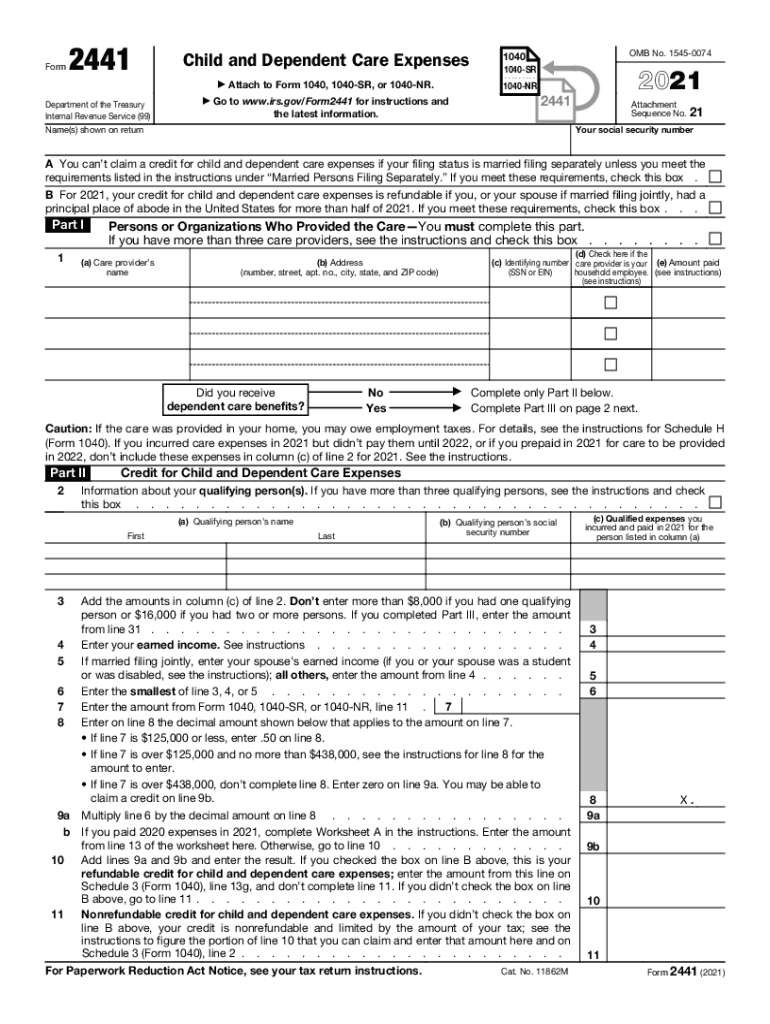

Definition and Purpose of Form 2441

Form 2441, titled "Child and Dependent Care Expenses," is an IRS document that taxpayers use to claim the Child and Dependent Care Expenses credit. This form is filed along with tax returns like Form 1040, 1040-SR, or 1040-NR. The primary purpose of this form is to report expenses incurred for the care of a child or a dependent that allows the taxpayer to work or actively look for work. By utilizing this form, taxpayers can potentially reduce their tax liability if they meet certain criteria.

- Eligibility Requirements: To qualify for the credit, certain conditions must be met, including having earned income and maintaining a home for the qualifying person.

- Qualifying Persons: Generally, qualifying persons include children under thirteen and those who cannot care for themselves due to physical or mental disabilities.

Steps to Complete Form 2441

To successfully complete Form 2441, follow these systematic steps:

-

Gather Required Information:

- Obtain your and your spouse’s (if filing jointly) earned income details.

- Collect all household information, including qualifying persons' details.

-

Complete Part I - Persons or Organizations Who Provided the Care:

- Enter caregiving providers’ names, addresses, and Taxpayer Identification Numbers (TINs).

- Provide the total amount paid for each care provider.

-

Complete Part II - Credit for Child and Dependent Care Expenses:

- Indicate the number of qualifying persons and list their details.

- Calculate eligible expenses based on your income.

-

Calculate the Credit:

- Use provided worksheets to determine your credit.

- Transfer the calculated nonrefundable and refundable amounts to the appropriate lines on Form 1040.

Filing Deadlines and Important Dates

- Regular Deadline: Form 2441 is submitted in conjunction with your annual tax filing, generally due by April 15 each year. If the filing deadline falls on a weekend or holiday, it is usually extended to the next business day.

- Extensions: If you file for an extension on your tax return, the deadline for Form 2441 aligns with your extended tax filing date, usually October 15.

- Importance of Timeliness: Filing on time is crucial to avoid penalties or interest on unpaid taxes.

Eligibility Criteria for Using Form 2441

Several criteria determine a taxpayer's eligibility to utilize Form 2441:

- Income Limits: The credit amount is influenced by your Adjusted Gross Income (AGI).

- Work-Related Expense Requirement: The incurred expenses must facilitate your ability to work or seek employment.

- Qualifying Dependent Rules: Dependents must either be under the age of thirteen or physically/mentally unable to care for themselves.

Examples of Using Form 2441

Example 1: Single Parent

A single parent works full-time and incurs childcare expenses to maintain their employment. By completing Form 2441, they can claim these expenses to reduce their taxable income, ultimately lowering their tax payment.

Example 2: Married Couple

A married couple, both employed, pays for adult daycare for a disabled family member. They fill out Form 2441 to report and potentially claim credits for these expenses, assuming other criteria, like income limits, are met.

Important Terms Related to Form 2441

Understanding the terminology associated with Form 2441 is vital for correct completion:

- Qualifying Individual: An individual for whom care expenses are incurred, such as children under thirteen or adults who cannot self-care.

- Care Provider Information: Details about individuals or organizations paid to care for your qualifying dependent.

- Earned Income: Income from employment, which must be reported to claim the credit.

Software Compatibility for Filing Form 2441

Various tax software programs can assist in filling out Form 2441, offering step-by-step guidance:

- TurboTax and H&R Block: Popular options that integrate seamlessly with this form, supporting taxpayers in calculating the appropriate credits.

- QuickBooks: Often used by self-employed individuals to manage expenses and integrate tax forms directly, ensuring accurate filing for business owners.

IRS Guidelines for Form 2441

The IRS provides specific guidance for filling out Form 2441:

- Instructions: Detailed instructions available on the IRS website can help you navigate sections and calculations.

- Updates: Check IRS releases for any changes to credit amounts or new requirements annually, ensuring compliance with the current tax code.

Meeting these guidelines ensures the accurate completion of Form 2441 and the correct calculation of the Child and Dependent Care Expenses credit.