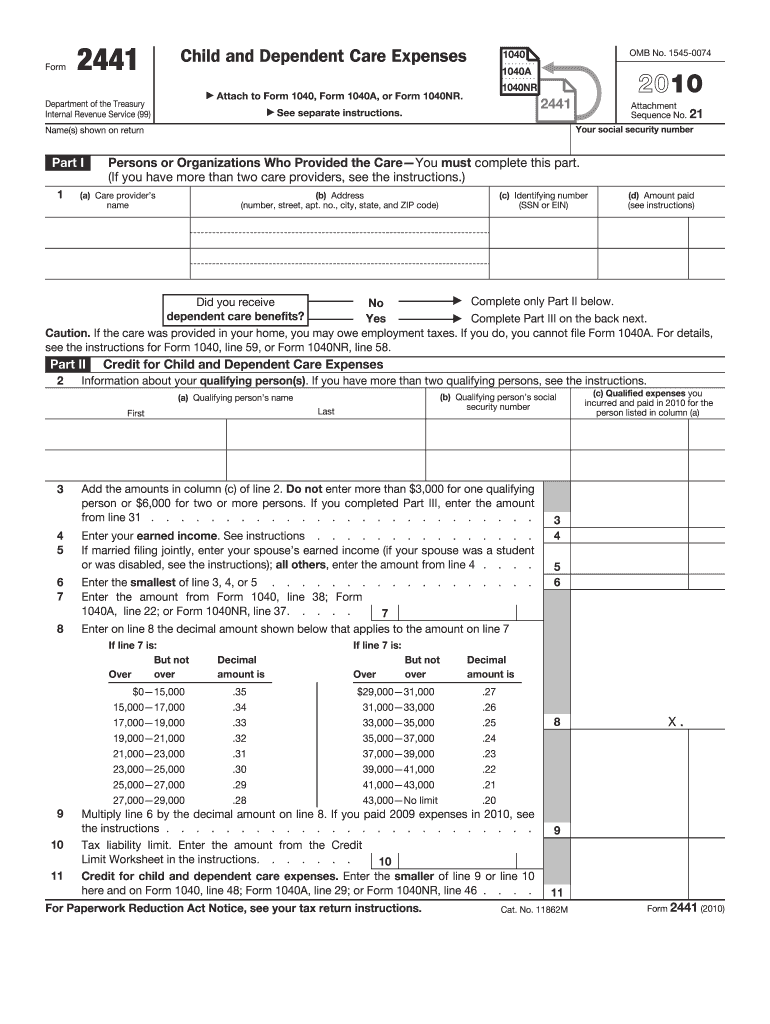

Definition and Meaning of Form 2441

Form 2441 is a document used by taxpayers in the United States to report Child and Dependent Care Expenses for tax purposes. This form is integral for taxpayers who wish to claim the Child and Dependent Care Credit. It is essential to provide information on care providers and the individuals receiving care, ensuring that qualified expenses are captured for potential tax credits.

Understanding Qualified Expenses

Qualified expenses refer to costs necessary for the taxpayer to work or look for work. These typically include payments made for the care of a dependent child under age 13 or a disabled spouse or dependent who lives with the taxpayer for more than half the year.

Importance of Form 2441

By filing Form 2441 alongside their standard tax return, taxpayers can potentially reduce their taxable income through the Child and Dependent Care Credit. This credit is designed to alleviate some of the financial burdens associated with child and dependent care costs.

Steps to Complete the 2 Form

Completing Form 2441 requires careful attention to detail to ensure all applicable sections are properly filled out. Below is a step-by-step guide:

-

Section 1: Information about the care provider:

- Enter the name, address, and taxpayer identification number (TIN) of the care provider.

- Include the total amount paid for care services.

-

Section 2: Information about the qualifying person(s):

- List the name, Social Security Number (SSN), and the qualifying income of the person who received care.

- Specify the amount of expenses incurred for each qualifying individual.

-

Section 3: Expenses and tax credit calculations:

- Enter the total amount of eligible expenses from all sources.

- Utilize tax tables to determine the credit amount based on the taxpayer's income.

Required Documents for Form 2441

When preparing to file Form 2441, ensure that the following documentation is available:

- Receipts or statements from care providers indicating amounts paid and services rendered.

- Taxpayer identification details for each care provider.

- SSNs and other identifying information for each qualifying child or dependent.

- Documentation supporting earned income and expenses incurred.

Supporting Documentation for Providers

Ensure that all information about care providers, including their valid TIN or social security numbers, is verifiable. This documentation supports the legitimacy and claimed amounts on the form.

IRS Guidelines for Form 2441

The IRS offers specific instructions and guidelines for completing Form 2441 that must be adhered to for the successful filing:

- Taxpayers must file Form 2441 with their Form 1040 or 1040NR.

- Only work-related expenses qualify.

- Points out that qualifying expenses cannot exceed the lesser of earned income of either spouse or a set threshold amount.

Adhering to Income Limits

The credit amount is subject to phasing out at higher income levels. Taxpayers need to ensure that they comply with the IRS guidelines regarding income limitations, which impact the credit received.

Who Typically Uses Form 2441

Form 2441 is predominantly used by:

- Working parents who incur care expenses to maintain employment.

- Single parents responsible for dependent care.

- Married taxpayers where both spouses are either working or a full-time student.

Situations and Scenarios

For instance, a single working mother paying a daycare to look after her child while she is at work will benefit from filing this form to receive potential credits.

Key Elements of Form 2441

The key elements of Form 2441 include the detailed specification of care providers, documentation of incurred expenses, and careful adherence to IRS instructions for calculating allowable credits.

Importance of Accurate Reporting

The accuracy of reported expenses and details about care providers is crucial. Errors or misleading information can lead to processing delays or penalties.

Software Compatibility with Form 2441

Many tax preparation software, such as TurboTax and QuickBooks, provide integrated support for preparing Form 2441. These tools assist in ensuring accurate calculations and help streamline the filing process.

Using Software for Filing

Leveraging tax software simplifies the form completion process by automatically calculating credits and ensuring compliance with IRS guidelines, thus reducing the likelihood of human errors.

Filing Deadlines and Important Dates for Form 2441

To maximize eligibility for tax credits, Form 2441 must be filed with the individual's annual tax return by the federal tax filing deadline, typically April 15th. Extensions may be granted, but they don’t extend the time to pay taxes owed.

Understanding Extensions

Filing for an extension provides additional time to file the paperwork, but not additional time to pay potential taxes owed. It's crucial to estimate and remit payment by the original deadline to avoid penalties.

Penalties for Non-Compliance with Form 2441

Failure to correctly file Form 2441 or provide accurate information can result in penalties, including fines and interest charges. Providing false information or neglecting to file can lead to disqualification from receiving tax credits.

Avoiding Common Pitfalls

Common mistakes include incorrect TINs for care providers or failing to document expenses thoroughly. It's advisable to double-check all entries and consult with a tax professional if necessary to ensure compliance.