Definition and Purpose of Form 2441

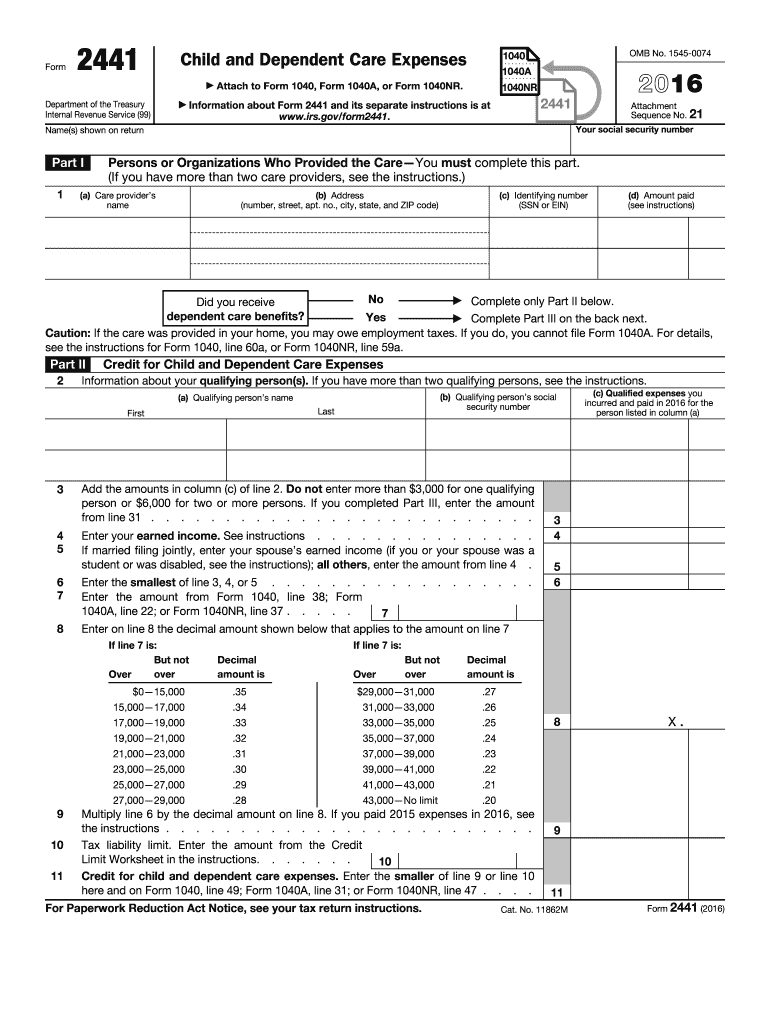

Form 2441, Child and Dependent Care Expenses, is used by taxpayers in the United States to report expenses related to the care of children or dependents, which may result in a tax credit. The form is essential for those who need to work or look for work while ensuring dependents are taken care of, as it can provide significant tax relief. It requires comprehensive information about the care providers, qualifying individuals who received the care, and any dependent care benefits obtained through employment.

Key Elements of Form 2441

Form 2441 is structured to capture detailed financial and personal data that influence the amount of credit a taxpayer can claim. Essential components include:

-

Part I: Persons or Organizations Who Provided the Care

This section requires details about each care provider, including their name, address, and Social Security Number (SSN) or Employer Identification Number (EIN). -

Part II: Credit for Child and Dependent Care Expenses

This part calculates the total expenses and the corresponding credit. It requires taxpayers to provide information about qualifying individuals, their relationship, age, and care period. -

Part III: Dependent Care Benefits

Here, taxpayers disclose any benefits received from employers related to dependent care, as these affect the eligibility and amount of the credit.

Eligibility and Who Typically Uses Form 2441

Taxpayers eligible to use Form 2441 typically have incurred expenses for the care of dependents to enable them and their spouse, if filing jointly, to work or seek employment. Eligible individuals include:

-

Working Parents

Those with children under 13 who need supervision while the parents are at work. -

Individuals with Disabled Dependents

Care expenses for a spouse or other dependent who is physically or mentally incapable of self-care.

Important Terms Related to Form 2441

Understanding specific terms is crucial to correctly filling out Form 2441:

-

Qualifying Person

This refers to the dependent child or person who receives care. -

Dependent Care Benefits

Benefits offered by employers to assist with dependent care expenses, which play a role in the overall credit calculation.

Steps to Complete Form 2441

Filling out the form involves several distinct steps to ensure completeness and accuracy:

-

Gather Necessary Information

Collect details about all care providers and expenses incurred. Verify Social Security Numbers or Employer Identification Numbers for each provider. -

Complete Part I

Enter each care provider's information, ensuring adherence to IRS requirements for identifying and reporting these parties. -

Fill Out Part II

Detail expenses per child or dependent, calculating limits per individual using provided IRS worksheets when necessary. -

Address Part III

Report employer-provided dependent care benefits, and use worksheets to determine how these influence the claimable amount. -

Finalize Calculations

Aggregate expenses and calculate allowable credits, cross-referencing IRS guidelines to confirm income thresholds and limits.

How to Obtain Form 2441

Form 2441 can be accessed through several channels:

-

Direct Download from the IRS Website

The official IRS website provides a PDF version that taxpayers can download and print. -

Tax Preparation Software

Most modern tax software solutions, like TurboTax or QuickBooks, include Form 2441 in their suite of forms accessible during the filing process.

Filing Deadlines and Submission

Form 2441 must be attached to the taxpayer’s Form 1040, 1040A, or 1040NR. Timing is in conjunction with the regular tax return deadline, typically on or around April 15.

Form Submission Methods

-

Online Submission

E-file options with tax software or through an authorized e-file provider ensure speedy submission and confirmation. -

Mail Submission

Hard copies can be mailed to regional IRS offices following the address guidelines provided in tax instructions.

IRS Guidelines and Important Dates

The IRS provides comprehensive instructions for completing Form 2441, which include details on eligible expenses, limits on credits, and required documentation validation. It is critical to stay informed about IRS announcements regarding filing dates, changes to requirements, or adjustments in credit calculations to ensure compliance and maximize benefit.

Penalties for Non-Compliance

Failing to correctly complete or attach Form 2441 when claiming the dependent care credit can lead to penalties, ranging from fines to audit risks. It is imperative to ensure all information is accurate and all supporting documentation is maintained for potential review.

Software Compatibility and Digital vs. Paper Version

For those using tax software, accessing an electronic version of Form 2441 streamlines data entry and calculation accuracy. Software like TurboTax and QuickBooks is directly compatible, offering guided assistance through each step of completion. In contrast, the paper version may require manual calculations and familiarity with IRS worksheets to ensure correct completion.

By thoroughly exploring these aspects, taxpayers will be well-equipped to handle Form 2441 for the 2016 tax year, ensuring accurate reporting and optimizing potential credits.