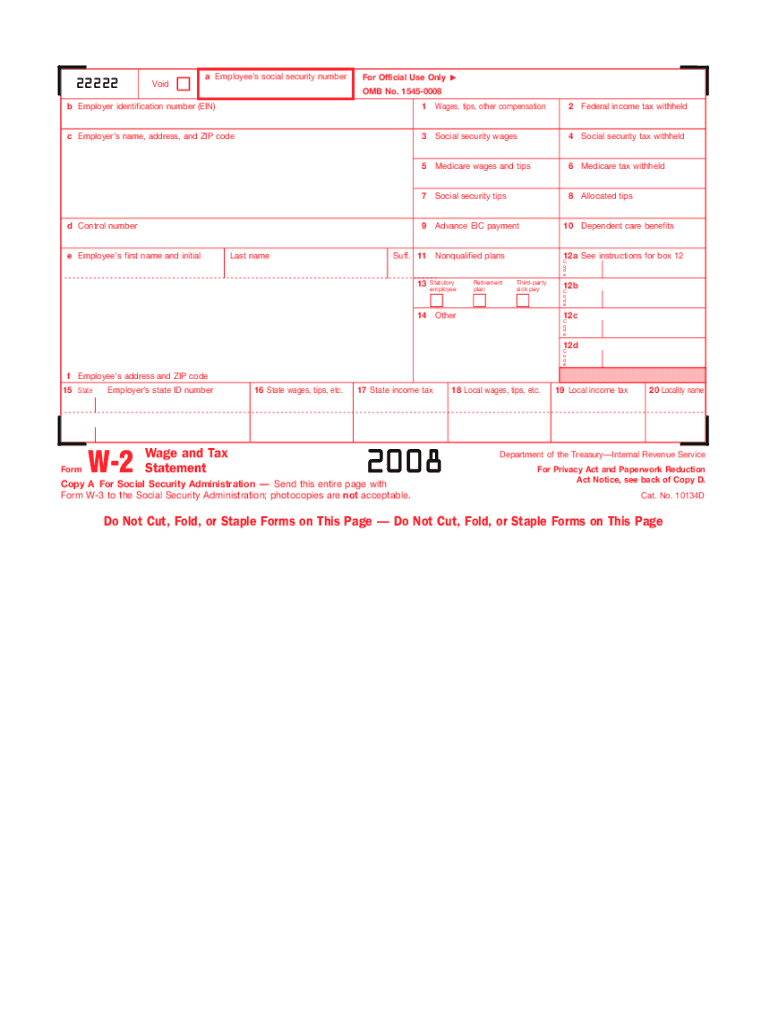

Definition and Purpose of the 2008 Form W-2

The 2008 Form W-2, formally known as the Wage and Tax Statement, is a crucial document used by employers in the United States to report wages paid to employees and the taxes withheld from those wages. This form is essential for both employers and employees as it is a foundational component of tax reporting and compliance. Employers are required to furnish this form to their employees, the Social Security Administration (SSA), and the Internal Revenue Service (IRS).

The primary purpose of the Form W-2 is to provide a detailed summary of an individual's annual earnings and withheld taxes. It includes information on federal income tax, Social Security tax, and Medicare tax withheld. Additional entries might include state and local taxes, employer-provided benefits, and other compensatory aspects. For employees, this form is vital for accurately filing their annual federal and state income tax returns.

How to Obtain the 2008 Form W-2

Employees typically receive the 2008 Form W-2 from their employers by the end of January following the calendar year of earnings. It can be delivered in various formats, including a paper copy or a digital version sent via email or accessible through an employer-provided online portal. Employers must ensure the form is sent to the correct address on record for each employee to avoid issues in tax filing.

If an employee does not receive their Form W-2 by mid-February, they should contact their employer immediately to request a copy. Additionally, employees can reach out to the IRS for assistance. While the IRS does not issue the W-2 directly to employees, they can provide guidance on how to obtain it from one’s employer and recommend steps to take if the form is not delivered.

