Definition & Meaning

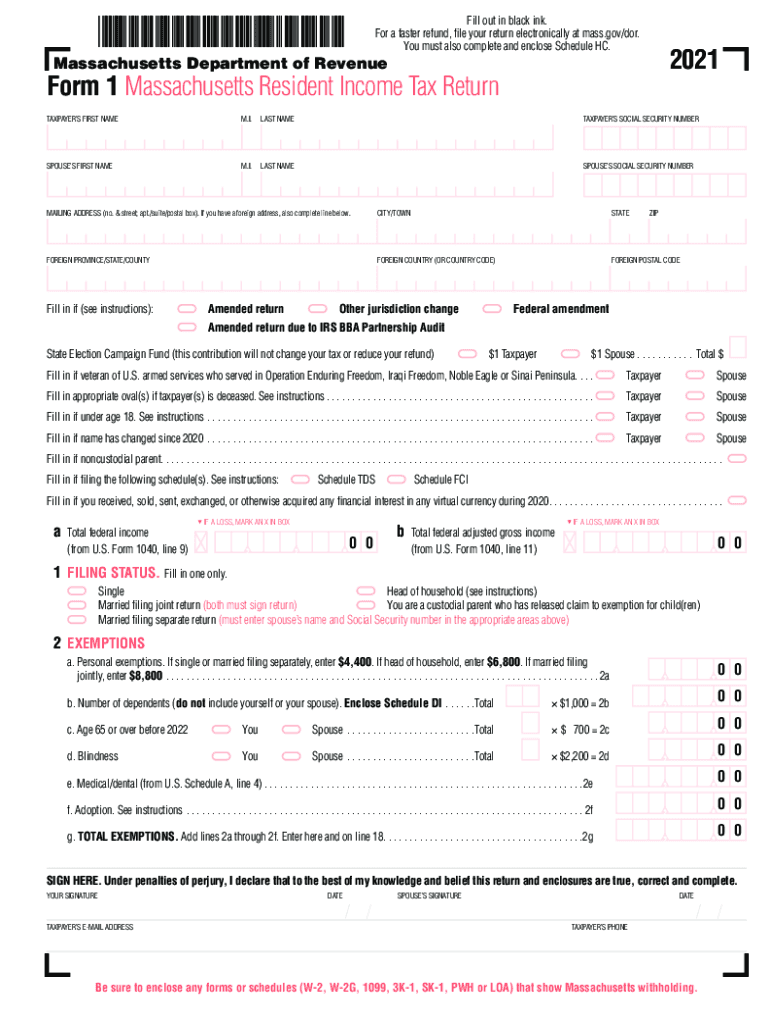

The Massachusetts Form 1 is a resident income tax return used by individuals who reside in Massachusetts. It is essential for reporting income, claiming deductions, and calculating tax liabilities for the state. The form is designed for individual taxpayers and allows them to provide necessary personal information, income details, and any applicable tax credits. Understanding the specific requirements and sections of the Massachusetts Form 1 is crucial for accurate filing.

Key Components of Massachusetts Form 1

- Personal Information: Taxpayers must provide their name, current address, Social Security number, and filing status.

- Income Reporting: This section requires detailed reporting of all income sources, including wages, interest, and dividends.

- Deductions and Credits: Taxpayers can claim various deductions, such as those for health care coverage, and credits, which directly reduce tax owed.

- Tax Calculation: After reporting income and deductions, taxpayers calculate their tax due or refund expected.

Steps to Complete the Massachusetts Form 1 Fillable PDF

Filling out the Massachusetts Form 1 fillable PDF requires careful attention to detail and organization. Here are the essential steps involved:

-

Download the Form: Obtain the Massachusetts Form 1 fillable PDF from a reliable source, ensuring it is the current version for the year you are filing.

-

Fill Out Personal Information: Enter your name, address, and Social Security number accurately at the top of the form.

-

Report Income: Input all sources of income in the designated sections. Be thorough—missing income could lead to penalties or delays.

-

Claim Deductions and Credits: Identify applicable deductions and tax credits, such as medical expenses or education tax credits, ensuring all documentation is on hand to support your claims.

-

Calculate Your Tax: Complete the sections for tax calculations by following instructions carefully, ensuring you include all necessary figures.

-

Review Your Submission: Double-check all entries for accuracy. Errors could lead to issues with your tax return and refund.

-

Submit the Form: Decide whether to file electronically or print and mail your completed form, following submission guidelines specific to Massachusetts.

Important Terms Related to Massachusetts Form 1

Understanding terminology associated with the Massachusetts Form 1 is vital for accurate completion and compliance.

- Filing Status: Defines an individual's status for tax purposes (e.g., single, married filing jointly, head of household).

- Deductions: Allowable expenses that reduce taxable income, including standard and itemized deductions.

- Tax Credit: A dollar-for-dollar reduction in tax owed, which can include credits for children and education.

- Withholding: The amount withheld from a taxpayer's paycheck for state taxes throughout the year, impacting overall tax owed.

By familiarizing yourself with these essential terms, you will navigate the Massachusetts Form 1 more effectively.

How to Obtain the Massachusetts Form 1 Fillable PDF

The Massachusetts Form 1 fillable PDF can be obtained through various official sources:

- Massachusetts Department of Revenue Website: This is the primary source for obtaining the most up-to-date form.

- Tax Preparation Software: Many tax software programs provide access to state forms including the Massachusetts Form 1, often integrated into their filing systems.

- Local Libraries and Tax Assistance Sites: Physical copies and possibly fillable versions may be accessible at community resources assisting with tax preparations.

Prioritize acquiring the most recent version of the form to ensure compliance with current tax regulations.

Filing Deadlines / Important Dates

Taxpayers need to be aware of critical deadlines associated with the Massachusetts Form 1 to avoid penalties:

- Tax Filing Deadline: Typically due on April 15 of each year, taxpayers should confirm if this date falls on a weekend or holiday, in which case the deadline may shift.

- Extensions: If additional time is needed to file, Massachusetts residents can apply for an extension, although tax payments owed must still be submitted by the original deadline.

- Refund Timing: Understanding when to expect refunds after electronically filing versus mailing a paper return can prevent unnecessary confusion.

Staying informed about these deadlines is crucial for timely and compliant tax submission.