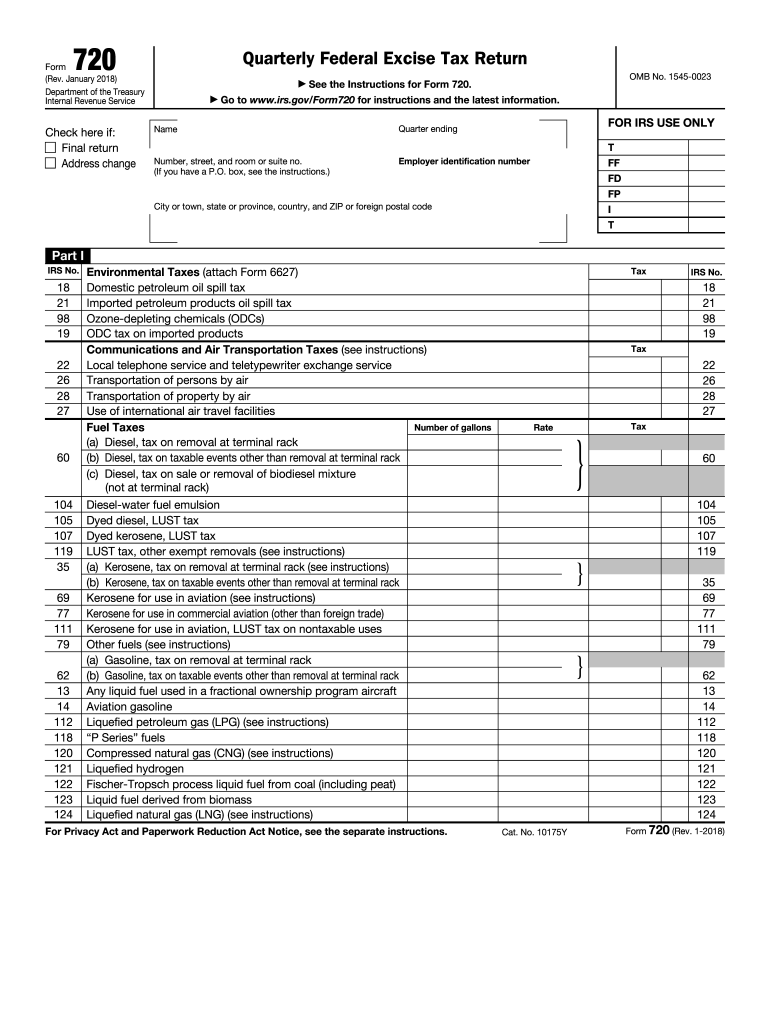

Definition and Purpose of Form 720 (Rev January 2019)

Form 720 (Rev January 2019) is the official document used for filing the Quarterly Federal Excise Tax Return with the Internal Revenue Service (IRS). This form is primarily designed for taxpayers who are responsible for reporting and paying federal excise taxes. Excise taxes are usually applicable to specific goods, services, and activities, and they are typically built into the price of the product or service.

The form collects information about various types of excise taxes, including taxes on fuel, airline tickets, and certain luxury items. By requiring businesses to report these taxes quarterly, the IRS ensures that excise tax revenues are collected efficiently and transparently. The form helps the IRS monitor compliance and enforce tax laws, allowing for a more equitable tax system.

Understanding the implications of excise taxes is crucial for businesses in regulated industries, such as transportation and manufacturing. It ensures correct compliance with IRS regulations and avoids potential penalties associated with incorrect reporting.

How to Use Form 720 (Rev January 2019)

Using Form 720 involves a systematic process that begins with gathering the required information and documentation. To effectively utilize the form, follow these key steps:

-

Collect Relevant Data: Gather information on the products or services subject to excise taxes. This includes knowledge of applicable tax rates, sales figures, and records of prior filings.

-

Obtain the Form: Form 720 (Rev January 2019) can be downloaded from the IRS website or obtained through a tax professional or software.

-

Complete the Form: Fill in the required fields accurately. This includes providing details on your business, specific excise taxes applicable, and calculating the total amount due.

-

File the Form: Submit the completed form either electronically via the IRS e-file system or by mailing it to the appropriate IRS address based on your location.

