Definition & Meaning

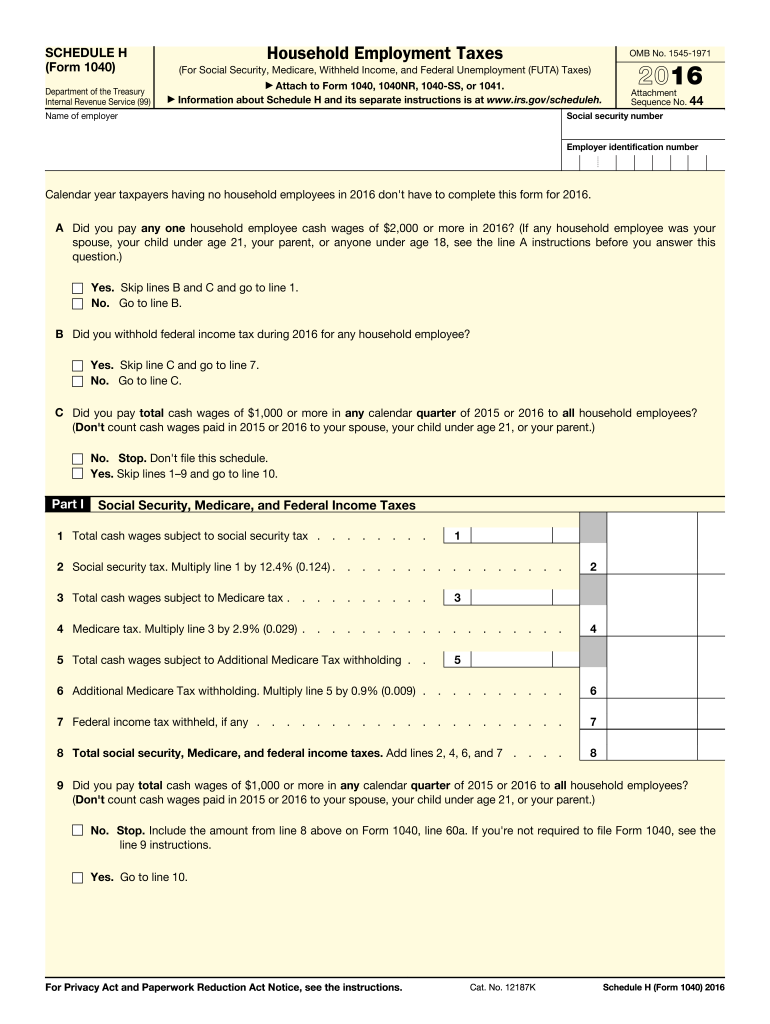

Schedule H (Form 1040) for the year 2016 is a tax form used by household employers to report specific employment taxes. This includes Social Security, Medicare, withheld income, and Federal Unemployment (FUTA) taxes for household employees. A household employee is someone employed to work in or around a private residence, such as a nanny, gardener, or housekeeper. The purpose of Schedule H is to capture all necessary wage and tax details related to these employees, ensuring compliance with federal tax obligations.

Importance of Schedule H

- Tax Compliance: It's crucial for household employers to report all cash wages paid to employees accurately, ensuring all tax obligations are met.

- Comprehensive Reporting: Encompasses Social Security, Medicare, and FUTA taxes in one form.

- Legal Requirement: Non-compliance may lead to penalties, so correct filing is essential for avoiding legal issues.

How to Obtain the Schedule H

Household employers can access Schedule H (Form 1040) in a few different ways, depending on their preference for digital or paper formats.

Digital Access

- IRS Website: The most direct method is to download the form as a PDF from the IRS website, providing immediate access to the most up-to-date and official version.

- Tax Software: Tools such as TurboTax and QuickBooks usually include Schedule H in their package, allowing users to fill it out as part of the broader tax filing process.

Paper Version

- Local IRS Office: Physical copies can be obtained by visiting a local IRS office where printed forms are available.

- Mail from IRS: By calling the IRS or using their website service, you can request that forms be sent to your mailing address.

Steps to Complete the Schedule H

Filling out Schedule H requires careful attention to several detailed sections:

- Enter Employer Information: Personal details, such as name, Social Security number, and any applicable business number.

- Report Wages Paid: Document total cash wages paid to each household employee over the fiscal year.

- Calculate Employer Taxes: Compute the amount of Social Security, Medicare, and any FUTA tax liabilities.

- Reconciliation and Declarations: Ensure all calculated amounts align with prior tax payments and verify all data is accurate before signing and lodging the form within the broader Form 1040 tax return.

Common Mistakes to Avoid

- Incorrect Wage Reporting: Ensure all wages, including cash, are accurately reported.

- Missing Deadlines: Submit the form as part of the annual tax return by April 15th to avoid penalties.

Key Elements of the Schedule H

Schedule H is divided into distinct sections, each of which serves a particular aspect of the tax reporting process:

- Part I – General Information: Collects basic identifying data.

- Part II – Total Household Employment Taxes: Focuses on tax calculations, including Social Security, Medicare, and FUTA.

- Part III – Tax Return Penalties: Calculates overdue penalties and fees, if applicable.

Detailed Breakdown

- Social Security & Medicare Taxes: Percentages applied to wages above the specified limit to calculate obligations.

- FUTA Tax: Federal Unemployment tax calculation considering any state unemployment contributions.

IRS Guidelines

Following the IRS guidelines is crucial for correctly completing and filing Schedule H:

- Annual Filing Requirement: Schedule H must be filed alongside Form 1040 if you employed a household employee and paid wages surpassing the IRS threshold.

- Electronic Filing: Encouraged to expedite processing and improve accuracy.

Practical Examples

- Nanny Tax: If you paid your nanny $2,500 for the year, these wages must be reported, and applicable taxes paid.

- Multiple Employees: Calculate each employee's wages and total taxes separately before entering the combined values.

Filing Deadlines / Important Dates

The Schedule H form must be submitted as part of your annual tax return. The common deadlines and important dates include:

- April 15th: Standard deadline for filing Schedule H with your personal tax return.

- Extensions: An automatic six-month filing extension can be requested using Form 4868.

Alignment with Financial Year

- End of Year Preparations: Gather all wage documentation by December 31st to prepare for accurate filing.

Required Documents

Preparing various documents aids in the efficient and accurate completion of Schedule H:

- Employee Wages: Detailed records of all wages paid, including cash payments.

- Previous Tax Payments: Documentation of estimated tax payments or prepayments.

- State Contributions: Proof of state unemployment tax payments, if applicable.

Supporting Materials

- Employer Identification Numbers: Personal or business identification numbers required.

- Tax Payment Receipts: Ensure all past payments are accounted for and correctly attributed.

Penalties for Non-Compliance

Failure to correctly file Schedule H could result in significant consequences:

- Fines: Late filing or incorrect reporting may result in IRS fines.

- Interest: Accumulated interest on overdue taxes can increase payment burdens.

- Audit Risks: Non-compliance increases the chance of an IRS audit, leading to more scrutiny and possible further penalties.

Mitigation Strategies

- Timely Filings: Submitting accurate returns by the deadline can prevent penalties.

- Professional Assistance: Consider consulting a tax professional for complex tax situations or significant liabilities.