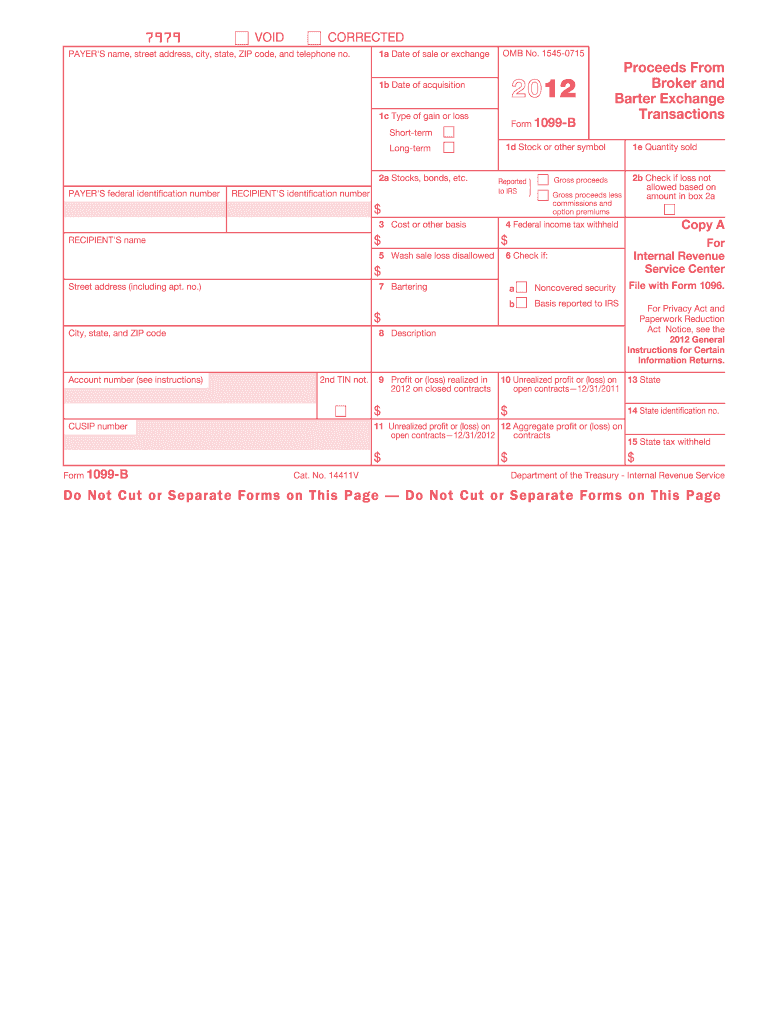

Definition and Meaning of Form 1099-B

The Form 1099-B is a tax form used to report proceeds from broker and barter exchange transactions. These transactions typically involve the sale or exchange of financial assets like stocks, bonds, and mutual funds. Used extensively within the United States, this form helps the Internal Revenue Service (IRS) track individuals’ capital gains and losses. The form 1099-B for 2012 includes crucial information such as the description of the property sold, the sales date, purchase date, sale proceeds, and cost basis. Understanding the details on this form is essential for accurately calculating and reporting any potential taxes owed on investment income.

How to Use the 1099-B 2012 Form

Using the Form 1099-B involves deciphering the information provided by your broker or barter exchange and accurately including it on your tax return. Here are essential steps to follow:

- Review the form: Begin by examining all entries on the form, focusing on the details of each transaction.

- Calculate gains or losses: Use the sales proceeds and cost basis to determine any gains or losses.

- Transfer data to your tax return: Enter the relevant information on Schedule D of Form 1040, detailing capital gains and losses.

- Adjust for wash sales: Make necessary adjustments if any transactions are marked as wash sales.

Steps to Complete the Form 1099-B

Completing the Form 1099-B requires accuracy. Below are detailed steps to ensure it is filled correctly:

- Identify the parties involved: Clearly state your details and those of the broker or barter exchange in the designated sections.

- Document transactions: List each transaction, including the sale date and proceeds, as per the brokerage statements.

- Calculate the cost basis: This involves determining the original purchase price of the assets sold.

- Account for multiple transactions: If numerous transactions are reported, ensure each is separately itemized to prevent errors.

How to Obtain the 1099-B 2012 Form

To acquire Form 1099-B for the year 2012, one typically follows these steps:

- Contact your broker or exchange: They should provide this form by late January following the reporting tax year.

- Access online brokerage accounts: If applicable, download the form directly from your online account.

- Request physical copies: If electronic access isn’t available, ask your broker to mail a hard copy.

Key Elements of the 1099-B Form

The key components of Form 1099-B include:

- Description of property: Clearly outlines the nature of the asset sold.

- Sales and purchase dates: Indicate the timing of transactions.

- Proceeds and cost basis: Reflects the financial details necessary to compute gains or losses.

- Short-term and long-term transactions: This distinction impacts tax rates applied to capital gains.

Important Terms Related to 1099-B 2012 Form

Understanding these terms is crucial for working with Form 1099-B:

- Proceeds: The total amount received from the sale.

- Cost Basis: Original value of the investment for tax purposes.

- Wash Sale: A regulation that disallows a deduction of a loss from a sale if a similar security is repurchased within 30 days.

IRS Guidelines for the 1099-B 2012 Form

Following IRS guidelines ensures compliance and accuracy:

- Reporting schedule: The IRS requires brokers to file Form 1099-B by February 28 if filing by paper or March 31 if filing electronically.

- Foreign accounts: Special attention is needed for reporting transactions executed in foreign accounts.

- Backup withholding: Brokers must withhold federal income tax from payments of certain reportable interest and dividends under specific conditions.

Filing Deadlines and Important Dates

Strict adherence to deadlines ensures compliance and avoids penalties:

- Form issuance: Brokers and barter exchanges generally issue the form by January 31 of the year following the tax year.

- Tax filing deadline: Include this information in your federal tax return due by April 15, unless an extension is filed.

- Corrections: Report any discrepancies immediately to avoid late fees or interest on underpayments.