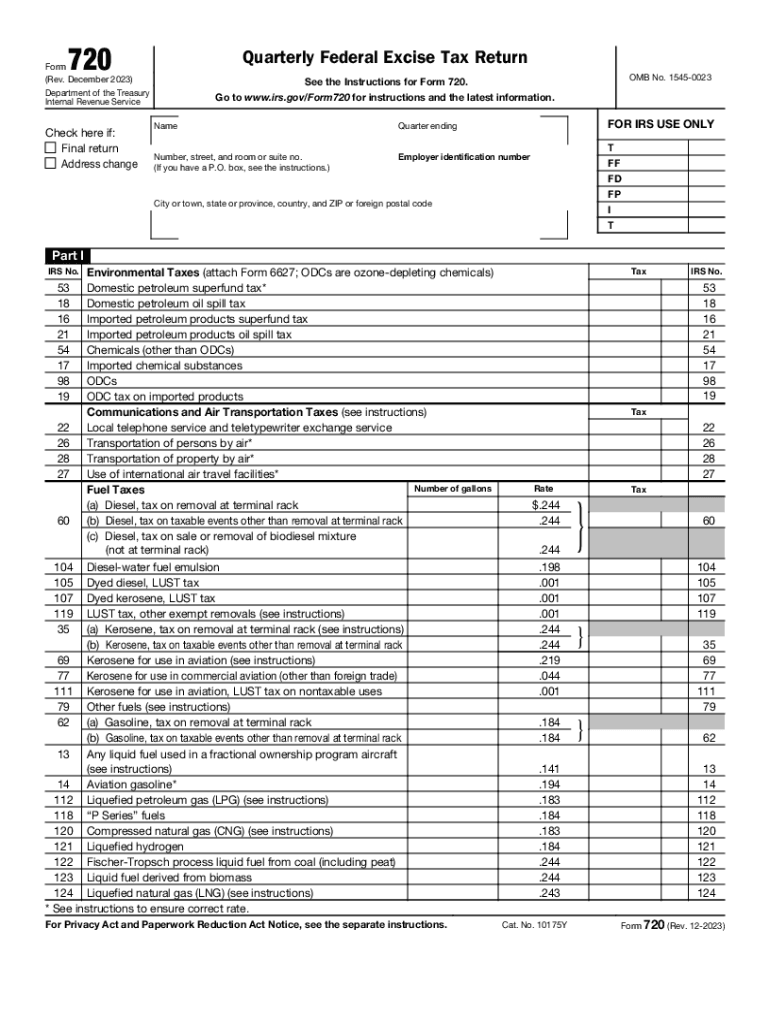

Definition and Overview of Form 720

The Quarterly Federal Excise Tax Return (Form 720) is an official document issued by the Department of the Treasury, Internal Revenue Service (IRS). This form is required for reporting various excise taxes that apply to specific activities and products. The most common excise taxes include those related to environmental taxes, fuel taxes, communications, and air transportation taxes. Understanding the purpose and requirements of Form 720 is essential for compliance with federal tax laws.

Important Features of Form 720

-

Tax Reporting: The form is used to report tax liabilities for excise taxes on specific goods and services. For example, businesses involved in selling gasoline or other fossil fuels may need to file Form 720 to report fuel taxes.

-

Payment Details: Form 720 includes sections for detailing payment methods and amounts, ensuring that taxpayers can fulfill their excise tax obligations accurately and on time.

-

Claiming Refunds: Taxpayers using Form 720 can also claim refunds on overpaid excise taxes, thus providing a recourse for any discrepancies in payment amount.

This form aims to standardize the reporting process for various excise taxes, thereby streamlining compliance for businesses and individuals alike.

Steps to Complete the Quarterly Federal Excise Tax Return

Completing Form 720 requires careful attention to details and adherence to several specific steps to ensure accurate submission. Below are the key steps involved:

-

Gather Necessary Information: Collect all data regarding taxable activities and revenues associated with the excise taxes you need to report. This may include sales figures, details about taxable products, and previous tax filings.

-

Obtain the Form: Access Form 720 from the IRS website, or through other legal means. Ensure you have the most current version of the form.

-

Complete the Identification Section: Fill out your name, address, and Employer Identification Number (EIN) accurately. This section establishes your identity with the IRS.

-

Report Tax Liabilities: Navigate to the appropriate sections of the form where you will enter your tax liabilities based on your business activities. Be sure to include the correct figures for each qualified excise tax.

-

Specify Payment Details: Provide payment information, including how you intend to pay the taxes owed. Options typically include electronic payments or checks.

-

Review and Submit: Double-check all entries for accuracy, ensure compliance with IRS guidelines, and submit the form electronically or via mail by the designated deadline.

Examples of Taxable Activities

- Fuel Sales: Businesses buying or selling motor fuels must report fuel excise taxes accurately.

- Air Transportation: Airlines need to report the transportation taxes generated from ticket sales.

By thoroughly understanding and correctly completing these steps, individuals and businesses can maintain compliance with federal excise tax regulations.

Filing Deadlines for Form 720

Adherence to filing deadlines for Form 720 is crucial to avoid penalties and ensure compliance with IRS regulations. The deadlines are as follows:

-

Quarterly Filing Requirements: Form 720 must generally be filed quarterly. Due dates are set for the last day of the month following the close of each quarter:

- Quarter 1: April 30

- Quarter 2: July 31

- Quarter 3: October 31

- Quarter 4: January 31 of the following year

-

Extended Guidelines: If a filing date falls on a weekend or holiday, the deadline typically shifts to the next business day. Taxpayers should regularly check for updates or changes to these deadlines to ensure timely submissions.

Being aware of these deadlines helps taxpayers avoid unnecessary fines, interests, or penalties resulting from late submissions.

Key Elements of Form 720

Form 720 comprises several key elements and specific sections that applicants must complete accurately:

-

Page 1: Identification information, including taxpayer details and quarter being filed.

-

Part I: Taxable activities related to certain products and services, where taxpayers report applicable excise taxes. This includes detailed lines for specific taxes based on the product types, such as environmental tax or indoor tanning services.

-

Part II: Claims for refunds or credits for overpaid taxes. This section allows taxpayers to detail reasons for requesting refunds and the amounts being claimed.

-

Payment and Signature Section: Finalize your submission by signing the document and preparing any necessary payment details for taxes owed.

Each of these elements is critical to the proper assessment and compliance with federal excise tax obligations.

Legal Use of Form 720

Form 720 is legally required for various businesses and individuals who engage in activities subject to excise taxation in the United States. Adhering to the use of Form 720 offers several advantages:

-

Compliance with Federal Laws: Utilizing the form helps taxpayers comply with IRS regulations governing excise taxes.

-

Record Keeping: The form serves as a documented proof of tax liabilities and payments made, which can be useful in case of audits or discrepancies.

-

Ability to Claim Refunds: Taxpayers can utilize Form 720 to claim refunds for any tax overpayments, protecting their financial interests.

In summary, the legal necessity of Form 720 ensures that taxpayers accurately report their financial responsibilities regarding excise taxes while reinforcing compliance with IRS regulations.