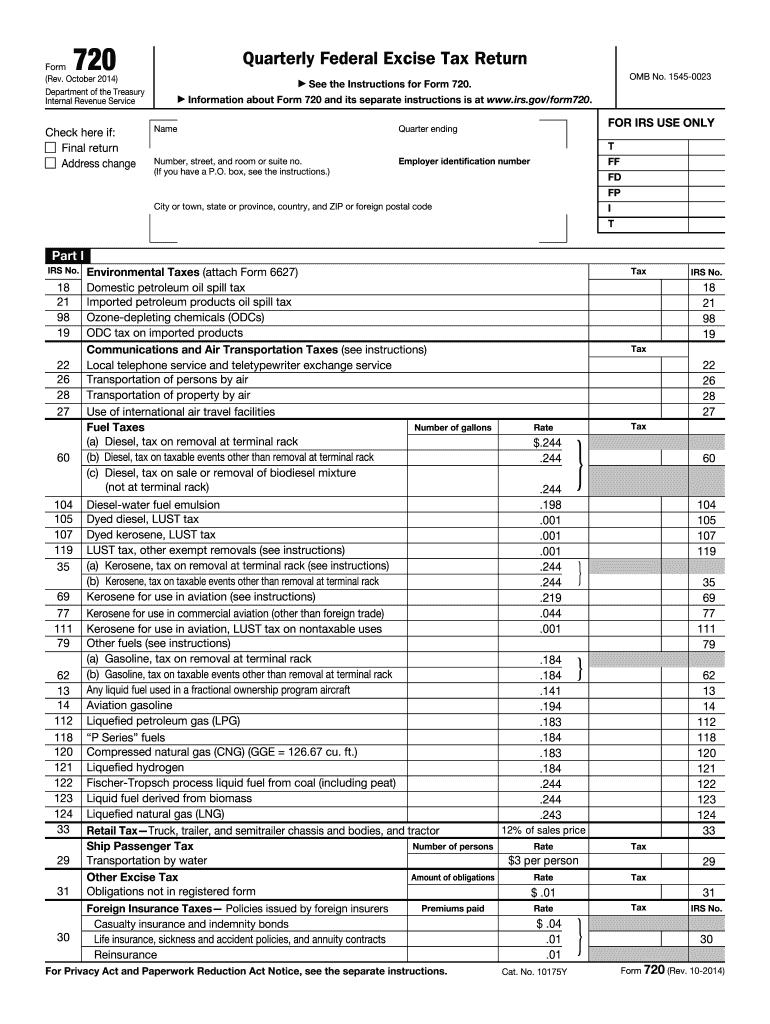

Definition and Purpose of the 2014 Form 720

The 2014 Form 720, also known as the Quarterly Federal Excise Tax Return, is a form issued by the Internal Revenue Service (IRS) that is used for reporting and paying various federal excise taxes. This form is essential for business entities that engage in activities subject to excise tax, which typically includes environmental taxes, fuel taxes, communication taxes, and taxes on air transportation and other excise liabilities. Proper completion and timely submission of this form is crucial for compliance with federal tax regulations.

How to Use the 2014 Form 720

Using the 2014 Form 720 involves several key steps that ensure accuracy and compliance. The form must be filled out to report taxable activities for a quarterly period. Here’s how to effectively use the form:

- Identify Tax Obligations: Businesses need to determine which excise taxes apply to them. Common examples include fuel taxes for those selling fuel and environmental taxes for manufacturers of certain products.

- Compile Necessary Information: Gather all relevant information, such as taxpayer identification details, tax amounts owed, and any claims for refunds.

- Complete the Form: Carefully fill in the required fields of the form, ensuring all calculations are accurate and up-to-date.

- Submit Timely: The form must be filed by the quarterly deadlines set by the IRS to avoid penalties and maintain good standing.

- Maintain Records: Keep a copy of the submitted form and any related documents for your records, as they may be needed for future reference or in case of an audit.

Steps to Complete the 2014 Form 720

Completing the 2014 Form 720 requires attention to detail and an understanding of the specific excise taxes that apply. The following steps guide the completion process:

- Obtain the Form: Download the 2014 Form 720 from the IRS website or obtain a copy through authorized tax preparation software.

- Enter Taxpayer Information: Fill in your business's name, address, and Employer Identification Number (EIN).

- Report Excise Tax Liabilities:

- Navigate to the appropriate sections for different taxes, such as those related to fuels or environmental products.

- Accurately calculate the tax amount due for each applicable category.

- Calculate Total Tax Due: Add all the tax amounts together to determine the total amount owed.

- Sign and Date the Form: Ensure that the responsible party or an authorized representative signs the form before submission.

Important Deadlines for Filing the 2014 Form 720

Timely filing of the 2014 Form 720 is vital to avoid penalties. Key deadlines include:

- Quarterly Submission Dates: The form is due on specific dates corresponding to each quarter:

- April 30 for the first quarter

- July 31 for the second quarter

- October 31 for the third quarter

- January 31 of the following year for the fourth quarter

- Payment Submission: Payments for any taxes owed should be submitted by the same deadlines to avoid interest and fines.

Understanding these deadlines helps ensure compliance with IRS regulations and can facilitate smoother financial planning for businesses.

Who Typically Uses the 2014 Form 720

The 2014 Form 720 is primarily used by various types of taxpayers engaged in specific business activities, including:

- Fuel Distributors: Businesses that sell gasoline or other taxable fuels must report their fuel excise taxes.

- Environmental Product Manufacturers: Companies producing certain materials subject to environmental taxes.

- Airline Operators: Airlines or air transportation entities that owe excise taxes on ticket sales.

- Telecommunication Companies: Entities that provide telecommunications services may also need this form for reporting related taxes.

Each of these business types must understand their specific reporting obligations to ensure compliance with federal tax laws.

Key Elements of the 2014 Form 720

The 2014 Form 720 consists of several important components that need careful attention:

- Filing Periods: The section where filers specify the quarter for which they are reporting.

- Excise Tax Types: Different sections correspond to various excise taxes applicable to the business.

- Payment Information: Details concerning the total tax due and methods available for payment.

- Signature Section: Where the responsible party certifies that the information is accurate.

Understanding these elements is critical for businesses to ensure that they appropriately report and pay any taxes owed on time.

Digital vs. Paper Version of the 2014 Form 720

Businesses can choose between a digital or paper version of the 2014 Form 720 for submission. Each has its advantages:

-

Digital Submission:

- Efficiency: Allows for faster completion and submission.

- Record Keeping: Electronic copies are easily stored and managed.

- Automatic Calculations: Tax software can reduce errors in calculations.

-

Paper Submission:

- Simplicity: Some users may be more comfortable with traditional paper forms.

- Direct Control: Filers can maintain a physical copy for their records.

Selecting the appropriate format depends on the specific needs and preferences of the business. However, digital submission has increasingly become the preferred method for many due to its convenience and accuracy.

IRS Guidelines for Filing the 2014 Form 720

Filing the 2014 Form 720 requires adherence to specific IRS guidelines that ensure compliance and accuracy. These guidelines include:

- Accurate Reporting: All taxable activities must be accurately reported based on business transactions relevant to the quarter.

- Additional Documentation: Supporting documents may be required to substantiate claims for refunds or tax credits.

- Review of Instructions: Filers should always refer to the latest IRS instructions for Form 720 to ensure compliance with any changes in tax law or reporting requirements.

Following these guidelines will help mitigate the risk of errors, which can lead to penalties or audits by the IRS. Proper compliance is crucial for maintaining a good standing as a taxpayer.