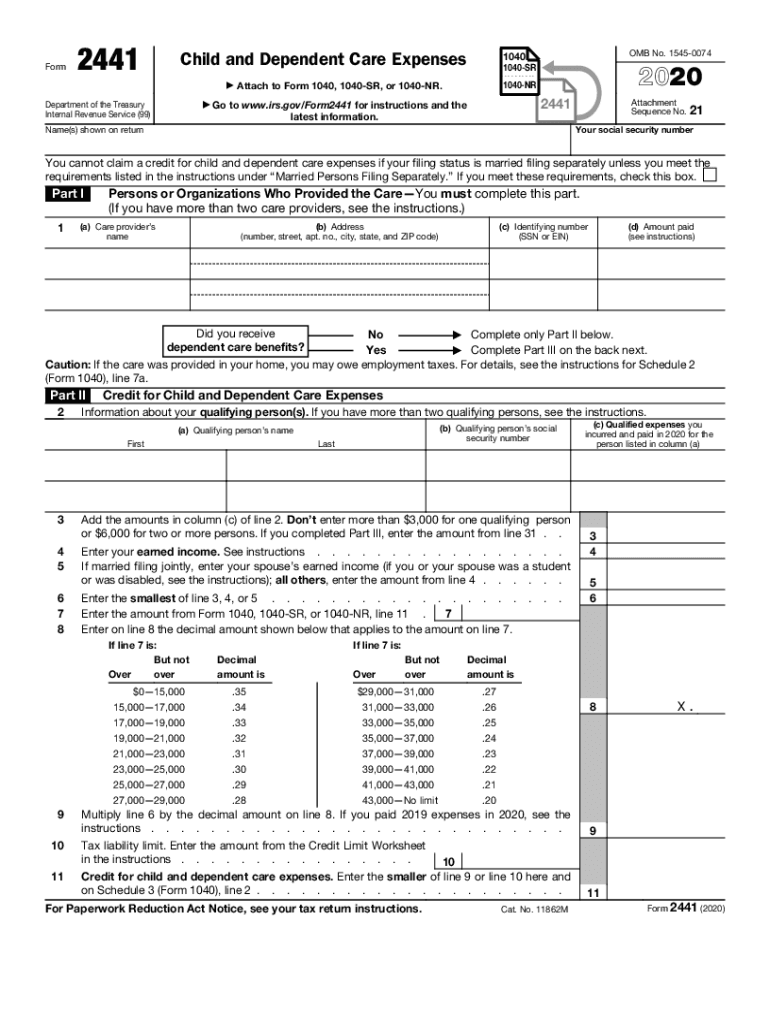

Definition and Use of Form 2441

Form 2441 is primarily used by taxpayers to claim the Child and Dependent Care Expenses credit. This tax credit is available to individuals who incur costs for the care of a qualifying child or dependent while they work or look for work. The form is essential for providing detailed information about care providers, qualifying individuals, and the specific expenses that have been incurred.

Eligibility Requirements

To qualify for the credit, taxpayers must meet certain eligibility criteria. This includes having earned income and paying expenses for the care of a qualifying individual to enable the taxpayer to work or look for work. Taxpayers should also file as single, head of household, qualifying widow(er) with dependent child, or married filing jointly. It's important to note that married individuals filing separately will generally not qualify for the credit.

Key Elements of the Form

Form 2441 requires specific information to be filled in correctly.

- Care Provider Information: Names, addresses, and taxpayer identification numbers of the care providers are necessary.

- Qualifying Person(s): Details about the individuals receiving care, including their names and individual taxpayer identification numbers.

- Expense Details: The amount paid for the care services must be disclosed.

How to Complete Form 2441

Completing Form 2441 involves a structured approach to ensure all sections are properly filled out.

Steps to Fill the Form

- Provide General Information: Enter your name and social security number as it appears on your tax return.

- Care Provider Listing: Input all necessary information about the care providers, including their names, addresses, and taxpayer identification numbers.

- List Qualifying Persons: Enter the names, social security numbers, and the amounts paid for each qualifying person.

- Calculate the Credit: Use the information provided to calculate the allowable credit and fill in the relevant sections on the form.

Required Documentation

To complete Form 2441, taxpayers should gather all receipts and records relating to care expenses. This includes bills from care providers, proof of payment, and any relevant documents that confirm work-related expenses.

Obtaining and Submitting Form 2441

Form 2441 can be obtained through several convenient methods to suit different preferences.

How to Obtain the Form

- Online Access: Download from the official IRS website.

- Tax Preparation Software: Many programs include Form 2441 for e-filing.

- Local IRS Office: Collect printed copies directly from an IRS location.

Submission Methods

- Online Filing: Electronic submission via tax preparation software or IRS e-file.

- Mail: Paper submission can be mailed to the IRS address specified in the form instructions.

- In-Person: Filing at an IRS location, though this is less common.

Legal Aspects and Compliance

Using Form 2441 correctly ensures compliance with U.S. tax laws, specifically regarding the Child and Dependent Care Expenses credit.

Legal Use of the Form

The form must be accurately completed and submitted with the taxpayer's federal income tax return. Failure to provide correct information or meet eligibility requirements could result in disallowed credits and potential penalties.

Penalties for Non-Compliance

Non-compliance or inaccuracies may lead to penalties. This could include fines or audits from the IRS. To avoid such issues, it is crucial to double-check all information and maintain thorough records.

Taxpayer Scenarios: Understanding Use Cases

Form 2441 is beneficial for a wide range of taxpayers, each with unique scenarios.

Typical Users

- Working Parents: Often use the form to claim credits for daycare services.

- Guardians: Those responsible for elderly dependents utilize the form for qualifying care expenses.

- Job Seekers: Individuals looking for employment can claim the credit if care expenses are incurred during this period.

Understanding each scenario helps tailor the use of Form 2441 to maximize benefits.

Important IRS Guidelines and Deadlines

Filing deadlines and critical IRS guidelines play a significant role in the successful submission of Form 2441.

Filing Deadlines

Form 2441 usually needs to be submitted by the tax deadline, typically April 15. Extensions may be granted, but they must be officially requested.

IRS Guidelines

Taxpayers should adhere closely to the IRS guidelines to ensure compliance. This includes maintaining receipts, records of expenses, and verification of qualifying individuals and care providers.