Definition & Meaning

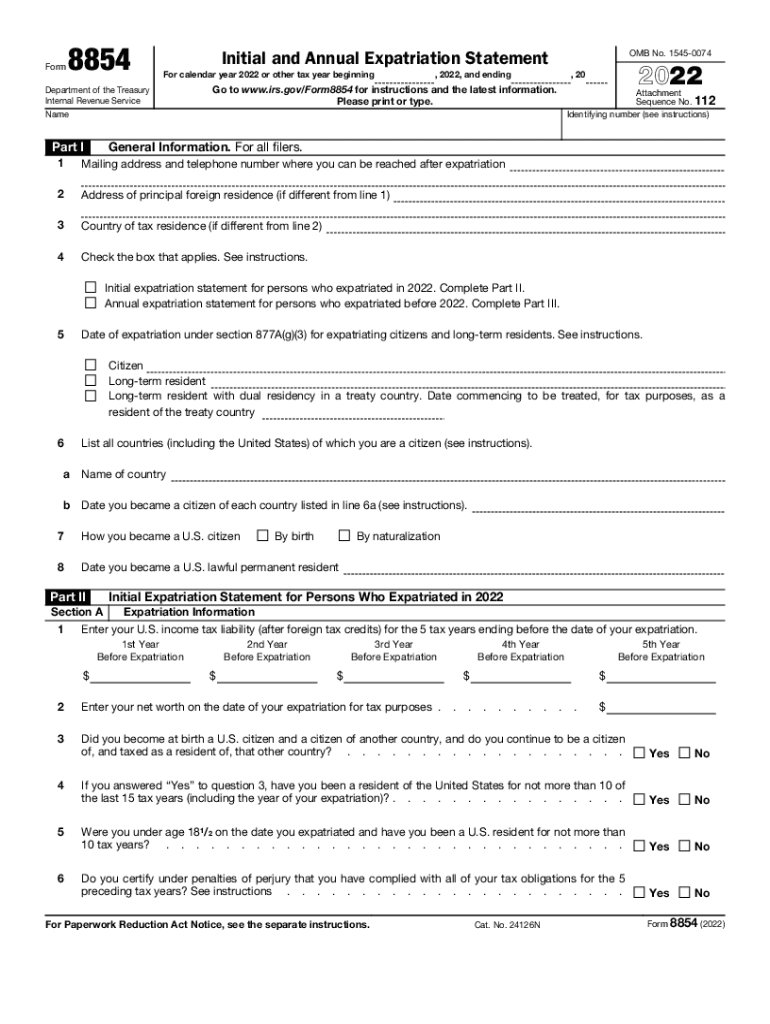

Form 8854, also known as the Initial and Annual Expatriation Statement, is designed for individuals who expatriated from the United States. This form applies if you have renounced your U.S. citizenship or given up your long-term resident status. It mandates that expatriates report personal information, citizenship details, and financial information such as net worth and tax liabilities. The purpose of Form 8854 is to assess and ensure that expatriated individuals meet all necessary tax obligations associated with their change in residency status.

How to Obtain Form 8854

Form 8854 can be accessed and downloaded from the IRS website as a PDF document. Additionally, digital platforms like DocHub offer alternatives for seamless form acquisition and editing. Using platforms that support PDF formats can simplify the process of editing and submitting the form without converting it into a different format, ensuring all information remains intact.

Steps to Complete Form 8854

-

Personal Information: Start by entering your name, Social Security number (SSN), and date of expatriation. Ensure that these details are accurate to avoid compliance issues.

-

Details on Citizenship: Provide information regarding your former U.S. citizenship or long-term resident status during the past 15 years before expatriation.

-

Asset Declaration: Enter your net worth on the expatriation date. This includes assets such as real estate, bank accounts, stocks, and personal belongings with monetary value.

-

Tax Liabilities: Report your U.S. tax liabilities for the five years preceding the expatriation date. This ensures the IRS evaluates tax compliance history.

-

Financial Information: Include any financial data pertaining to foreign trusts, gifts, or inheritances that might affect your U.S. tax responsibilities post-expatriation.

-

Signature: Sign and date the form at the designated signature area to validate the provided information.

IRS Guidelines

The IRS provides specific regulations associated with Form 8854 to ensure lawful expatriation. Key guidelines include maintaining accurate financial records and understanding the implications of expatriation on your taxable assets. Completing the form accurately is critical, as misreporting or omissions may lead to penalties. The IRS mandates compliance with these guidelines to promote adherence to tax laws for individuals relinquishing U.S. citizenship or residency.

Filing Deadlines / Important Dates

Form 8854 must be filed annually by the due date of your tax return, including extensions. Failing to meet this deadline may result in penalties or interest on any owed taxes. For those expatriating in the current year, additional deadlines might apply to ensure completion of all relevant tax obligations.

Penalties for Non-Compliance

Expatriates who fail to file Form 8854 or submit inaccurate information face financial penalties. The IRS imposes fines for non-compliance, including failure-to-file penalties that can accrue until the form is appropriately filed. Serious breaches could lead to an expatriation tax assessment, further escalating costs for individuals in violation of tax regulations.

Form Submission Methods

Form 8854 can be submitted to the IRS online or through traditional mailing methods. For those opting for a paper submission, it must be sent to the appropriate IRS address specified on their official website. Online submission via platforms like DocHub streamlines the process, validating all necessary information before delivery to the IRS.

Key Elements of Form 8854

- Personal Details: Including identification and expatriation specifics.

- Net Worth: Declared on expatriation date, addressing all asset types.

- Tax Liabilities: Covering the preceding five years prior to expatriation.

- Noteworthy Financial Transactions: Including foreign trusts and estates.

- Signatures: Ensuring authentication of the information provided.

Required Documents

Completing Form 8854 necessitates preparation and collection of relevant documentation:

- Proof of Expatriation: Documentation affirming citizenship renunciation or residency abandonment.

- Financial Records: Bank statements, investment portfolios, and property valuations.

- Tax Returns: Copies of tax filings from the previous five years.

- Additional Forms: Any supporting documents for claimed deductions or credits.

Taxpayer Scenarios

Various expatriate scenarios determine how Form 8854 should be approached:

- Self-Employed Individuals: Focus on business assets and deductions.

- Retirees: Must consider retirement account impacts and distributions.

- Internal Company Transfers: Evaluate stock options and other company-related asset transfers.

- Foreign Income Earners: Assess all international income streams for tax implications.

This comprehensive understanding of Form 8854 ensures that expatriates are informed and adequately prepared to meet their tax filing obligations while renouncing U.S. citizenship or residency.