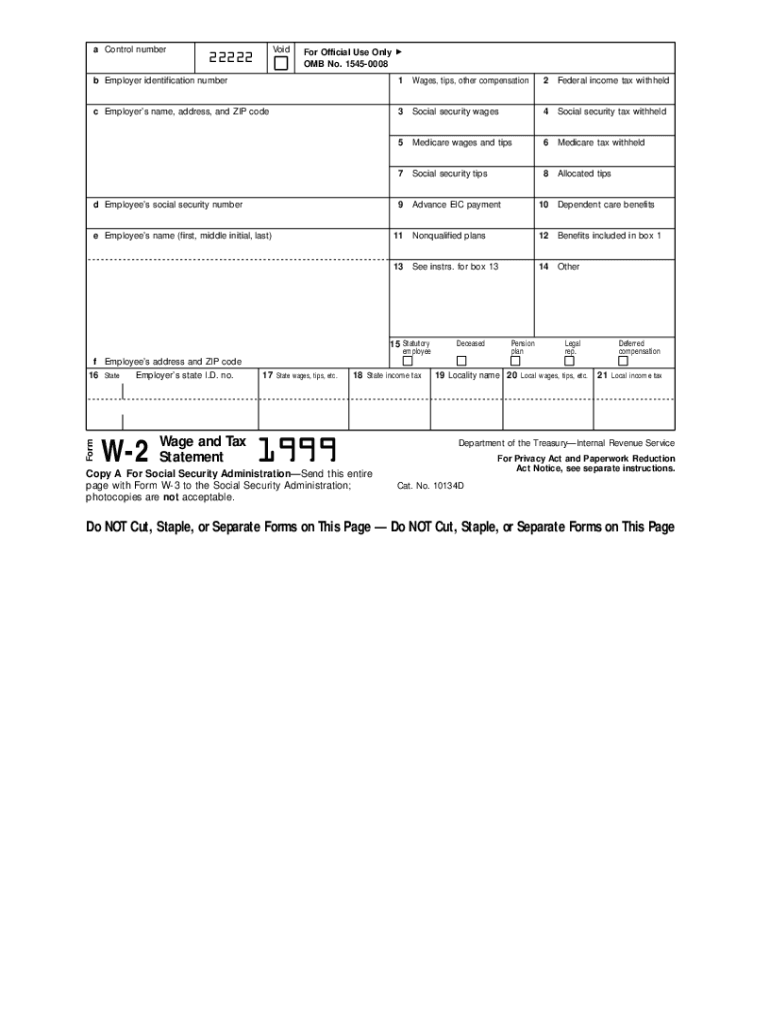

Definition and Meaning of the 1999 W-2 Form

The 1999 W-2 Form, officially known as the Wage and Tax Statement, is a crucial tax document used in the United States for reporting wages, tips, and other compensation paid to employees throughout the calendar year. It reflects the amount of federal, state, and other taxes withheld from an employee's paycheck.

Importance of the 1999 W-2 Form

- Income Reporting: Employees use the 1999 W-2 to report income when filing federal and state tax returns.

- Tax Withholding: The form indicates how much tax has already been withheld, affecting the final tax liability or refund.

- Mandatory Filing: Employers are legally obliged to provide this document to employees by January 31 of the following tax year.

Understanding the specifics of the 1999 W-2 Form is essential for accurate tax reporting and compliance, ensuring that both employers and employees meet their tax obligations effectively.

How to Obtain the 1999 W-2 Form

Employers typically generate the 1999 W-2 Form at the end of the tax year for their employees. However, individuals can also obtain a copy through various channels.

Methods for Obtaining the 1999 W-2 Form

- From Your Employer:

- Employers are required to provide a W-2 to all employees by January 31. If you have not received yours, contact your HR or payroll department for assistance.

- Online Portals:

- Some employers maintain online payroll systems where employees can securely access their W-2 forms. Check if your employer provides such services.

- IRS Request:

- If you cannot obtain your W-2 from your employer, you can request a copy from the IRS. Complete Form 4506-T to request a transcript, which can provide your wage and withholding information for the specified years.

Important Considerations

- Always ensure the W-2 details are accurate to prevent issues with tax filing.

- If you receive an incorrect W-2, promptly discuss the discrepancies with your employer.

Steps to Complete the 1999 W-2 Form

Filling out the 1999 W-2 Form requires careful attention to detail to ensure all information is accurate and complete.

Step-by-Step Procedure

- Gather Necessary Information:

- Collect employee details: full name, address, and Social Security number.

- Ensure you have the total wages and all applicable taxes withheld from the employee's pay throughout the year.

- Complete the Form Sections:

- Box A - Employee Social Security Number: Enter the employee's nine-digit Social Security number.

- Box B - Employer Identification Number (EIN): Include your business's EIN.

- Box C - Employer's Name, Address, and ZIP Code: Fill in your company's official name and address.

- Box D - Control Number: If you use one, enter it in this box; otherwise, leave it blank.

- Boxes 1-20: Accurately input the corresponding amounts for federal income, Social Security wages, Medicare wages, and various state wage details as applicable.

Important Tips

- Ensure the form is printed on special paper if submitting directly.

- Double-check all figures for reporting accuracy; mistakes may lead to penalties or delays in processing taxes.

Who Typically Uses the 1999 W-2 Form

The 1999 W-2 Form is primarily used by employees and employers in various sectors across the United States.

Main Users of the 1999 W-2 Form

- Employees:

- Individuals employed by a business who receive compensation, including full-time and part-time workers.

- Temporary or seasonal employees who are classified as employees rather than independent contractors.

- Employers:

- Businesses of all sizes, including corporations, LLCs, and partnerships, are required to generate and distribute W-2 forms to their employees.

- Tax preparers and accountants also utilize the W-2 to prepare individual tax returns for clients.

Understanding the roles of these users ensures compliance with tax obligations and proper reporting of income.

Key Elements of the 1999 W-2 Form

The 1999 W-2 Form contains several critical elements that capture essential financial and identification information.

Layout of the W-2 Form

- Boxes A-D: These boxes contain identifying information such as the employee's and employer's details.

- Income and Tax Withholding Boxes:

- Box 1: Total taxable wages and tips.

- Box 2: Federal income tax withheld.

- Box 3: Social Security wages.

- Box 4: Social Security tax withheld.

- Box 5: Medicare wages.

- Box 6: Medicare tax withheld.

- Boxes 15-20: Provide state-specific information including state wages, state tax withheld, and local tax information.

Importance of Each Element

- Each box serves to ensure that both the IRS and the employee have complete records of income and tax obligations. Accurate reporting enables proper processing of tax returns and minimizes complications during audits.

IRS Guidelines for the 1999 W-2 Form

Adhering to IRS guidelines is crucial when preparing and submitting the 1999 W-2 Form.

Compliance Requirements

- Filing Deadlines: Employers must submit copies of all W-2 forms to the Social Security Administration by the last day of January each year.

- Form Specifications: The W-2 must be printed on specific tax form paper that enables machine readability. The IRS specifies dimensions and formatting to prevent issues in processing.

Handling Errors

- If errors are discovered after submission, employers should issue a corrected form, known as Form W-2c, to rectify any inaccuracies, ensuring compliance with IRS regulations.

By understanding these critical aspects, both employers and employees can navigate the requirements and ensure correct tax reporting for the year 1999.