Definition & Meaning

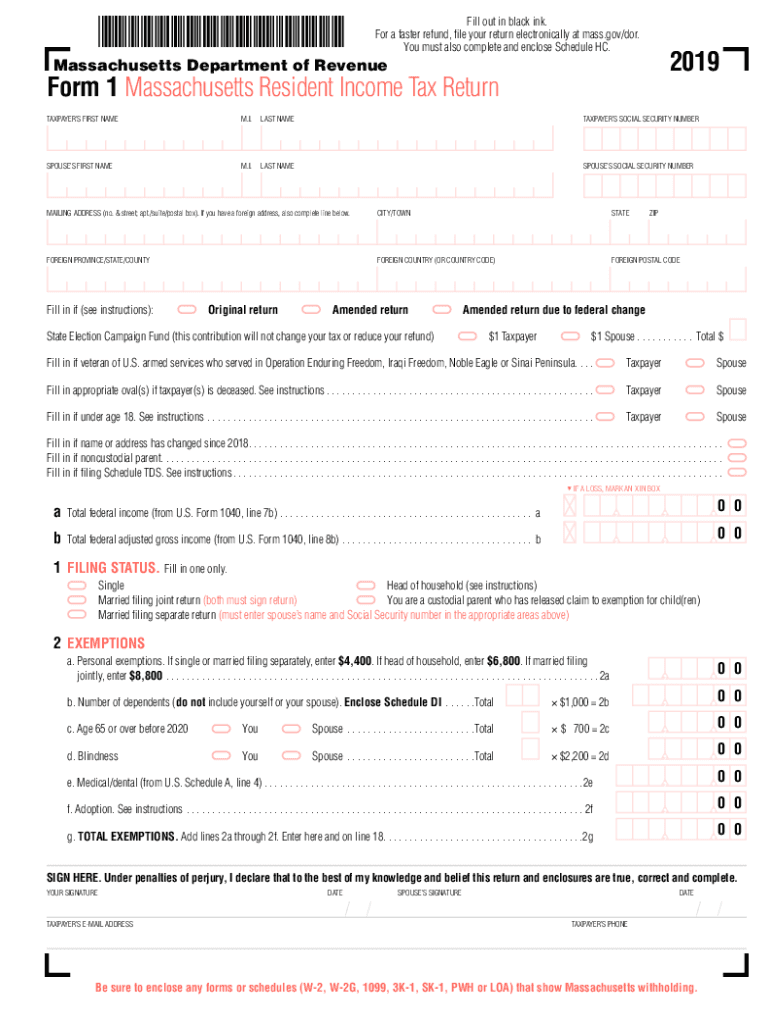

The Massachusetts state tax form 2021, specifically Form 1, is a critical document for residents filing their annual income tax returns. This form is intended for individual taxpayers, including residents who have earned income during the tax year. Completing this form allows residents to report their income, claim eligible deductions, and determine the amount of tax owed or the refund due. Additionally, it provides necessary information to the Massachusetts Department of Revenue (DOR) for processing individual state tax returns in compliance with state taxation laws.

The Massachusetts Form 1 includes various sections that require taxpayers to detail personal information, total income, adjustments, taxes owed, and credits applicable to their situation. Understanding the purpose and requirements of Form 1 is essential for accurate tax filing, ensuring that residents meet their legal obligations while maximizing eligible deductions and credits for which they qualify.

Key components of this form include:

- Personal Information: Name, address, Social Security number, and filing status.

- Income Reporting: Various types of income, such as wages, business income, and other sources.

- Deductions: Specifications on state itemized deductions or the option to take a standard deduction.

- Tax Calculation: Step-by-step determination of tax liability based on reported income and applicable tax rates.

- Credits: Opportunities to reduce tax liability through qualified credits provided by the state.

This form serves as a comprehensive guide for Massachusetts residents to navigate their state income tax responsibilities effectively.

Steps to Complete the Massachusetts State Tax Form 2021

Completing the Massachusetts state tax form 2021 requires careful attention to detail and several important steps. Here is a step-by-step guide to ensure accurate filing:

-

Gather Necessary Documentation: Before starting the form, collect all relevant financial documents, including W-2s, 1099s, and records of any other income. Additionally, have receipts for deductible expenses ready.

