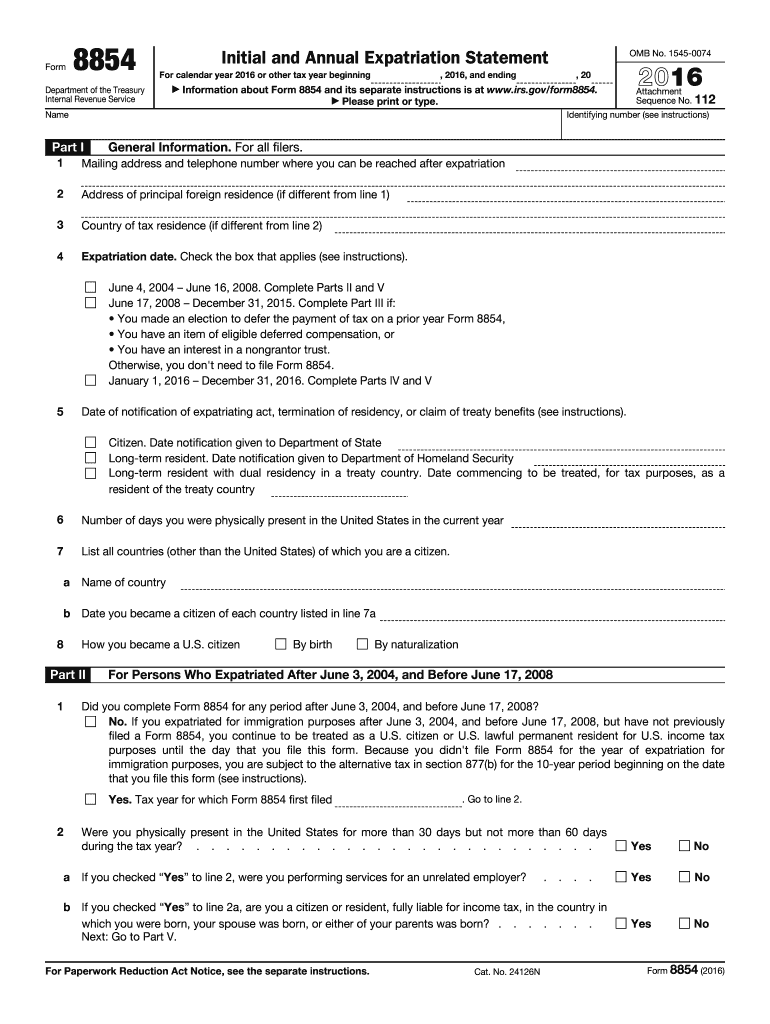

Definition and Purpose of 2016 Form 8854

The 2016 Form 8854, also known as the Initial and Annual Expatriation Statement, is a tax form used by individuals who expatriated during the tax year 2016. This form is essential for reporting compliance with U.S. tax obligations after expatriation. It collects detailed information about the individual's expatriation date, tax residency status, citizenship, income tax liability, and net worth. The purpose of Form 8854 is to ensure that individuals have met all tax responsibilities in connection with their expatriation and to declare any deferred taxes or financial interests that may be relevant.

Steps to Complete the 2016 Form 8854

-

Obtain the Form: Access the 2016 Form 8854 from the IRS website or your tax advisor.

-

Fill in Personal Information: Begin with your full name, social security number, and address.

-

Declare Expatriation Date: Clearly state the date of your expatriation and provide supporting documentation if required.

-

Financial Information:

- Complete sections regarding your income tax liability, net worth, and any deferred taxes.

- Include details about property owned at the time of expatriation.

-

Submit the Form:

- Ensure all required fields are completed accurately.

- Sign and date the form before submission.

- Submit via the selected method: online, mail, or in-person.

Eligibility Criteria for Filing Form 8854

- Expatriation: Individuals who have renounced their U.S. citizenship or long-term residents who have ended their U.S. resident status during the tax year.

- Net Worth and Income Checks: U.S. regulations may require specific declarations from those whose net worth exceeds certain thresholds.

Important Deadlines and Filing

Ensure timely submission by checking annual IRS deadlines specific to expatriating individuals. Late filing may incur penalties, so it's crucial to mark important dates on your calendar and reach out to a tax professional for deadlines applicable to your situation.

Key Elements of Form 8854

- General Information: Personal data, expatriation details.

- Financial Declarations: Assets, liabilities, net worth at expatriation.

- Compliance Statement: Assurance of the fulfillment of tax obligations post-expatriation.

Penalties for Non-Compliance

Failure to accurately complete and submit Form 8854 on time may result in significant penalties, including fines based on your income and potential legal consequences. These penalties emphasize the importance of meticulous attention to detail and the consulting of tax professionals if necessary.

Obtaining the Form

Form 8854 for 2016 can be accessed through multiple channels:

- Online Download: Available on the IRS official website.

- Tax Advisors: Consult a tax professional who can provide access to the form and offer guidance on completion.

IRS Guidelines Relating to Form 8854

The IRS provides specific instructions for individuals completing Form 8854, including definitions of expatriating acts, assessment of tax liability, and guidance on completing each section. Following these guidelines is crucial for accurate reporting and compliance.

Comparison of Digital vs. Paper Submission

-

Digital Submission:

- Efficient for faster processing and receiving confirmations.

- More environmentally friendly, reducing paper usage.

-

Paper Submission:

- Preferred for those uncertain about digital platforms.

- Allows manual verification and a physical copy for your records.

By understanding each section of the 2016 Form 8854 and following these comprehensive guidelines, individuals can ensure accurate compliance with expatriation-related tax requirements.