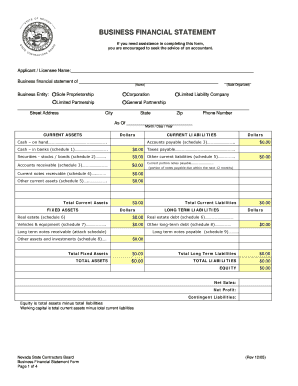

Personalize Stockholder’s equity section of the Balance Sheet Templates online with DocHub flexible adjustment capabilities. Develop and manage your financial records all in one location without compromising your information and security.

Your workflows always benefit when you can discover all the forms and files you may need at your fingertips. DocHub provides a a huge library of templates to relieve your day-to-day pains. Get hold of Stockholder’s equity section of the Balance Sheet Templates category and quickly find your document.

Start working with Stockholder’s equity section of the Balance Sheet Templates in a few clicks:

Enjoy smooth document managing with DocHub. Check out our Stockholder’s equity section of the Balance Sheet Templates category and locate your form right now!