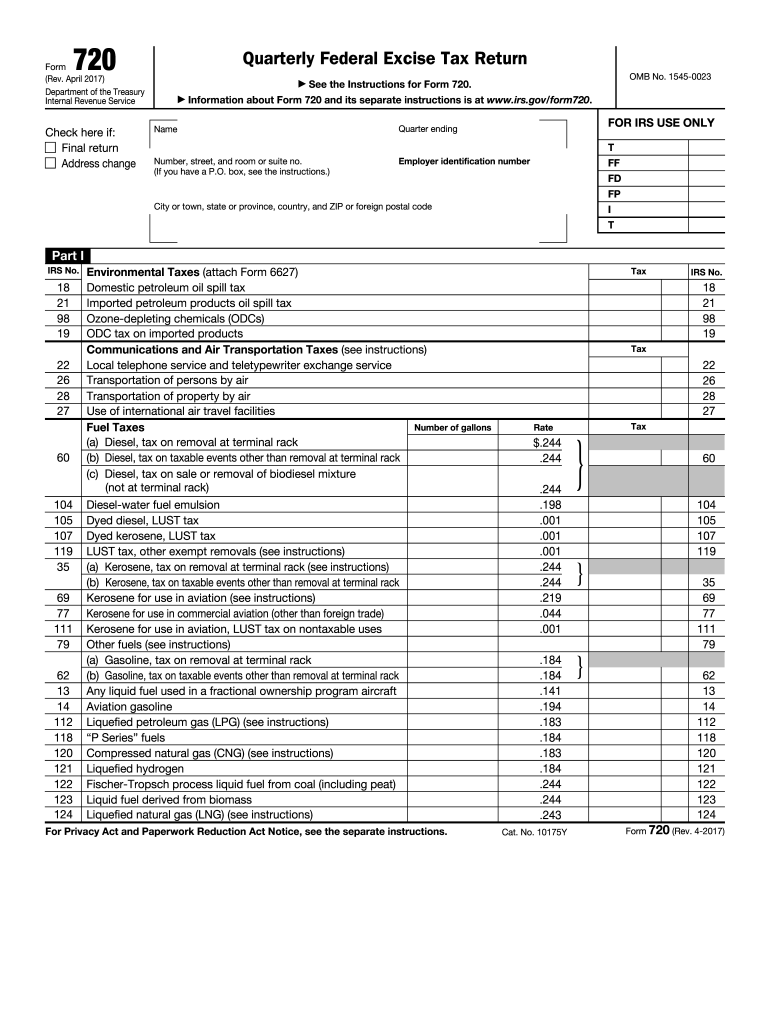

Definition and Purpose of Form

Form 720 (Rev. April 2017) is the IRS document used for filing the Quarterly Federal Excise Tax Return. This form primarily serves businesses liable for various excise taxes, which are taxes paid on specific goods, services, and activities. Its purpose is to report and pay these taxes quarterly to the IRS, ensuring compliance with federal tax regulations.

The form encompasses multiple excise tax types, including:

- Environmental taxes on certain chemicals and substances

- Fuel taxes imposed on gasoline and other fuels

- Taxes on the sale or use of products like heavy trucks and tires

Understanding the categories of taxes reported on Form 720 is crucial for any business subject to these taxes.

Steps to Complete the Form

Completing Form 720 requires careful attention to detail and an understanding of the various sections. The procedure involves several steps to ensure accurate reporting.

-

Gather Required Information: Before starting, obtain all the necessary documentation related to your business and the products or activities subject to excise taxes. This includes sales records, inventory data, and past tax returns.

-

Choose the Correct Tax Type: Identify which categories of excise taxes apply to your business. Each type of tax has specific lines on Form 720 that must be completed.

-

Fill Out the Form: Start completing the form by entering your business's name, address, and employer identification number (EIN) at the top. Proceed with the excise tax reporting sections that correspond to your collected data.

-

Calculate Total Taxes Owed: After filling out the applicable sections, total your excise tax liabilities. This amount represents what you will need to pay to the IRS for the quarter.

-

Review and Submit: Carefully review the entire form for accuracy. Any errors can lead to penalties or delays in processing. Once confirmed, submit the form through your preferred method: electronically or by mail.

Important Terms Related to Form

Understanding the terminology associated with Form 720 is vital for anyone filing this form effectively. Key terms include:

-

Excise Tax: A tax charged on specific goods, activities, or services, typically included in the price of the product. It is separate from sales tax, which consumers pay upon purchase.

-

Employer Identification Number (EIN): A unique number assigned by the IRS to businesses for identification purposes, necessary for tax filings.

-

Taxable Event: An occurrence that triggers tax liability, such as the sale of a product subject to excise tax.

Familiarity with these terms will enhance comprehension of the form and ensure compliance with tax regulations.

Filing Deadlines and Important Dates for Form

Timeliness is crucial when filing Form 720. This form is due quarterly, with the following deadlines:

- First Quarter (January 1 - March 31): Due April 30

- Second Quarter (April 1 - June 30): Due July 31

- Third Quarter (July 1 - September 30): Due October 31

- Fourth Quarter (October 1 - December 31): Due January 31 of the following year

Paying attention to these deadlines helps avoid penalties and interest on unpaid taxes.

Who Typically Uses Form

Form 720 is typically utilized by a range of business entities and individuals subject to federal excise taxes. Common users include:

- Retailers of fuel and motor vehicles, who must report taxes tied to sales of taxable goods.

- Manufacturers of certain products, such as chemicals and appliances that incur excise taxes.

- Businesses importing goods falling under excise regulations, ensuring compliance with federal tax policies.

Understanding who must file can help businesses prepare and structure their tax compliance strategies effectively.