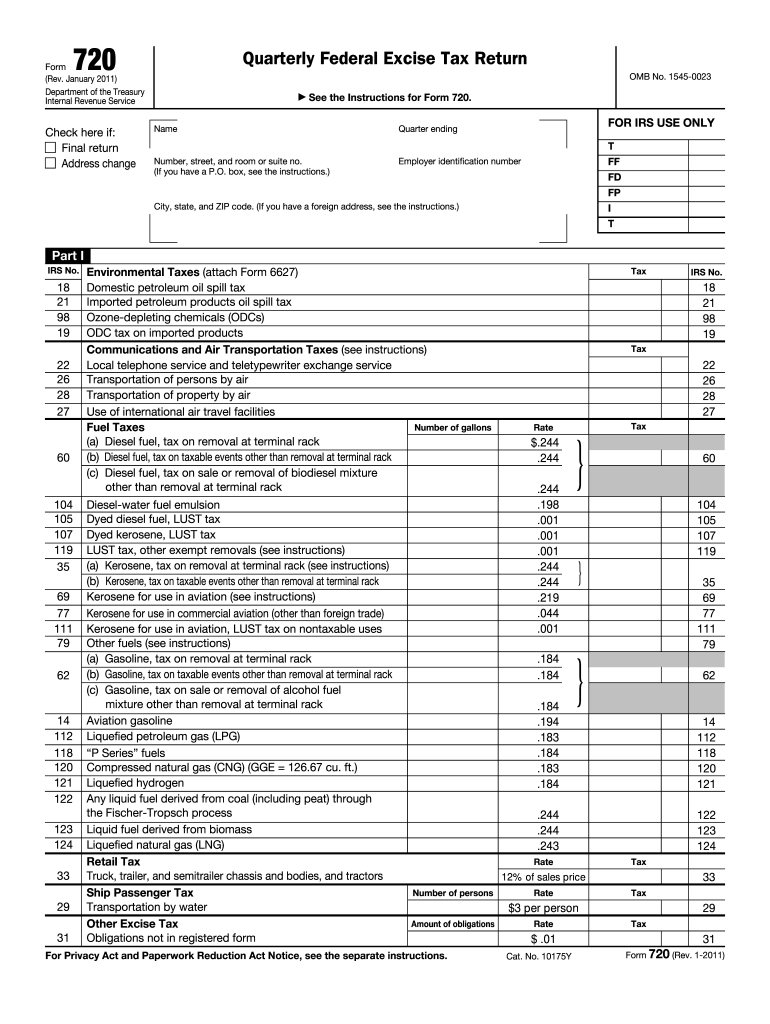

Definition and Meaning of the 2011 Form 720

The 2011 Form 720 is the Quarter Federal Excise Tax Return utilized by businesses to report and pay federal excise taxes on various goods and services. This form is a critical component of tax compliance for entities involved in specific activities, including the sale of certain products that incur excise taxes, such as gasoline, tires, and certain types of equipment. The form's categorization makes it applicable for a range of tax liabilities, which may include environmental taxes, fuel taxes, and manufacturers' taxes.

Businesses must utilize this form to detail their tax obligations related to these specific categories. The completion of the form requires careful attention to the applicable tax rates, as well as a thorough understanding of the types of excise taxes relevant to the business's operations. Filing this form ensures compliance with IRS regulations and avoids potential penalties linked to underreporting or late payments.

Steps to Complete the 2011 Form 720

Filling out the 2011 Form 720 involves several definitive steps that ensure accuracy and compliance. Here are the detailed procedures to follow:

-

Gather Necessary Information:

- Collect all relevant financial data related to your business operations for the reporting quarter. This includes sales data and expenses related to taxable goods and services.

-

Identify Applicable Excise Tax Categories:

- Review which categories of excise taxes apply to your business. It is essential to understand whether you are liable under environmental taxes, fuel taxes, or other specific excise categories.

-

Fill Out the Form:

- Begin by entering your business information at the top of the form, including the taxpayer's name, Employer Identification Number (EIN), and address.

- Progress through lines corresponding to each excise tax obligation, inputting accurate figures for tax liabilities as computed.

-

Calculate Total Taxes Due:

- At the end of the form, total the amounts reported in each section to determine the total excise taxes payable.

-

Review and Sign:

- Carefully review the completed form for accuracy, errors, and ommisions. After thorough verification, the form must be signed by an authorized representative of the business.

-

Submit the Form:

- Choose the appropriate submission method (online, mail, or in-person) and ensure that it is sent by the due date.

Important Terms Related to the 2011 Form 720

Understanding the terminology associated with the 2011 Form 720 is essential for effective compliance and reporting. Here are key terms to be familiar with:

- Excise Tax: A tax imposed on specific goods produced and sold within a country, or on certain activities, such as wagering. These taxes are usually included in the price of the product or service.

- Taxpayer Identification Number (TIN): This includes both Social Security Numbers (SSNs) and Employer Identification Numbers (EINs) used by the IRS to track taxpayer obligations.

- Environmental Taxes: A category of excise tax levied on certain goods that may have harmful environmental impacts, like fuel.

- Refund Claims: Instances in which a business is entitled to a refund on overpaid excise taxes, which must be appropriately reported and documented on the form.

Filing Deadlines and Important Dates for the 2011 Form 720

Adhering to deadlines is crucial in tax compliance. The following are the important filing dates related to the 2011 Form 720:

-

Quarterly Filing Requirements: Form 720 is usually due on the last day of the month following the end of each quarter. Therefore, the deadlines are:

- For Q1 (January - March): Due April 30

- For Q2 (April - June): Due July 31

- For Q3 (July - September): Due October 31

- For Q4 (October - December): Due January 31

-

Payment Deadlines: Payments for the excise taxes due must coincide with these filing deadlines to avoid interest and penalties associated with late payments.

Who Typically Uses the 2011 Form 720

Various businesses and individuals may find themselves needing to use the 2011 Form 720. Here are the primary users:

- Manufacturers: Those who produce excise tax-liable products, such as tires, alcohol, and tobacco.

- Retailers and Wholesalers: Businesses that sell products subject to excise taxes at the retail level are required to report these figures.

- Environmental Compliance Businesses: Companies that deal with environmental goods and services may have excise taxation obligations linked to their operations.

- Energy Sector: Companies involved in the production and sale of fossil fuels are subject to specific excise taxes related to diesel and other energy products.

This form serves a crucial role in ensuring that businesses comply with federal tax obligations, promoting transparency and accountability in tax reporting.