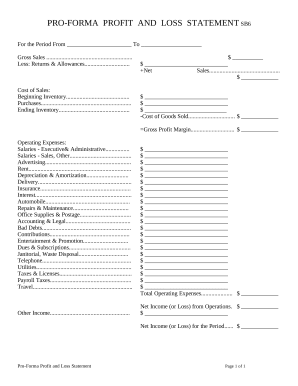

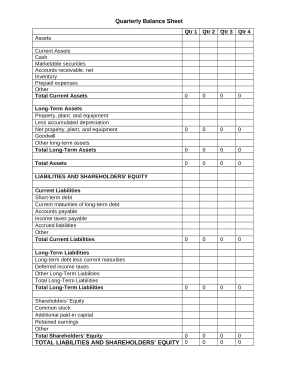

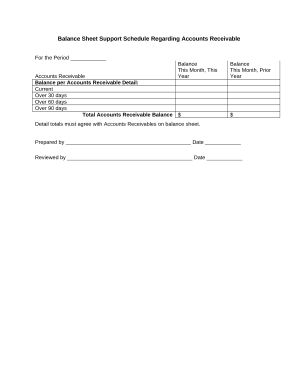

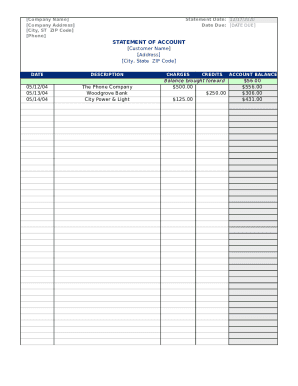

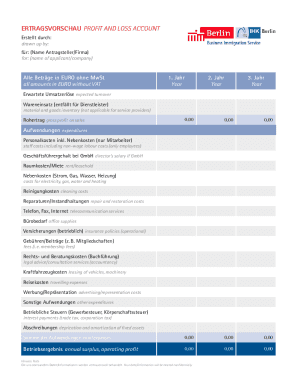

Collaborate and edit Profit and loss services Balance Sheet Templates in real-time. Sign up for a free DocHub and manage your financial records with precision, stay ahead your competition, and safeguard your data.

Accelerate your file managing with our Profit and loss services Balance Sheet Templates category with ready-made templates that suit your requirements. Get your document, change it, fill it, and share it with your contributors without breaking a sweat. Begin working more efficiently with the documents.

The best way to use our Profit and loss services Balance Sheet Templates:

Discover all of the opportunities for your online file administration with our Profit and loss services Balance Sheet Templates. Get your totally free DocHub account right now!