-

Keep Records: Retain a copy of the filed form and any supporting documentation for your records. This will be essential for audits or any future inquiries from the IRS.

Following these steps ensures compliance and minimizes the risk of errors while filing the quarterly return.

Steps to Complete Form 720 (Rev January 2019)

Completing Form 720 requires attention to detail and an understanding of your business's activities. The following steps provide a comprehensive guide:

-

Identify the Tax Period: Indicate the quarter for which you are filing. This is essential for proper processing by the IRS.

-

Fill in Identification Information:

- Taxpayer Identification Number (TIN): Provide your Employer Identification Number (EIN) or your Social Security Number (if applicable).

- Business Name and Address: Accurately fill in the name and business address to ensure IRS correspondence reaches you.

-

Report Taxable Activities:

- Report each taxable activity separately. This includes identifying specific excise taxes and calculating the amounts owed.

-

Calculate Total Excise Tax Due:

- Sum the excise taxes for the reporting period. This total represents what you owe to the IRS for that quarter.

-

Sign and Date the Return: The form must be signed by an authorized individual within the business, indicating that the information is true, correct, and complete to the best of their knowledge.

-

File the Completed Form: File by the designated deadline to avoid penalties. You can submit electronically or via mail, based on your preference and available IRS options.

Following this structured approach to completing Form 720 will help ensure that all relevant information is captured accurately, supporting compliance with IRS regulations.

Important Terms Related to Form 720 (Rev January 2019)

Understanding key terms associated with Form 720 is vital for effectively navigating the excise tax landscape. Here are some important terms to consider:

-

Excise Tax: A tax imposed on specific goods or activities, often included in the purchase price, such as those on fuel and tobacco.

-

Taxpayer Identification Number (TIN): A unique identifier assigned by the IRS to individuals and businesses for tax purposes. It can be an Employer Identification Number (EIN) or Social Security Number.

-

Non-compliance: Occurs when a taxpayer fails to accurately report or pay the owed excise taxes, which can result in penalties.

-

Form 2290: Often confused with Form 720, this form is specifically used for Heavy Vehicle Use Tax. Understanding the difference helps in filing the appropriate forms.

-

Tax Period: The reporting timeframe during which taxes are assessed. For Form 720, this could be quarterly.

-

Estimated Payments: Tax payments made to the IRS based on anticipated tax liability. This term is relevant for taxpayers who may opt to prepay taxes due for a more manageable payment structure.

Familiarity with these terms will aid taxpayers in accurately completing Form 720 and ensuring compliance with federal tax obligations.

Filing Deadlines for Form 720 (Rev January 2019)

Filing deadlines for Form 720 are crucial for maintaining compliance and avoiding penalties. The following outlines the key dates associated with the filing of this form:

-

Quarterly Due Dates: The return must be filed quarterly, with specific due dates:

- First Quarter (January - March): Due by April 30

- Second Quarter (April - June): Due by July 31

- Third Quarter (July - September): Due by October 31

- Fourth Quarter (October - December): Due by January 31 of the following year

-

Late Filing Penalties: If the form is not filed by the due date, penalties may apply. These could include fines based on the size of the business and the length of delay.

-

Extensions: While Form 720 does not offer an automatic extension, taxpayers can file for an extension of time to pay taxes. This requires submitting Form 7004 before the filing deadline.

Awareness of these deadlines can help taxpayers manage their filing obligations effectively and avoid unnecessary complications.

Who Uses Form 720 (Rev January 2019)

Form 720 (Rev January 2019) is primarily utilized by a variety of taxpayers, particularly in industries affected by federal excise taxes. The following groups typically use this form:

-

Businesses in Transportation: Companies engaged in trucking, aviation, and maritime shipping often report excise taxes on fuel and transportation services.

-

Manufacturers: Industries producing goods subject to excise taxes, such as tobacco, alcohol, and firearms, are required to file this form regularly.

-

Service Providers: Businesses providing certain taxable services, including indoor tanning and certain telephone services, may also be accountable for excise taxes and thus utilize Form 720.

-

Importers: Companies importing goods into the U.S. that are subject to excise taxes will also need to report their activities using this form.

Understanding the landscape of taxpayers that utilize Form 720 aids in recognizing the varied applications of this essential tax document.