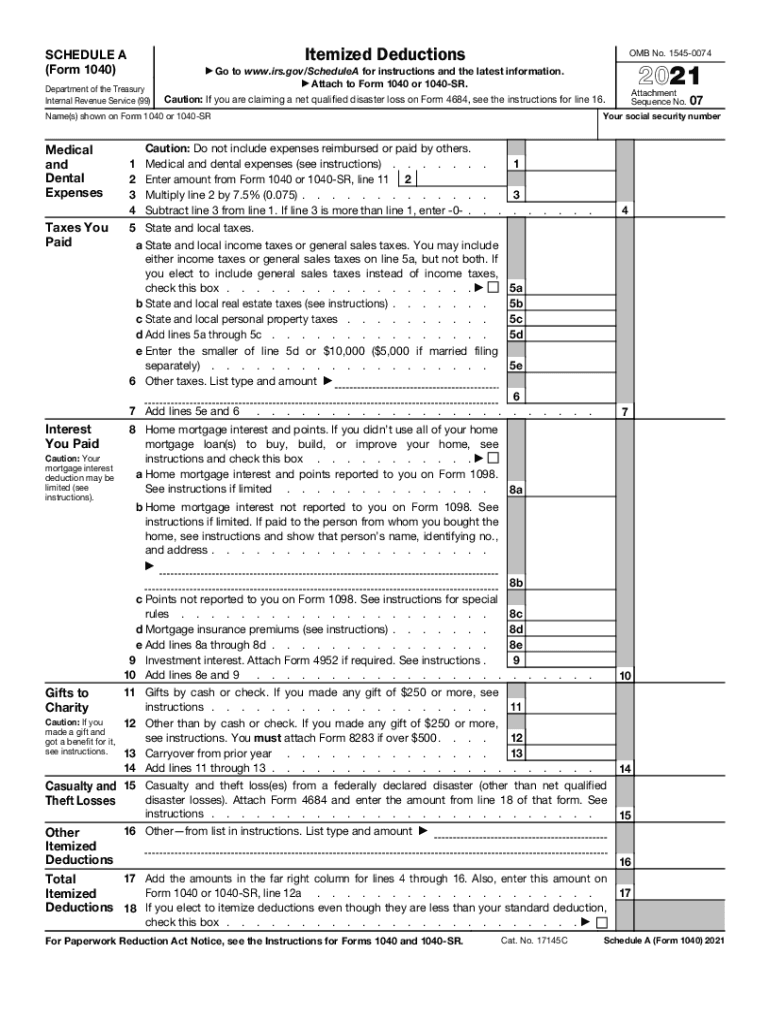

Definition and Meaning of Schedule A

Schedule A (Form 1040) is a supplementary form used by individual taxpayers to itemize their deductions on their federal income tax returns. Unlike the standard deduction, which is a fixed dollar amount that reduces the taxable income, itemizing allows taxpayers to list specific deductible expenses, often resulting in a lower tax liability. This form outlines various categories of expenses that can be deducted, including medical and dental expenses, mortgage interest, state and local taxes, charitable contributions, and unreimbursed business expenses. By using Schedule A, taxpayers can potentially benefit from significant tax savings based on their individual financial situations.

How to Use Schedule A

Using Schedule A effectively involves several key steps. First, you must determine if itemizing is beneficial compared to claiming the standard deduction. For the tax year 2021, the standard deduction is $12,550 for single filers and $25,100 for married couples filing jointly. If your total itemized deductions exceed these amounts, you'll likely want to complete Schedule A.

-

Gather Documentation: Collect all relevant documents that support your deductions. This includes receipts, invoices, and forms from various sources (e.g., medical bills, mortgage statements, and charitable donation receipts).

-

Fill Out the Form: The form is divided into sections for different categories of deductions. Input the appropriate totals in each section based on your collected documentation.

-

Total Your Deductions: After entering your deductions in the prescribed sections of the form, sum them all to arrive at your total itemized deductions.

-

Attach to Your Tax Return: Ensure that Schedule A is attached to your Form 1040 when you file your federal tax return, whether online or by mail.

Steps to Complete Schedule A

Completing Schedule A requires attention to detail and organization. Follow these steps for proper completion:

-

Personal Information: Start by entering your name and Social Security number at the top of the form.

-

Check the Box: Indicate whether you are married filing jointly, married filing separately, or filing as head of household.

-

Identify Deduction Categories: The form contains sections for different categories such as:

- Medical and Dental Expenses: Include total medical expenses that exceed 7.5% of your adjusted gross income (AGI).

- Taxes You Paid: This includes state and local income or sales taxes, real estate taxes, and personal property taxes.

- Interest You Paid: Mortgage interest, as well as points paid on a purchase or refinance, can be deductible.

- Gifts to Charity: Document your charitable contributions with receipts or bank records.

- Other Itemized Deductions: Include unreimbursed employee expenses and other specific deductions.

-

Complete All Relevant Sections: Fill in all applicable fields with accurate totals.

-

Calculate Total: At the bottom of Schedule A, add up all deductions and ensure the total is correctly carried over to Form 1040.

Important Terms Related to Schedule A

Understanding key terminology is crucial when navigating Schedule A. Here are important terms related to this form:

- Itemized Deductions: Specific expenses that taxpayers can claim to reduce their taxable income.

- Adjusted Gross Income (AGI): An individual’s total gross income minus specific deductions, which can affect eligibility for certain deductions and credits.

- Deductible Expenses: Expenses that the IRS allows you to subtract from your total income before calculating your tax liability.

- Standard Deduction: A fixed dollar amount the IRS allows you to deduct from your taxable income.

- Taxable Income: The income amount that is subject to taxation after deductions.

IRS Guidelines for Schedule A

The IRS provides specific guidelines related to the completion and submission of Schedule A. Adhering to these guidelines is essential for compliance and accuracy:

-

Eligibility: Only taxpayers who opt to itemize their deductions are required to complete Schedule A. Ensure your deductions exceed the standard deduction amount available for your filing status.

-

Documentation: Maintain thorough documentation, as the IRS may request proof for claimed deductions. This can include receipts and bank statements.

-

State and Local Tax (SALT) Deduction: Be aware that the SALT deduction is capped at $10,000. This cap applies to the total of state and local income taxes and real estate taxes combined.

-

Medical Expenses Over 7.5%: Only medical expenses that exceed 7.5% of your AGI can be deducted, so ensure you calculate this threshold accurately.

Filing Deadlines and Important Dates

It's critical to be aware of filing deadlines to ensure timely submission of Schedule A along with Form 1040. For the 2021 tax year, the following dates apply:

- Tax Return Due Date: April 15, 2022 (unless extensions are filed).

- Extension Filing: If more time is needed, you can file for an extension, typically granting an additional six months to submit your return.

- State Specific Deadlines: Stay informed about state tax deadlines, as they can differ from federal deadlines.

Each of these timelines is crucial in avoiding penalties and ensuring compliance with tax regulations.