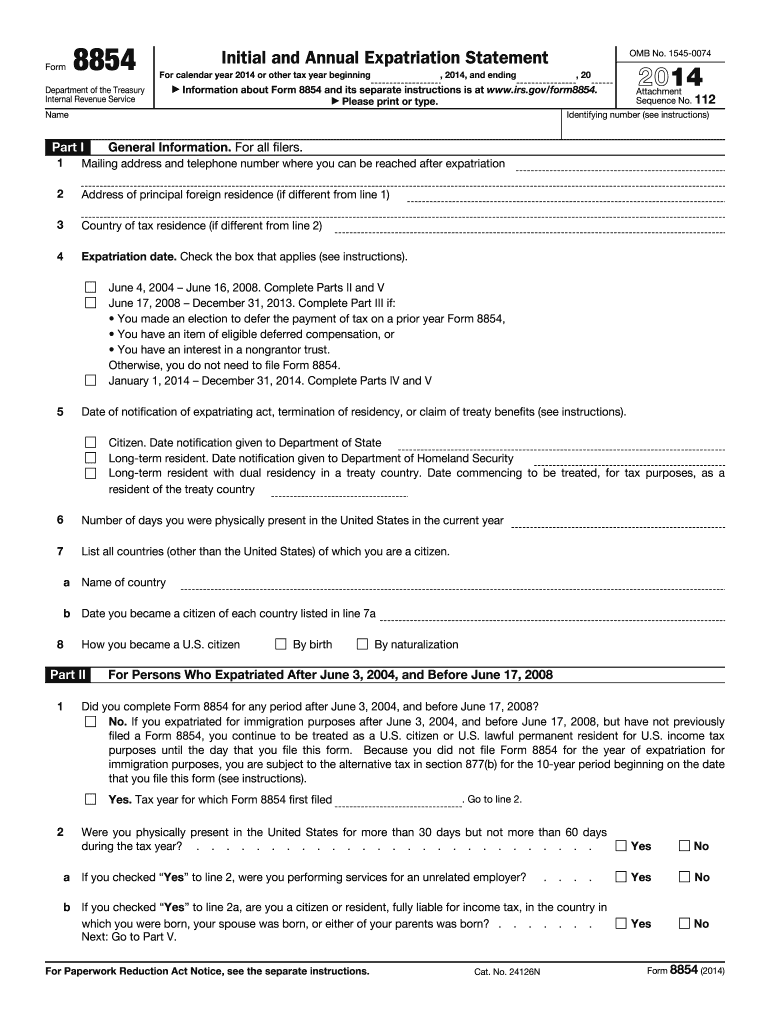

Definition & Meaning

The phrase "Check the box that applies (see instructions)" is commonly used in various forms, particularly in tax or legal documentation. It instructs individuals to select one or more options that correspond to their specific circumstances. This step typically helps in categorizing or assessing a person’s eligibility, status, or requirement based on predefined criteria in the accompanying instructions. Understanding how to interpret this phrase is crucial for ensuring accuracy and compliance when filing documents.

Practical Examples

- In tax forms, checking a box might determine your eligibility for certain deductions.

- For legal documentation, it might directly relate to specific legal rights or obligations.

Contextual Importance

Ensuring the correct box is checked avoids delays and potential compliance issues, especially with entities like the IRS where specific criteria must be met for accurate tax reporting.

How to Use the Check the Box that Applies (see instructions)

Step-by-Step Guidance

-

Read the Instructions Carefully: Always refer to the specific instructions provided with the form that explain the purpose of each box.

-

Identify Relevant Categories: Assess all the available options to understand which categories or statuses apply to your situation.

-

Check the Box: Once an option that accurately applies to your current status or requirement is identified, mark it clearly on the form.

-

Review for Accuracy: Double-check all selections to ensure they align with your understanding and the instructions provided.

Tips for Accuracy

- Ensure that the checkbox is fully marked to avoid ambiguity.

- If unsure, consult the form's help resources or seek professional guidance.

Steps to Complete the Check the Box that Applies (see instructions)

Detailed Breakdown

-

Acquire the Form: Obtain the relevant form that includes this checkbox section from a trusted source, such as the IRS or legal service provider.

-

Gather Necessary Information: Before beginning, collect all pertinent data that influences your selection process.

-

Cross-Reference Instructions: Examine the accompanying instructions on which criteria should influence your decisions.

-

Complete the Form: Proceed with filling out the form, ensuring that the box checked reflects your current situation or status.

-

Verification and Submission: Review the completed form to verify all information is correct before submission via the chosen method (online, mail, or in-person).

Why You Should Check the Box that Applies (see instructions)

Importance of Correct Selection

Ensuring that the correct box is checked allows for:

- Accurate Representation: Reflects the true status and eligibility criteria relevant to you.

- Compliance: Keeps the form in line with legal or regulatory requirements.

- Efficiency: Reduces the need for follow-ups due to mistakes or omissions.

Examples of Using the Check the Box that Applies (see instructions)

Real-World Scenarios

- Tax Filing: Selecting the filing status that applies (e.g., single, married) impacts tax calculations and potential deductions.

- Legal Documentation: Indicating consent or agreement to specific legal terms by marking a box.

Case Study

A taxpayer who recently got married must update their filing status on tax forms by checking the appropriate box to benefit from possible deductions and ensure compliance with tax laws.

IRS Guidelines

Compliance and Accuracy

- Detailed Instructions: IRS forms that include this statement typically provide comprehensive guidelines on what each checkbox signifies.

- Seeking Clarifications: Always reach out to an IRS official or consult a tax professional when encountering uncertainties.

Importance

Following IRS guidelines ensures legitimacy and accuracy in one’s tax filings, thereby reducing the risk of audits or penalties.

Required Documents

Necessary Documentation

When filling out forms with a checkbox section:

- Identity Proofs: Such as a social security number or tax identification number.

- Financial Records: Income statements, deductions, and relevant previous filings.

Tips

Keep all supporting documents on hand to ensure selections are backed by necessary evidence if required.

Who Typically Uses the Check the Box that Applies (see instructions)

Common Users

- Individuals: Completing tax returns and legal forms.

- Businesses: Filing compliance and regulatory documents tailored to their specific entity type.

Benefits for Users

- Simplification of complex forms by narrowing down applicable sections.

- Helping organizations and individuals meet compliance requirements with less effort.

Filing Deadlines / Important Dates

Key Timing Considerations

- Tax Deadlines: Certain forms need to be completed with the checkbox selections by April 15th in the United States.

- Amendments and Extensions: Be aware of deadlines for amendments or extensions to ensure timely and complete filing.

Practical Advice

Mark important dates on a calendar and use reminders to facilitate timely filling and submission of required forms.