Definition and Meaning

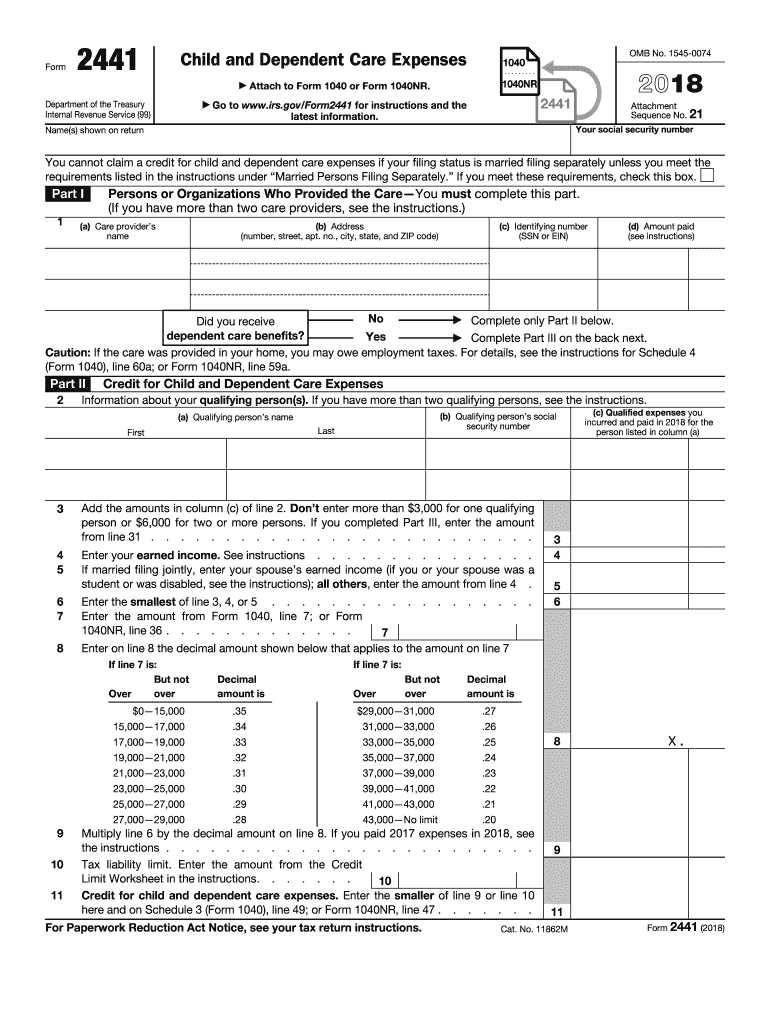

Form 2441, commonly referred to as "Form 2441," is utilized by taxpayers in the United States to claim the Child and Dependent Care Expenses credit on their federal tax returns. This form is specifically applicable for individuals who file Form 1040 or Form 1040NR. The purpose of Form 2441 is to outline the necessary details regarding childcare providers, qualifying dependents, and any dependent care benefits received throughout the tax year. By accurately completing Form 2441, taxpayers can determine the amount of credit they are eligible for based on their eligible expenses and earned income.

Key Components of Form 2441

Form 2441 contains several sections that require detailed information. Some of the essential elements include:

- Care Provider Information: Taxpayers must enter the name, address, and taxpayer identification number of each care provider.

- Qualifying Person Details: Information about each qualifying dependent, including name, Social Security number, and relationship to the taxpayer.

- Calculation of Expenses: A detailed worksheet to calculate eligible child and dependent care expenses.

- Credit Calculation: Instructions for determining the possible credit, which considers both the taxpayer's earned income and adjusted gross income (AGI).

IRS Guidelines for Form 2441

The Internal Revenue Service (IRS) provides specific guidelines to aid taxpayers in completing Form 2441 accurately. These guidelines include instructions regarding eligibility for the Child and Dependent Care Expenses credit, what constitutes acceptable documentation, and the precise process for inputting details into the form.

Eligibility Criteria

To qualify for the Child and Dependent Care Expenses credit, taxpayers must meet several criteria:

- The care must have been necessary for the taxpayer (and their spouse, if filing jointly) to work or actively seek employment.

- The care must have been provided to a qualifying person under the age of 13 or a physically or mentally incapacitated dependent.

- Taxpayers must maintain detailed records of all payments made to childcare providers.

Important Definitions

The IRS also defines terms such as "care provider," "qualifying person," and "earned income," each having specific meanings within the context of Form 2441. For example, earned income includes wages, salaries, tips, and other taxable employee compensation but does not include pensions or annuities.

Steps to Complete Form 2441

Completing Form 2441 requires meticulous attention to detail to ensure all sections are filled correctly. Below are the step-by-step instructions for completing the form:

-

Gather Required Information: Before starting, compile all necessary information, including the care provider's details, dependent’s Social Security numbers, and receipts for any payments made.

