Definition and Meaning

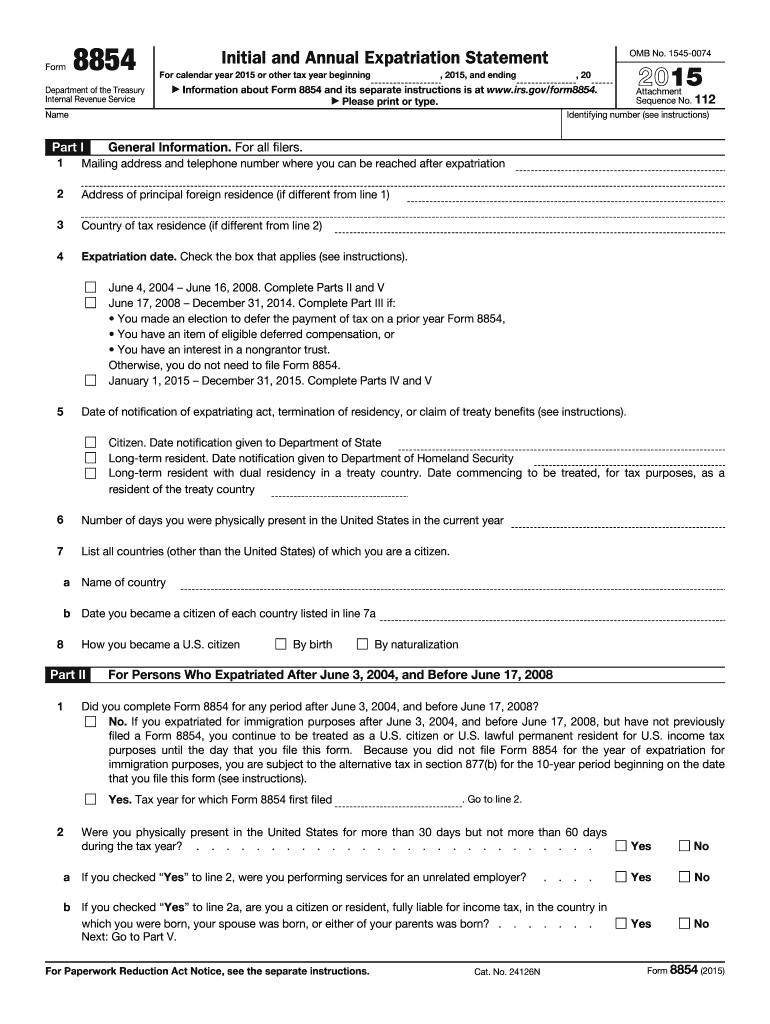

Form 8854, the Initial and Annual Expatriation Statement, serves as a crucial document for individuals who have expatriated from the United States. In 2015, this form was used to report details related to expatriation, including personal information, financial affairs, and tax liabilities as they stood on the date of expatriation. It ensures compliance with U.S. tax obligations post-expatriation and assesses eligibility for tax deferral options under specific circumstances related to expatriation.

How to Use the 2015 Form 8854

The 2015 Form 8854 is used primarily by individuals who have chosen to expatriate from the U.S. It is a detailed document that captures essential information about the individual's financial status and tax compliance. To use this form effectively:

- Gather personal and financial information, including asset values on the expatriation date.

- Fill each section meticulously to ensure accuracy in reported data.

- Attach necessary supporting documents for claims or deductions.

- Submit the completed form to the IRS by the assigned deadlines to avoid penalties.

Steps to Complete the 2015 Form 8854

Completing the 2015 Form 8854 requires attention to detail and accuracy:

- Start with Personal Information: Enter your full name, taxpayer identification number, and date of expatriation.

- Detail Expatriation Information: Explain the reason for expatriation and confirm renunciation of U.S. citizenship or termination of long-term residency.

- Declare Your Tax Liabilities: List your U.S. income tax obligations for the year.

- Asset and Liability Disclosure: Provide comprehensive details of your financial situation, including all worldwide assets and liabilities on the expatriation date.

- Calculate and Report Tax: Use the information provided to determine and report your tax liability, adhering to IRS rules.

- Review and Attach Documents: Ensure all calculations are correct and attach any required documentation.

- Submit the Form: Send the completed form to the IRS by the stipulated deadline.

Who Typically Uses the 2015 Form 8854

This form is typically used by:

- U.S. citizens who have officially renounced their citizenship.

- Long-term residents terminating an eight-year minimum lawful residency in the U.S.

- Individuals who need to establish compliance with U.S. tax code requirements post-expatriation.

Key Elements of the 2015 Form 8854

The form includes several sections crucial for compliance:

- Personal Identification: Essential for verifying the expatriating individual.

- Expatriation Details: Legal confirmation and declaration of expatriative actions.

- Financial Information: Includes a detailed account of assets, liabilities, and income to assess tax liability.

- Tax Liability: Calculation results based on disclosed information to determine outstanding tax obligations.

IRS Guidelines

According to IRS guidelines relating to Form 8854:

- The form must be filed annually by a specific deadline if you expatriated during the tax year.

- Ensure all information aligns with IRS regulations regarding asset reporting and tax obligations.

- Follow specific instructions for valuing different types of assets to avoid discrepancies.

Penalties for Non-Compliance

Non-compliance with Form 8854 filing requirements can result in significant penalties:

- Individuals failing to file on time could incur financial penalties.

- Misreporting or underreporting information can lead to audits and additional penalties.

- Legal action may follow if the IRS contends with significant discrepancies or omissions.

Form Submission Methods

The 2015 Form 8854 can be submitted through various channels:

- By Mail: Submit the completed form to the designated IRS mailing address.

- Online: For some taxpayers, submission via IRS-recognized tax filing software is an option.

- In-Person: Some choose in-person submission for direct handling, though this is less common.

Filing Deadlines / Important Dates

Adhering to the deadlines for Form 8854 is essential:

- The form must be filed annually by the tax return due date, including extensions, for the year of expatriation.

- Missing the deadline may result in penalties and interest on unpaid taxes.