Definition and Meaning of Form 13

Form 13615, titled "Volunteer Standards of Conduct Agreement," is a crucial document used in the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. This form ensures that volunteers adhere to high ethical standards while assisting eligible taxpayers with free tax return preparation. It underlines the responsibility of volunteers to uphold integrity, confidentiality, and professionalism. Compliance with this form is mandatory to maintain the trust between taxpayers and volunteers, highlighting the serious commitment to maintaining program integrity.

How to Obtain Form 13

Form 13615 can typically be accessed through the Internal Revenue Service (IRS) website, where it is available for download. Participating organizations within the VITA and TCE programs might also provide this form directly to their volunteers. It can be distributed electronically or in paper format during orientation or training sessions. Organizations often include this form as part of the initial volunteer package to ensure volunteers understand their responsibilities from the outset.

Steps to Complete Form 13

-

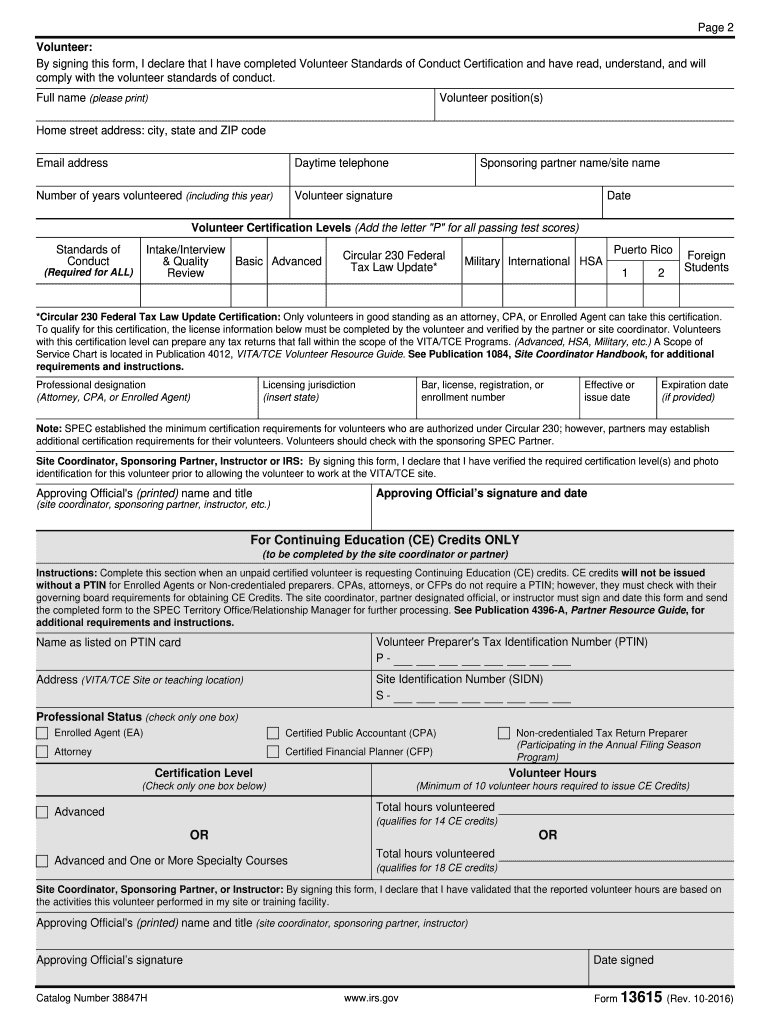

Identification Details: Begin by filling out the top section with your name, volunteer site name, and contact information. This establishes your identity and connects you to a specific volunteer location.

-

Understanding Conduct Standards: Carefully review the standards of conduct outlined on the form. These include guidelines on confidentiality, conflict of interest, and accuracy in tax return preparation.

-

Testing and Certification: Indicate your completion of the required volunteer standards training and certification test. Volunteers are generally expected to pass this test to affirm their understanding of ethical guidelines.

-

Sign and Date: Signature is required at the bottom of the form along with the date, affirming your commitment to adhere to the standards.

-

Submission: Submit the completed form to your VITA or TCE site coordinator, who will retain it for program records.

Legal Use of Form 13

Form 13615 serves a legal purpose by formalizing the agreement between the volunteer and the VITA/TCE program regarding ethical conduct. It acts as a documented proof of the volunteer's acknowledgment and agreement to abide by the specified standards. This form provides a foundation for legal recourse in instances of non-compliance, ensuring that volunteers who do not adhere to these standards can face appropriate consequences, including removal from the program.

Key Elements of Form 13

-

Volunteer Information: Personal and site-related details that help in identifying and contacting the volunteer.

-

Conduct Standards: Specific guidelines that dictate the expected behavior of volunteers, emphasizing accuracy, honesty, and confidentiality.

-

Certification Confirmation: A section where volunteers affirm the completion of necessary training and the passing of the voluntary standards test.

-

Signature Section: The area that requires a volunteer's signature to confirm their commitment to upholding these standards.

Who Typically Uses Form 13

Form 13615 is primarily used by volunteers who participate in the IRS-sponsored VITA and TCE programs. These volunteers usually include individuals with knowledge of tax laws and a commitment to assist underserved communities with tax return preparation. The form is also used by program coordinators and administrators to ensure that all active volunteers understand and agree to comply with the program's ethical requirements.

Penalties for Non-Compliance

Non-compliance with the Volunteer Standards of Conduct outlined in Form 13615 can lead to significant consequences. Volunteers found to be in violation may be removed from the VITA or TCE programs. Additionally, severe breaches could result in investigations and possible legal actions, especially if the volunteer’s actions caused harm or jeopardized taxpayer information.

IRS Guidelines for Form 13

The IRS provides specific guidelines for completing Form 13615. These include requirements for training completion, adherence to ethical standards, and the procedures for submitting the form. The IRS emphasizes the importance of this form in maintaining program integrity, stressing that adherence is vital for the success and reliability of the VITA and TCE programs. Volunteers and participating organizations are encouraged to review these guidelines regularly to ensure full compliance.