-

Fill out Personal Information: Complete the identification section of Form 1 with your name, address, Social Security number, and the filing status. Ensure that all information is accurate to prevent processing delays.

-

Report Your Income: In the income section, report all sources of income, including wages, interest, dividends, and business income. Total these amounts to determine your gross income.

-

Claim Deductions: Decide whether to itemize your deductions or take the standard deduction, as both options have different implications on taxable income. Provide details on any deductions claimed, such as medical expenses, state and local taxes, and mortgage interest.

-

Calculate Your Tax: Use the tax tables provided with the form to determine the tax owed based on your taxable income. Carefully follow the instructions to apply the appropriate tax rates.

-

Apply Tax Credits: Include any eligible tax credits you are claiming, such as those for child care, education, or any others. Ensure you have the necessary documentation to support these claims.

-

Review and Sign the Form: Before submission, review the completed form for accuracy. Ensure all figures are correctly added, and sign and date the form to validate it.

-

Submit the Form: Determine your method of submission. You can file electronically through approved software or mail a printed copy to the appropriate address as specified on the form instructions.

This structured approach will help ensure that taxpayers complete the Massachusetts state tax form accurately and minimize the risk of errors.

Important Terms Related to Massachusetts State Tax Form 2021

Understanding specific terminology related to the Massachusetts state tax form 2021 is essential for effective tax preparation and filing. Below are key terms commonly encountered:

-

Filing Status: Determines the tax rates and standard deductions applicable to individuals. Categories include single, married filing jointly, married filing separately, and head of household.

-

Adjusted Gross Income (AGI): Represents total income minus specific deductions, which taxpayers use to determine taxable income.

-

Deductions: Expenses that reduce taxable income, allowing taxpayers to lower their overall tax liability. Examples include standard deductions and itemized deductions.

-

Tax Credits: Direct reductions in tax liability. Unlike deductions, which reduce taxable income, credits directly lower the amount of tax owed and may be refundable or non-refundable.

-

Exemptions: Specific amounts that taxpayers can subtract from their income for themselves and dependents, reducing the taxable amount. Note that personal exemptions may differ based on recent tax laws.

-

Line Items: Specific rows or sections within the tax form where taxpayers input their data. Each line on Form 1 corresponds to different aspects of income, deductions, and credits.

These terms are integral to filling out the Massachusetts state tax form 2021 correctly and understanding the tax implications of individual financial situations.

Filing Deadlines / Important Dates

Filing deadlines for the Massachusetts state tax form 2021 are crucial for residents to ensure compliance and avoid penalties. Key dates include:

-

Tax Filing Deadline: Typically, the deadline for filing Form 1 is April 15 of the following tax year. For 2021 tax returns, the deadline is April 15, 2022.

-

Extension Requests: Taxpayers who require additional time can file for an automatic extension, typically extending the deadline to October 15. This extension must be requested by the original April deadline.

-

Payment Deadline: If taxes are owed, payment is also due by the original tax filing deadline to avoid interest and penalties.

-

Amended Returns: If you discover errors in your filing after submission, you can file an amended Form 1. The deadline for amended returns typically follows the same timeline as the original return.

Adhering to these deadlines is vital for maintaining good standing with the Massachusetts Department of Revenue and ensuring timely processing of tax returns.

Who Typically Uses the Massachusetts State Tax Form 2021

The Massachusetts state tax form 2021 is primarily used by residents who meet specific criteria. Understanding the typical users of this form provides insight into its applications:

-

Individual Taxpayers: The primary users are Massachusetts residents who earn taxable income from various sources, including wages, self-employment, investments, and pensions.

-

Dependents: Individuals who are dependents on another taxpayer's return may use Form 1 if they have sufficient income that necessitates filing.

-

Self-Employed Individuals: Those who operate a business as sole proprietors must report their income using Form 1 to comply with state tax laws.

-

Retirees: Seniors receiving pension income or Social Security benefits may need to fill out Form 1 to report their income accurately for Massachusetts tax purposes.

-

Students: Students working part-time or who might have scholarships that exceed tuition costs may also file using Form 1 if they meet the income thresholds set by state law.

Each of these groups may have distinct tax considerations, emphasizing the importance of accurately completing Form 1 to ensure compliance with Massachusetts tax regulations.