-

Complete Part I: In this section, list all care providers, their addresses, and taxpayer identification numbers.

-

Fill Out Part II: Enter the details of each qualifying dependent for whom you are claiming care expenses.

-

Proceed with Part III: Use this section to calculate your total employment-related expenses and the eligible amount based on your income.

-

Calculate the Credit: Follow the instructions to determine your allowable credit, taking into account your adjusted gross income and the expenses incurred.

-

Review: It is crucial to review all entered information to ensure accuracy and compliance with IRS guidelines.

Submission and Verification

Upon completion, Form 2441 must be attached to the taxpayer's Form 1040 or Form 1040NR when submitting their tax return. Retain all receipts and records in case the IRS requires verification or additional proof of the eligible expenses claimed.

Why Use Form 2441

Utilizing Form 2441 offers financial relief in the form of a tax credit, which can be substantial depending on the taxpayer's situation. This tax credit effectively reduces the overall tax liability by accounting for expenses directly related to the care of dependents, making it a crucial form for working families with children or dependent care needs.

Benefits of Claiming the Credit

- Reduced Tax Liability: The credit directly decreases the amount of taxes owed.

- Offsetting Costs of Care: Enables taxpayers to recover some expenses incurred while working or seeking employment.

- Support for Working Families: Recognizes the need for childcare assistance, providing a financial incentive to offset the cost of care.

Practical Examples

Consider a single parent who pays daycare costs: by using Form 2441, they might reduce their tax bill significantly, depending on their taxable income and documented care expenses. Similarly, a dual-income family with employer-provided dependent care benefits must still utilize the form to ensure all rules and adjustments are applied accurately.

Important Terms Related to Form 2441

Understanding specific terms is vital for the accurate completion of Form 2441. These terms hold particular significance in the context of IRS compliance and tax credits.

Key Definitions

- Earned Income: This includes wages, salaries, tips, and other forms of compensation that require taxpayers to work.

- Qualifying Person: Typically, a dependent under age 13 or an incapacitated spouse or dependent who requires care.

- Care Provider: An individual or organization paid to care for a qualifying dependent, requiring specific identification details.

Variations and Nuances

Certain nuances affect term definitions based on taxpayer situations, such as differing rules for married couples filing separately or special conditions for divorced or separated parents in claiming dependents for credit.

Legal Use of Form 2441

Adhering to legal requirements when using Form 2441 is essential to ensure compliance with IRS regulations. Misrepresentation or errors could lead to legal penalties or denied credits.

Compliant Use

- Accurate Completion: Ensure all parts of the form are correctly filled with verifiable information.

- Substantiation: Maintain evidence of all expenses and income statements relevant to the credit claim.

- Understanding Limits: Comprehend the limitations on expenses and income impacting the credit amount.

Consequences of Non-Compliance

Failure to complete Form 2441 accurately or maintain proper documentation can lead to:

- Penalties: Legal penalties for incorrect claims or neglecting to substantiate claimed expenses.

- IRS Audits: Potential audits requiring detailed reviews of the taxpayer’s financial and care expense records.

Filing Deadlines and Important Dates

Adhering to the IRS-provided deadlines is critical for ensuring eligibility to claim the credit through Form 2441 on time.

Key Filing Deadlines

- Generally Due: The form is due by the regular tax filing deadline for the respective year, typically April 15.

- Extensions: Taxpayers can file for an extension, providing additional time to complete their return but ensuring any owed taxes are paid.

Impact of Missing Deadlines

Failing to submit Form 2441 by the deadline can result in:

- Delays in Refunds: Slows the processing of eligible credits and potential refunds.

- Ineligibility: Missing deadlines might make taxpayers ineligible to claim the credit for that tax year.

Required Documents

Providing correct documentation is obligatory to substantiate claims on Form 2441. Such records validate the information provided to the IRS.

Essential Documentation

- Receipts from Care Providers: Clearly detailing costs incurred, provider contact information, and services provided.

- Employment Records: Proof of employment or job-seeking activities aligning with care needs.

- Taxpayer Identification Numbers: Essential for dependents and care providers.

Maintaining Records

It's recommended to keep these documents for several years after filing to ensure they are available in case of an IRS inquiry. Clear, organized records are vital for resolving any discrepancies quickly.

State-Specific Rules for Form 2441

While Form 2441 follows federal guidelines, taxpayers should consider potential state-specific rules affecting their credit eligibility and claiming process.

Understanding State Differences

Certain states offer additional credits or impose unique requirements related to dependent care expenses:

- State Credits: Some states provide supplemental credits aligning with federal claims.

- Additional Paperwork: A few jurisdictions might require separate state filings or documentation.

Example Scenarios

For instance, a taxpayer in a state with a complementary child care credit may have to file additional forms alongside their federal return. Staying informed about such state-level variations ensures comprehensive compliance with both state and federal tax obligations.