Important Steps to Complete the 2008 Form W-2

Filling out the 2008 Form W-2 requires attention to detail and accuracy to ensure compliance with IRS regulations. Employers should follow these steps:

-

Employee Information: Enter the employee’s Social Security Number, full name, and address.

-

Wage Details: Record the total wages, tips, and other compensation for the year.

-

Tax Withheld: Specify federal income tax withheld along with Social Security and Medicare taxes.

-

State and Local Details: Include state wages, tips, and income tax withheld for state-specific reporting.

-

Review and Verify: Verify all entered information for accuracy, including SSN and withholding amounts.

-

Distribute Copies: Provide copies to relevant parties:

- Copy A to the SSA

- Copy B, C, and 2 to the employee

- Copy D for employer records

Key Elements of the 2008 Form W-2

The 2008 Form W-2 includes several key elements that are integral to tax and income reporting:

-

Box 1 - Wages, Tips, Other Compensation: This box captures the total earnings subject to income tax.

-

Box 2 - Federal Income Tax Withheld: Displays the amount of federal tax withheld from the employee's pay.

-

Box 12: Use code identifiers to report different types of compensation and benefits, such as retirement plan contributions (e.g., 401(k) contributions).

-

Box 14 - Other: May include additional tax information like union dues or non-taxable income, depending on employer specifications.

Employers must ensure each box reflects accurate data for proper tax reporting and compliance, minimizing the risk of IRS penalties.

IRS Guidelines for the 2008 Form W-2

Adherence to IRS guidelines for the 2008 Form W-2 is crucial for avoiding penalties. The IRS mandates that the form must be issued to employees by January 31 of the following year and filed with the SSA by the end of February (or end of March if filed electronically). Employers should evaluate their reporting methods early and choose to file electronically when possible, as it often provides efficiency and reduces the likelihood of errors.

Moreover, the IRS requires W-2 forms to be scannable, meaning that handwritten entries should be avoided to ensure the SSA can process the forms accurately. Compliance with these guidelines is essential not only to avoid fines but also to protect employees from tax reporting complications.

Penalties for Non-Compliance

Non-compliance with the requirements of the 2008 Form W-2 can lead to significant penalties for employers. These penalties can vary based on the severity of the omission or error, timeliness of corrections, and whether the employer can prove a reasonable cause for the oversight. Penalties can escalate per instance and per day beyond the due date, making them costly if not addressed promptly.

Common causes of penalties include:

- Failing to file copies with the SSA by the deadline.

- Providing incorrect or incomplete information.

- Not delivering copies of the form to employees by the deadline.

Employers should take every measure to avoid administrative errors that could lead to financial liabilities or further scrutiny from tax authorities.

Employee Instructions and Taxpayer Scenarios

Employees rely on the 2008 Form W-2 for several purposes, especially in preparing their annual taxes. They should carefully review all information on the form as soon as it arrives, looking for discrepancies such as incorrect wages or Social Security numbers. Addressing these promptly with the employer ensures the proper reflection of these figures in their tax return.

Taxpayer scenarios include different forms of employment and life situations, such as self-employment or retirement, which might alter how the W-2 interacts with other tax documents. Employees must consider how their tax situation might intersect with additional forms (e.g., Form 1099 for independent contractors).

Filing Deadlines and Submission Methods

Timeliness in handling the 2008 Form W-2 is crucial. Employers must still comply with precise deadlines which include:

-

January 31: Deadline to provide employees with their W-2 form.

-

Last day of February: Deadline to file paper copies with the SSA.

-

March 31: Deadline for electronic filing to the SSA.

Submission methods vary, including mail and electronic filing options. Although both methods are acceptable, electronic filing is encouraged due to its efficiency, accuracy, and tracking abilities. Additionally, electronic filing is often easier to verify and can minimize the risk of errors that can occur with manual entry forms.