Definition and Meaning

Form 13615 is formally known as the Volunteer Standards of Conduct Agreement, used within the IRS's Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. This form outlines the ethical standards and requirements that volunteers must adhere to when assisting individuals with tax return preparation. By signing this agreement, volunteers commit to maintaining the integrity and public trust required in this role.

How to Use Form 13615

To effectively use Form 13615, volunteers should first understand the responsibilities outlined within it. The form details the ethical guidelines and conduct expected of every volunteer, such as the prohibition of preparing false tax returns or soliciting donations. Volunteers are required to review these standards and signify their commitment by signing the document. It's crucial for volunteers to fully internalize these guidelines as part of their active involvement in the VITA/TCE programs.

How to Obtain Form 13615

Volunteers can obtain Form 13615 through several channels. It's commonly distributed by IRS program coordinators during the recruitment or training sessions for the VITA and TCE programs. Additionally, the form can be downloaded directly from the IRS website as part of the volunteer resource materials. Local IRS offices and community organizations participating in these tax assistance programs may also provide the form upon request.

Steps to Complete Form 13615

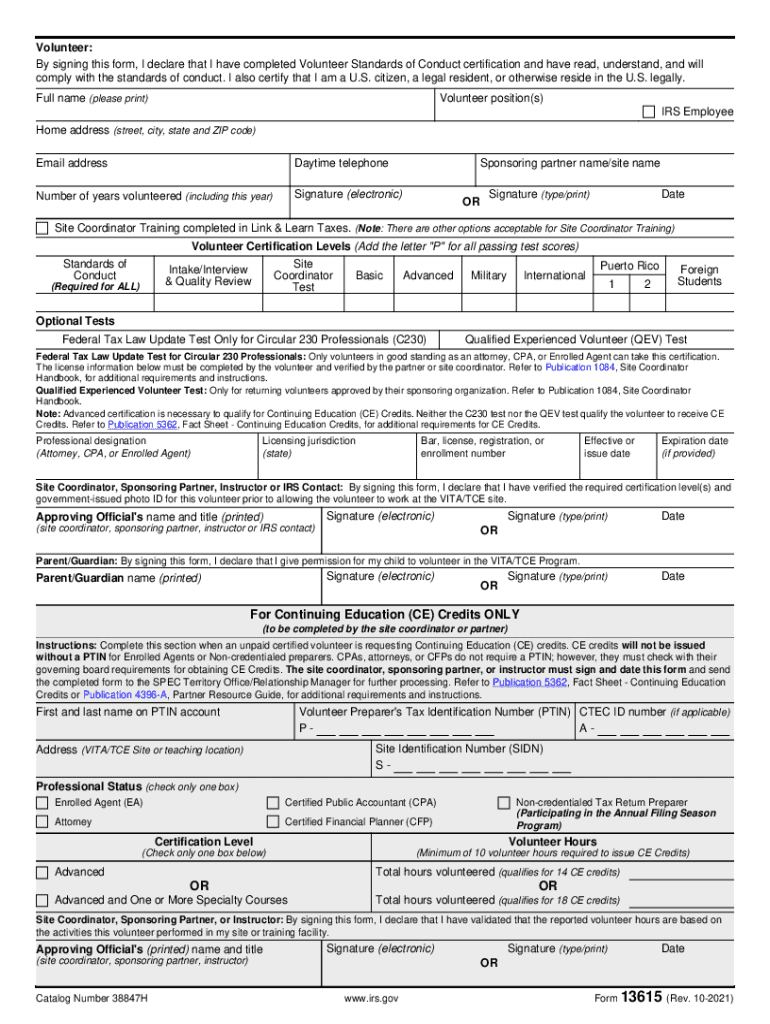

- Review the Code of Conduct: Volunteers need to carefully read and understand the six standards of conduct. These standards form the core ethics that guide all actions within the VITA/TCE programs.

- Certification of Training: Volunteers must complete the required training courses and certification tests, verifying their understanding of tax laws and preparation procedures.

- Personal and Contact Information: Complete the sections requiring personal information, including name, contact details, and volunteer site information.

- Signature: Sign and date the form to acknowledge agreement with the standards and confirm completion of the necessary training.

- Submit the Form: The completed form should be submitted to the local VITA/TCE site coordinator or IRS trainer, as instructed during the program orientation.

Key Elements of Form 13615

- Volunteer Standards: Detailed descriptions of the ethical standards volunteers are expected to uphold.

- Certification Requirements: Information on training and certification processes necessary for becoming a qualified VITA/TCE volunteer.

- Privacy Notices and Protection: Guidelines on maintaining taxpayer confidentiality and understanding the volunteer's role in protecting sensitive information.

- Consequences for Non-Compliance: Explicit details on potential actions for failing to adhere to outlined standards, which can include removal from the program.

Legal Use of Form 13615

Signing Form 13615 has legal implications, as it serves as an agreement between the volunteer and the IRS, ensuring that both parties adhere to defined ethical standards. This form substantiates a volunteer's commitment to complying with IRS guidelines in their conduct and the preparation of tax returns. The legal use of this form extends to protecting both the integrity of the tax preparation process and the privacy of taxpayer information.

Penalties for Non-Compliance

Volunteers found to be in violation of the standards outlined in Form 13615 may face several consequences, including immediate termination from the VITA/TCE program. Additionally, severe breaches, such as fraud or deliberate misconduct, could result in legal action by the IRS. Understanding these penalties underscores the importance of maintaining the ethical standards agreed upon in the form.

IRS Guidelines and Support

The IRS provides comprehensive guidelines regarding Form 13615 through various resources. These include online training modules, workshops, and support materials that are designed to help volunteers understand their roles fully. IRS coordinators offer additional assistance to ensure that volunteers are well-equipped to comply with the required standards and effectively assist taxpayers.

Taxpayer Scenarios

Volunteers using Form 13615 often encounter a wide range of taxpayer scenarios, such as assisting low-income individuals, non-native English speakers, and senior citizens. These scenarios make the understanding and compliance with the form's guidelines essential, as volunteers are required to cater to unique taxpayer needs while ensuring their actions remain ethical and within legal boundaries.