Definition and Meaning of Director Fees

Director fees refer to the compensation that a corporation’s board of directors receives for their services. This remuneration acknowledges their responsibilities regarding governance, compliance, and strategic direction within the company. Typically, director fees are structured as a fixed annual retainer supplemented by additional payments for attending meetings or serving on committees.

- Compensation Structure: Compensation can vary widely depending on the company’s size, type, and industry.

- Forms of Payment: Payments may include cash, stock options, or other financial benefits, aligning directors' interests with the company’s performance.

- Tax Implications: Director fees are treated as ordinary income and are subject to income tax. Understanding the tax implications is crucial for both the directors receiving the fees and the corporation reporting them.

Key Elements of Director Fees

Understanding the components of director fees is essential to ensure compliance and fair compensation. Key elements typically include:

- Base Retainer: A fixed fee that directors receive for their service over a stated period, usually determined annually.

- Meeting Fees: Compensation for attending board meetings and any additional committee meetings, often set on a per-meeting basis.

- Equity Components: Stock options or shares can be part of director remuneration, incentivizing performance and alignment with shareholder interests.

- Expense Reimbursement: Directors may receive reimbursements for travel and other expenses incurred while conducting corporate business.

Legal Use of Director Fees

Director fees are governed by both corporate law and the company’s by-laws. Adherence to legal frameworks is critical to avoid penalties and ensure transparency.

- By-Law Provisions: Companies must have explicit by-law provisions detailing the structure and approval process for director fees.

- Shareholder Approval: In many instances, fees may require shareholder approval, particularly if they involve significant changes or can influence shareholder sentiment.

- Regulatory Compliance: Public companies must disclose director remuneration in their proxy statements and annual reports as per the Securities and Exchange Commission (SEC) regulations. This requirement enhances transparency and builds trust with shareholders.

Steps to Complete Director Fees Documentation

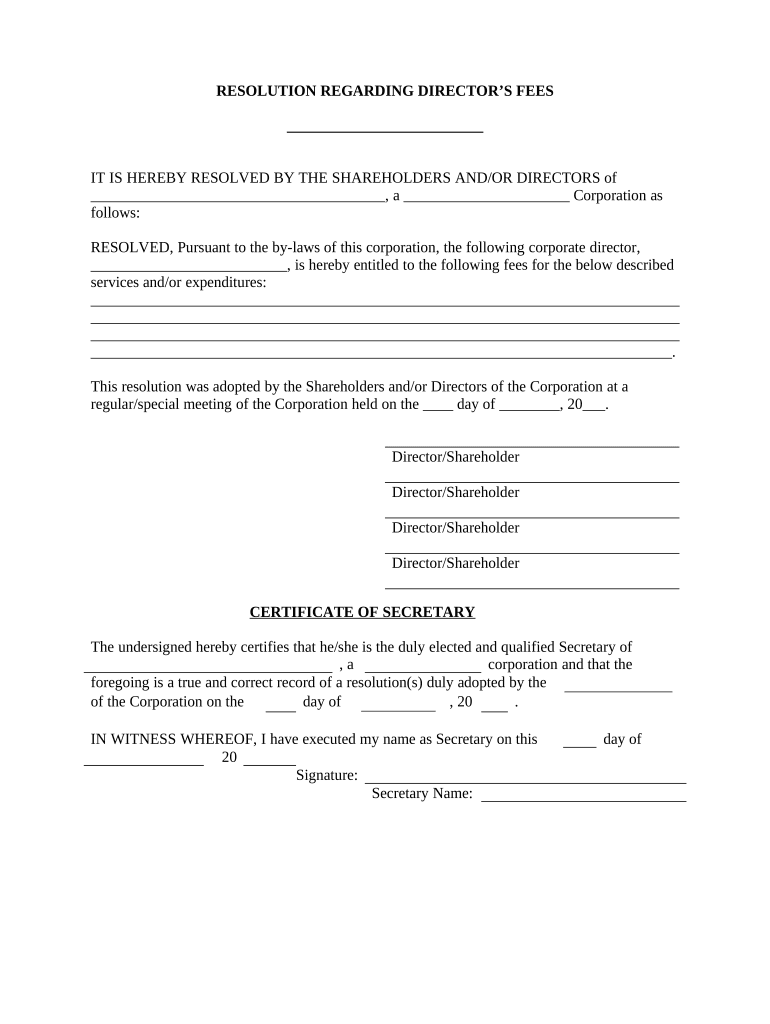

Creating the necessary documentation for director fees involves a structured approach to ensure compliance and clarity. The following steps outline the documentation process:

- Determine Fee Structure: Establish how fees will be determined, including base retainers and per-meeting compensation.

- Draft the Director Fee Resolution: Develop a formal resolution outlining the fee structure and obtain board approval.

- Certification of Resolution: Once approved, the Secretary must certify the resolution, ensuring it aligns with corporate governance standards.

- Distribution of Fee Agreement: Provide each director with a document detailing their specific compensation, terms, and any contingencies.

- Update Corporate Governance Documents: Ensure that the company's by-laws and corporate governance documents reflect the new fee structure.

- File Required Disclosures: For public companies, ensure that detailed disclosures regarding director fees are filed with the SEC in compliance with regulatory standards.

Important Terms Related to Director Fees

A few essential terms provide clarity and context when discussing director fees:

- Retainer: A fixed amount paid in advance to secure a director's services over a specified period.

- Equity Compensation: Part of director fees, this involves paying directors in shares or stock options to align their interests with that of shareholders.

- Disclosure Requirements: The legal obligations for companies to report director remuneration in financial statements to maintain transparency.

- Proxies: Shareholder documents that allow them to vote on matters such as director fees during annual meetings, emphasizing the need for clarity in communication.

Examples of Using Director Fees

To illustrate how director fees are implemented, consider the following scenarios:

- Technology Corporation: A major tech company offers a $100,000 annual retainer for board members, supplemented by $5,000 for each board meeting attended and stock options based on company performance metrics. This structure attracts skilled industry leaders.

- Non-Profit Organization: A nonprofit may offer a lower retainer but provide substantial reimbursement for travel and lodging expenses, balancing budget constraints while still attracting qualified directors committed to the organization’s mission.

- Startups: A startup might offer equity-heavy compensation packages to attract high-profile directors willing to accept lower cash payments due to the company’s early-stage funding constraints.

IRS Guidelines for Director Fees

The Internal Revenue Service (IRS) lays out specific guidelines for the treatment of director fees, which include:

- Income Reporting: Directors must report their fees as taxable income on their personal tax returns.

- Tax Withholding: Companies may have to withhold employment taxes from director fees, similar to payroll for employees.

- Self-Employment Considerations: If a director is also a business owner, they may need to report fees as self-employment income, affecting their overall tax obligations.

Being informed about these guidelines is critical for both the directors and the corporations compensating them.