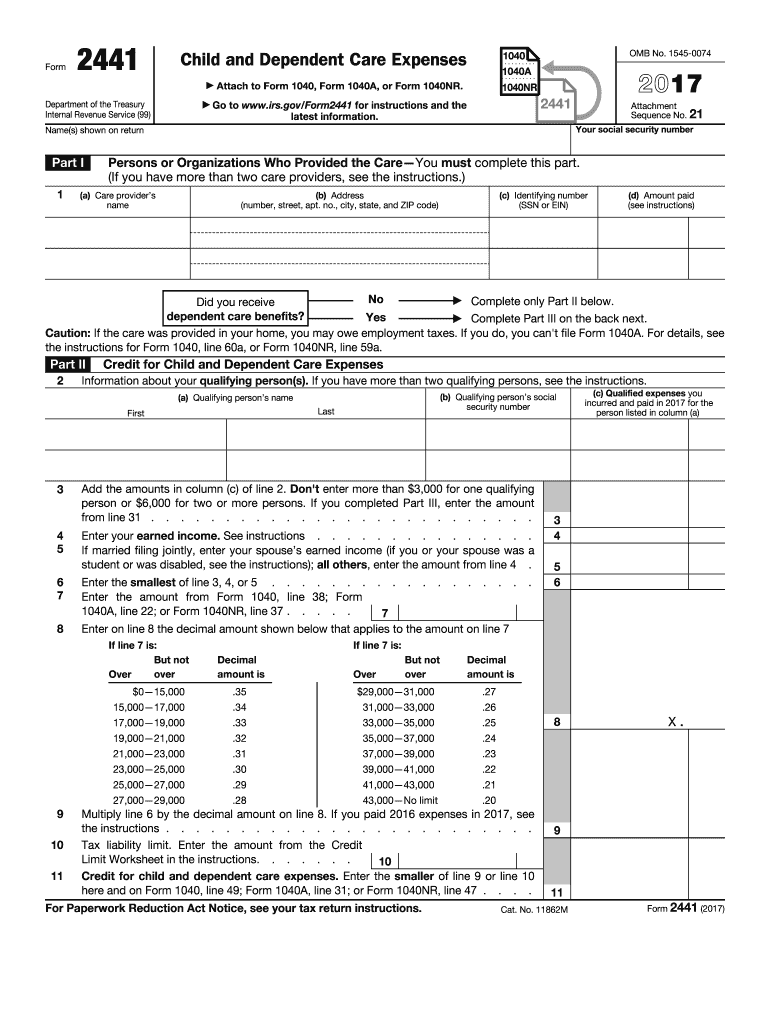

Definition and Purpose of Form 2441

Form 2441, Child and Dependent Care Expenses, is a tax form used by individuals in the United States to claim a credit for child and dependent care expenses. The form is for those seeking to reduce their taxable income based on the costs incurred for taking care of qualifying dependents. It applies specifically to expenses necessary for gaining employment, such as daycare expenses, and is used in conjunction with tax forms like Form 1040, 1040A, or 1040NR.

How to Use Form 2441 for 2017

To effectively use Form 2441 for 2017, taxpayers must report the amount spent on child and dependent care services. The form requires detailed information about each care provider, including their name, address, and taxpayer identification number (TIN). Taxpayers must also confirm the total cost of care services for each qualifying dependent. It's crucial to ensure that expenses are only from the 2017 tax year, as costs from previous or future years cannot be claimed on this form.

- Identify Eligible Dependents: Determine which dependents qualify based on IRS guidelines.

- Gather Care Provider Information: Collect essential information such as the care provider's name, address, and TIN.

- Calculate Expenses: Total the amount paid during 2017 for each eligible dependent.

Eligibility Criteria for Form 2441

Not all taxpayers are eligible to use Form 2441. Key criteria include:

- Employment Requirements: The credit applies if care expenses were incurred so the taxpayer (and spouse, if filing jointly) can work or look for work.

- Age and Dependent Status: The form covers care expenses for qualifying children under age 13 and dependents who are physically or mentally incapable of self-care.

- Income Limitations: The credit amount varies based on the taxpayer's adjusted gross income (AGI).

Steps to Complete the Form 2441

Completing Form 2441 requires a strategic understanding of its sections and requirements:

- Section I: Provide details of each care provider, including their legal information and TIN.

- Section II: Report care expenses per child or dependent, ensuring only eligible costs are claimed.

- Section III: Calculate the allowable credit based on income and reported expenses.

Each step must be followed precisely to avoid errors that could lead to delays or rejections.

Required Documents for Form 2441

To successfully complete Form 2441 for 2017, taxpayers need various supporting documents:

- Receipts and Statements: Proof of payment for care services rendered during 2017.

- Provider Information Documentation: Contracts or agreements that include important provider details.

- Taxpayer Income Records: Documents such as W-2s or pay stubs to establish income levels and eligibility.

These documents are essential for accurate form completion and successful credit claims.

Key Elements of Form 2441

Form 2441 comprises several critical components:

- Provider Information: Accurate and complete information regarding service providers.

- Expense Details: A thorough record of all related payments made in the 2017 tax year.

- Credit Calculation: An exact computation based on IRS guidelines to determine the tax credit amount.

These elements collectively determine how effectively a taxpayer can claim their entitled credits.

Legal Considerations and Compliance

Compliance with legal standards when using Form 2441 is crucial:

- Accuracy and Honesty: Submit truthful and complete information to avoid penalties.

- Documentation: Maintain records of all relevant documents and information used to prepare the form.

- IRS Regulations: Follow IRS guidelines closely concerning definitions and eligibility to ensure compliance.

Failure to adhere to these aspects may result in penalties, increased scrutiny, or denial of credit claims.

IRS Guidelines and Recommendations

The IRS provides specific instructions for Form 2441 usage:

- Guidance on Eligible Expenses: Including only those expenses that directly relate to employment requirements.

- Documentation Needs: Recommendations on keeping records to substantiate claims.

- Timing and Filing Instructions: Guidelines to ensure the form is filed correctly and timely within the tax year framework.

Following these guidelines ensures the process is as smooth and efficient as possible.