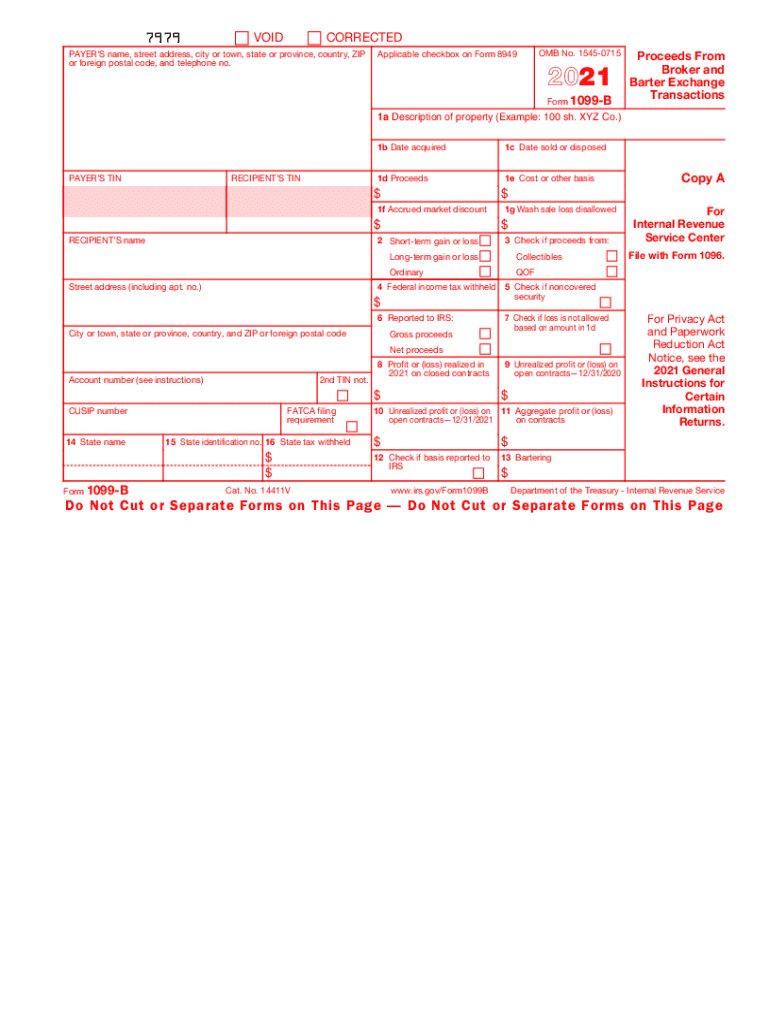

Definition and Meaning of Form 1099-B

Form 1099-B is an essential tax document used in the United States to report proceeds from broker and barter exchange transactions to the IRS. This form helps ensure that taxpayers accurately report their capital gains and losses on their federal tax returns. The "B" in the title stands for "Broker," highlighting its relevance in financial dealings involving stocks, bonds, and other securities. Understanding this form's role is crucial for individuals and entities engaging in financial transactions that may impact their tax liabilities.

Key Features of Form 1099-B

- Report Transactions: Accurately report sales or trades of securities via brokerage.

- Facilitate Tax Calculations: Helps in calculating capital gains or losses.

- IRS Requirement: Compliance with filing this form is mandatory for eligible transactions.

- Broker Responsibility: Often prepared and sent by the broker directly to the IRS and the taxpayer.

How to Use Form 1099-B

Using Form 1099-B is integral to the tax filing process for individuals and businesses involved in stock trading or exchange transactions. It serves as a record that taxpayers need to transfer relevant data to Schedule D, thereby determining the amount of capital gains or losses.

Step-by-Step Process

- Receive the Form: Usually provided by the broker after the end of the fiscal year.

- Review the Details: Check for accuracy in transaction data, including sale price and acquisition cost.

- Transfer Information: Use the details when filing Schedule D on the tax return.

- Calculate Gains or Losses: Assess capital gains or losses based on the form's data.

- File with Taxes: Ensure that the information aligns with federal tax return submissions.

How to Obtain Form 1099-B

Typically, Form 1099-B is issued by brokerage firms to clients who have engaged in transactions involving securities. It's part of their obligation to assist clients in complying with tax regulations.

Obtaining Form 1099-B

- Direct from Brokers: Brokers send the form electronically or via mail by early January.

- Online Platforms: Many brokers provide digital access to tax documents through their portals.

- Customer Request: If not received by the expected date, customers should contact their brokers directly.

Steps to Complete Form 1099-B

Proper completion of Form 1099-B ensures accurate tax reporting and compliance.

Detailed Instructions

- Personal Information: Ensure your personal and account details are correctly listed.

- Transaction Data: Verify each transaction’s date, type, proceeds, and cost basis.

- Adjustments: Note any necessary adjustments for wash sales or other specific transaction considerations.

- Submit with Tax Returns: Attach to federal tax return forms as needed, primarily Schedule D.

Who Typically Uses Form 1099-B

This form is not universal for all taxpayers but is specifically targeted at certain individuals and professional entities.

Typical Users

- Investors: Individuals actively trading stocks, bonds, or securities.

- Day Traders: Frequent traders dealing with multiple transactions.

- Financial Advisors: Those managing client investment portfolios may encounter this form on behalf of clients.

- Tax Professionals: Assist clients in ensuring accurate tax return filings based on 1099-B details.

Important Terms Related to Form 1099-B

Familiarity with critical terminology ensures clarity and accuracy in reporting.

Key Terms

- Proceeds: The total amount of money received from a sale.

- Cost Basis: The original purchase price of the securities, impacting gain or loss calculations.

- Capital Gains: The profit from selling a security.

- Wash Sale: A sale of a security at a loss, followed by repurchase within a short period, affecting the claimable loss.

IRS Guidelines for Form 1099-B

The IRS requires precise guidelines for handling and submitting Form 1099-B to ensure tax compliance.

Key Guidelines

- Accuracy: All transactions must be accurately reported to avoid potential audits.

- Timeliness: Brokers must issue the form by the end of January; taxpayers should review and utilize forms promptly.

- Submission: Both the IRS and the taxpayer receive copies of the completed form.

- Amendments: In case of errors, corrected versions must be filed to rectify report details.

Filing Deadlines and Important Dates for Form 1099-B

Adherence to deadlines is crucial to maintain compliance and avoid penalties.

Important Dates

- Broker Issuance Date: January 31; brokers must distribute 1099-B forms to clients.

- Tax Filing Deadline: April 15; align the data on Form 1099-B with filed returns.

- Extension Requests: Possible for filing returns, but forms should still be obtained and reviewed in a timely manner.

Having a comprehensive understanding of Form 1099-B, its usage, recipients, and guidelines ensures that taxpayers manage their obligations effectively, while minimizing risk and maximizing compliance and accuracy in their financial reporting duties.