Definition & Overview of Form 720 for 2021

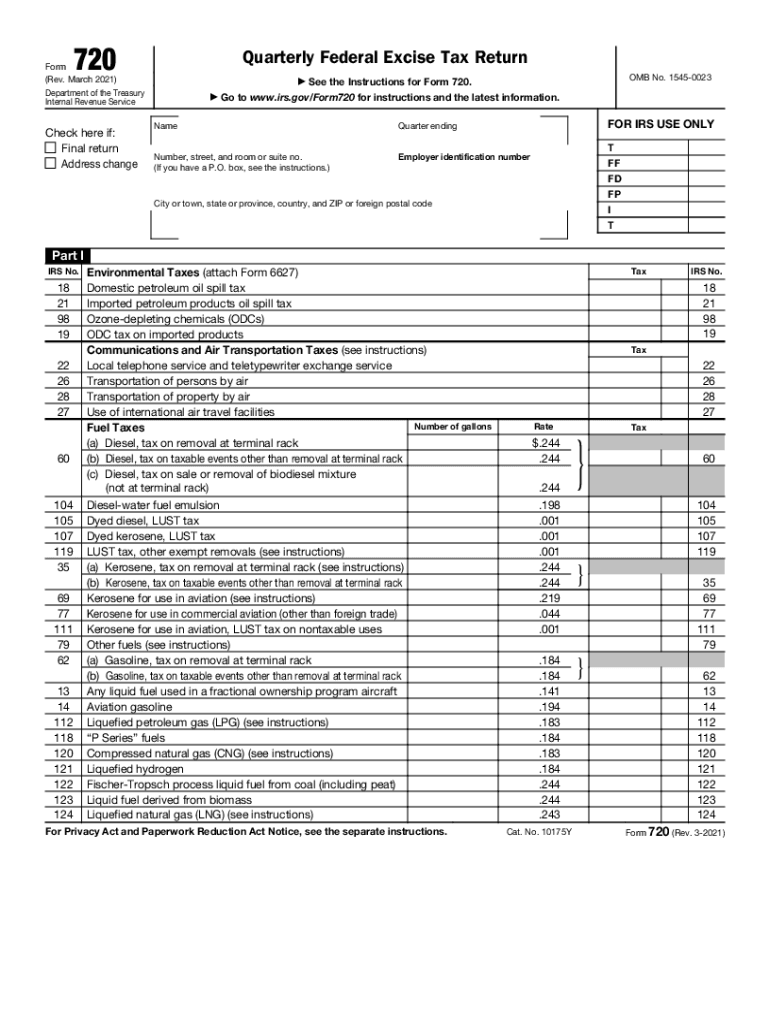

Form 720 is the Quarterly Federal Excise Tax Return used by businesses to report and pay various federal excise taxes, including specific taxes related to environmental concerns, fuel usage, and certain commodities. This form is essential for those businesses engaged in industries where these taxes are applicable, such as manufacturing, transportation, and retailing. The form acknowledges taxable activities and is a critical document for maintaining compliance with tax regulations mandated by the IRS.

Businesses must be aware that failing to file Form 720 accurately can lead to significant penalties and interest on unpaid taxes. It includes sections requiring taxpayer identification information, detailed calculations of excise taxes owed, and possible claims for refunds. Each component of the form reflects a specific tax obligation, making it crucial for businesses to understand their excise tax responsibilities fully.

Key Elements Included in Form 720

- Taxpayer Information: Identifying details such as your name, business name, and employer identification number (EIN).

- Excise Tax Calculation: Sections where taxpayers detail the amount of excise tax owed for various categories.

- Refund Claims: Provisions allowing taxpayers to claim credits or refunds for overpaid taxes.

- Instructions for Submission: Clear directives on how to submit the form, either electronically or via mail.

How to Use the Form 720 for 2021

Using Form 720 involves multiple critical steps, designed for accurate reporting and compliance. Businesses must first identify if they are liable for any excise taxes as per their operational activities.

- Determine Applicability: Verify whether your business operations trigger excise tax obligations under federal law. Industries such as telecommunications, transportation, and alcohol manufacturing are often involved.

- Gather Necessary Documentation: Collect prior tax records and relevant information regarding sales and purchases of taxable goods. This ensures accurate reporting.

- Complete the Form: Fill out the form, ensuring that all necessary fields are filled in correctly. It's advisable to use accounting software or tools that facilitate the process.

- Review for Accuracy: Conduct a thorough review of the completed form to ensure accuracy and completeness, which aids in avoiding potential penalties.

- Submit: Depending on your preference, either file electronically through IRS e-filing or mail a paper form to the designated IRS address.

Steps to Complete the Form 720 for 2021

Filling out Form 720 requires following specific steps to ensure it is done accurately and comprehensively.

- Read the Instructions: Start by reviewing the IRS instructions for the form to understand the requirements and definitions.

- Enter Taxpayer Information: Fill in your name, business name, and EIN at the top of the form.

- Calculate Taxes Owed:

- Use the applicable rate for each specified tax type.

- Input the correct figures for every applicable line, ensuring to sum correctly.

- Claim Refunds if Applicable: Fill out the section for refunds, providing a rationale if claiming for an overpayment.

- Sign and Date: Ensure that the form is signed and dated by an authorized person in your organization, affirming the accuracy of the information provided.

- File by Deadline: Adhere to filing deadlines to mitigate risks of late penalties.

Filing Deadlines for Form 720 in 2021

The timeliness of filing Form 720 is critical. Taxpayers must adhere to specific due dates to avoid potential late fees.

- Filing Periods: The form is typically filed quarterly. For 2021, the due dates are as follows:

- Q1: Due April 30, 2021

- Q2: Due July 31, 2021

- Q3: Due October 31, 2021

- Q4: Due January 31, 2022

Each quarter’s filing requires a separate, completed Form 720, which reflects the tax obligations for that specific period. Missing these deadlines can result in penalties imposed by the IRS.

Important Terms Related to Form 720 for 2021

Understanding vocabulary related to Form 720 facilitates better comprehension and accurate completion of the form.

- Excise Taxes: Taxes imposed on specific goods, services, or activities, often included in the price of goods.

- Employer Identification Number (EIN): A unique number assigned to businesses for tax purposes, akin to a Social Security number for individuals.

- Tax Liability: The total amount of tax owed to the IRS for the specified reporting period.

- Refund Claims: Requests for a return of overpaid taxes that are documented on the form.

Who Typically Uses Form 720 for 2021

Form 720 is primarily used by businesses and entities engaged in specific industries subject to federal excise tax. Common users include:

- Manufacturers of alcohol, tobacco, and certain fuels.

- Transportation companies that utilize fuel in operations.

- Telecommunications businesses that provide various services, incurring excise taxes.

- Importers involved in the trade of taxable goods.

Each of these entities must understand their excise tax responsibilities and ensure compliance through proper filing of Form 720 for 2021.