Definition and Meaning

Form 13615, known as the "Volunteer Standards of Conduct Agreement – VITA/TCE Programs," serves as an essential document for volunteers participating in the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. Established in 2012, this form is designed to acknowledge and document a volunteer's commitment to maintaining high ethical standards and providing quality tax preparation services to eligible taxpayers. The agreement outlines the basic principles volunteers must adhere to, such as integrity, accuracy, and professionalism, to ensure taxpayers receive trustworthy assistance.

How to Use Form 13615

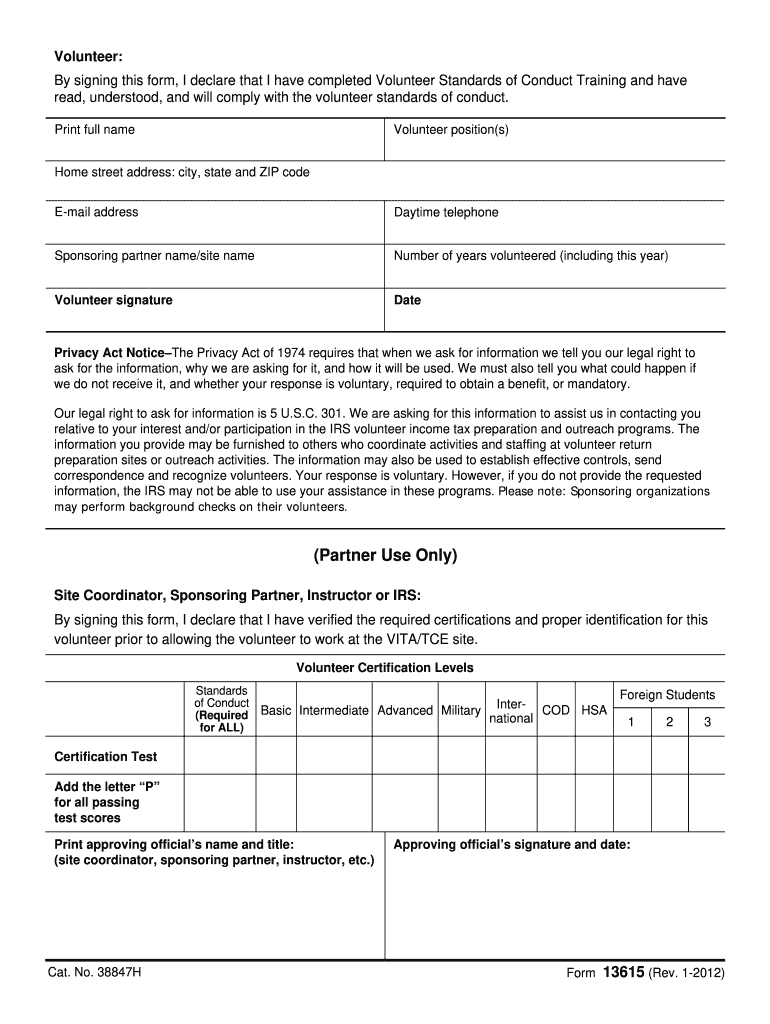

To effectively use Form 13615, volunteers are required to complete it prior to commencing their duties within the VITA/TCE programs. This form serves as both a pledge and a formal acknowledgment of the conduct standards expected during their volunteer services. Volunteers must also undergo training sessions that cover these standards and pass relevant certification tests. Upon completion, they will sign and date the form, confirming their understanding and commitment. Tax sites retain these signed forms as a record to ensure compliance with IRS regulations throughout the filing season.

How to Obtain Form 13615

Form 13615 is accessible through multiple channels for prospective volunteers. It can be downloaded directly from the IRS website, ensuring it is the latest version available. Many VITA/TCE program coordinators also provide the form during orientation sessions or training workshops for volunteers. Additionally, tax preparation centers under the VITA/TCE umbrella may distribute paper copies or digital links to facilitate easy access for incoming volunteers.

Steps to Complete Form 13615

- Personal Information: Volunteers must start by entering their personal details, such as name, contact information, and volunteer position within the program.

- Ethical Standards Agreement: Volunteers read through the ethical guidelines and acknowledge their understanding and willingness to comply by checking corresponding boxes.

- Sign and Date: The form requires a signature and date, signifying agreement to adhere to the volunteer standards.

- Submission: Upon completion, the signed form is typically submitted to the site coordinator or directly to the responsible authority within the VITA/TCE program for record-keeping.

Who Typically Uses Form 13615

Form 13615 is primarily used by volunteers who serve in the VITA/TCE programs, which provide free tax preparation assistance to qualifying individuals. This includes individuals from various backgrounds such as retirees, working professionals, college students, and community leaders who wish to contribute to public service. Under these programs, volunteers assist taxpayers, especially those seeking help with simple tax situations, the elderly, and disabled citizens, thereby broadening the reach and effectiveness of the IRS's free filing initiatives.

Important Terms Related to Form 13615

- VITA: Volunteer Income Tax Assistance focuses on helping low- to moderate-income taxpayers.

- TCE: Tax Counseling for the Elderly offers tax assistance to individuals aged 60 and older.

- Volunteer Protection Act: A law that provides certain immunities to volunteers, protecting them from liability while performing their duties.

- Ethical Standards: Guidelines that ensure volunteers act professionally and ethically in the preparation of tax returns.

Key Elements of Form 13615

- Commitment to Accuracy: Volunteers pledge to prepare returns accurately and refrain from fraudulent activities.

- Respect and Privacy: Volunteers agree to treat taxpayers respectfully and maintain confidentiality.

- Non-Compensation Clause: Acknowledgment that services provided are free and that volunteers will not accept any form of payment.

- Training Requirement: Verification that volunteers have completed necessary training and certifications.

Penalties for Non-Compliance

Non-compliance with the standards outlined in Form 13615 can result in serious consequences. Volunteers who fail to adhere to these guidelines may face immediate removal from the VITA/TCE programs. Furthermore, they could be subject to investigations, particularly if there is evidence of misconduct or unethical behavior. These penalties underscore the importance of maintaining high standards of conduct to protect both the volunteers and the taxpayers they assist.

IRS Guidelines for Form 13615

The IRS provides detailed guidelines on completing and utilizing Form 13615 to ensure uniformity and compliance across VITA/TCE sites. These guidelines cover the necessary training, verification processes, and ongoing supervision required to maintain ethical standards. Volunteers and site coordinators are encouraged to refer to the IRS's published materials to remain informed about any updates or changes to these requirements.

Filing Deadlines and Important Dates

Form 13615 should be completed and signed by all volunteers before they begin their service in any given tax season. This includes meeting all training and certification deadlines, which are typically set prior to the commencement of tax filing operations. Keeping track of these deadlines ensures that all preparers are authorized and compliant with IRS standards when interacting with taxpayers.

Required Documents for Completing Form 13615

To fully comply with Form 13615 and IRS stipulations, volunteers may need to present identification documents, such as a government-issued ID, or certification evidence showcasing the completion of necessary training modules. Having these documents ready will facilitate a smoother onboarding process into the VITA/TCE programs, confirming volunteer eligibility and readiness.

Who Issues Form 13615

Form 13615 is issued by the IRS as a formal agreement document within the VITA/TCE framework. VITA/TCE program organizers at various tax preparation sites are responsible for distributing, collecting, and retaining these signed agreements, ensuring all volunteers meet the specified conduct standards before assisting with taxpayer services.