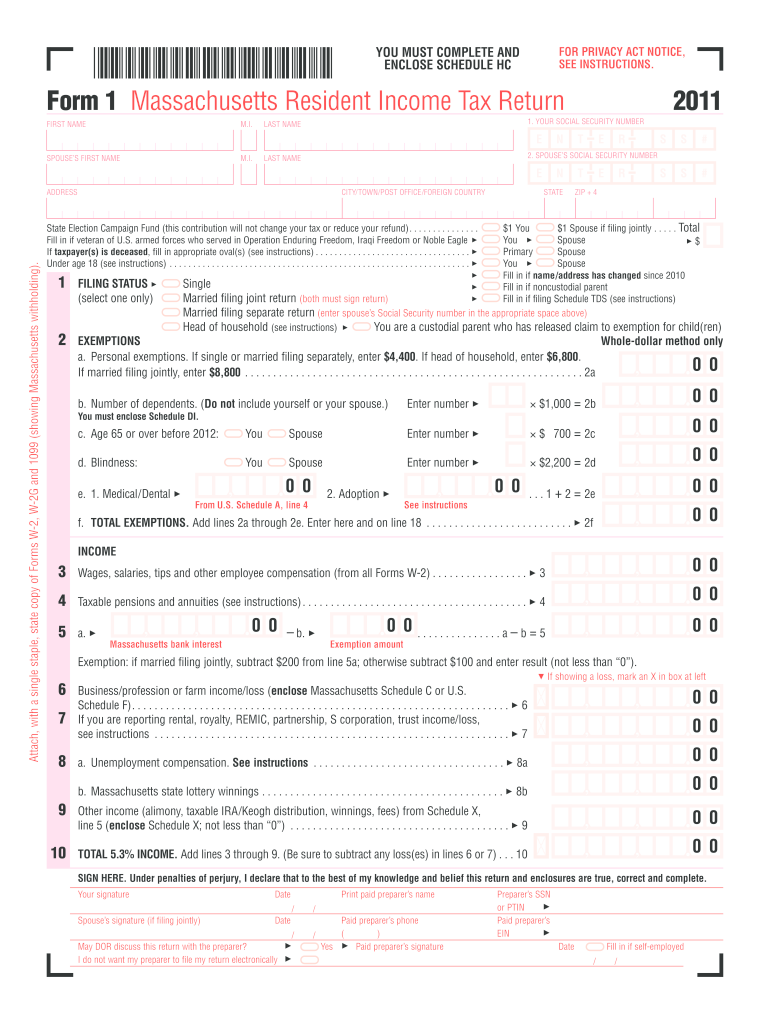

Definition and Meaning of the 2011mass Schedule HC Form 2011

The 2011mass Schedule HC form is a key document for Massachusetts residents filing their state income tax returns. Specifically, it pertains to health care information, allowing taxpayers to report compliance with the state's health care coverage requirements. In 2011, Massachusetts mandated that residents ensure they maintain health insurance coverage throughout the year, and this form is used to capture that compliance.

Essentially, the form helps determine whether individuals met the health insurance mandate during the tax year. Failing to comply with this requirement could lead to penalties, making the accurate completion of this form essential for all taxpayers in Massachusetts.

How to Use the 2011mass Schedule HC Form 2011

Using the 2011mass Schedule HC form involves several steps to ensure that all health care coverage information is accurately reported. First, taxpayers need to gather relevant documentation regarding their health insurance coverage throughout the year. This includes:

- Insurance policy details: names of the coverage providers, policy numbers, and dates of coverage.

- Forms from health insurance providers: such as 1099-HC, which provides details on the type of coverage and months of enrollment.

Once the necessary information is collected, the taxpayer should complete the form according to the provided instructions, including:

- Filling out personal information: This includes your name, Social Security number, and address.

- Detailing coverage: Indicate the type of health coverage you had for each month, whether through your employer, Medicaid, Medicare, or private insurance.

- Submitting the form: The completed form gets attached to your Massachusetts state income tax return and filed with the state.

It is critical that all information is accurate to avoid delays or issues with processing your tax return.

Steps to Complete the 2011mass Schedule HC Form 2011

Completing this form requires careful attention to detail. Here is a step-by-step guide on how to fill it out:

- Personal Information: Enter your name, Social Security number, and address at the top of the form.

- Coverage Information:

- Identify the health insurance provider.

- Enter the information regarding the months you had coverage and include your policy number.

- Reporting Exemptions: If you did not have coverage for any part of the year, indicate if you qualify for an exemption and specify the reason.

- Signature and Date: Ensure to date and sign the form after reviewing all entered information for accuracy.

- Filing the Form: Attach this form to your tax return and either file electronically or mail it to the state revenue department.

Following these steps thoroughly will help avoid penalties and ensure compliance with Massachusetts state health care requirements.

Important Terms Related to the 2011mass Schedule HC Form 2011

Understanding key terms related to the 2011mass Schedule HC form is essential for proper tax filing. Here are important terms to know:

- Health Insurance Mandate: A requirement in Massachusetts that residents have health insurance or face penalties.

- 1099-HC: A form provided by health insurance companies indicating the months of coverage and the extent of the individual’s coverage.

- Exemption: Situations that permit a taxpayer to not meet the health coverage requirement without facing penalties.

- Penalty: A fee imposed on individuals who do not comply with the health insurance mandate.

Familiarizing yourself with these terms can assist in navigating the form and the responsibilities tied to it.

Who Typically Uses the 2011mass Schedule HC Form 2011

The 2011mass Schedule HC form is primarily used by Massachusetts residents who are filing their state income tax returns. Specific demographics who may need to use this form include:

- Individuals with Health Insurance: Those who maintained continuous coverage through employers, government assistance, or individual plans during the tax year.

- Individuals Seeking Exemptions: Taxpayers who did not have health insurance at any point during the year but qualify for exemptions.

- Self-Employed Individuals: Freelancers or business owners must detail their coverage to ensure compliance with health insurance laws.

Knowing the target audience for this form helps clarify its purpose and the importance of accurate completion.

Filing Deadlines and Important Dates Related to the 2011mass Schedule HC Form 2011

For taxpayers, being aware of crucial deadlines is critical to avoid penalties. The important dates related to the 2011mass Schedule HC form include:

- Filing Deadline: Typically, Mass residents must file their tax returns, including the Schedule HC, by April 15. However, extensions for filing may be available, so checking current regulations is wise.

- Health Insurance Reporting: Coverage must be maintained throughout the year, and any gaps must be reported on the form.

Staying informed of the deadlines helps ensure compliance and avoids any potential fines associated with late filings.

Legal Use of the 2011mass Schedule HC Form 2011

The 2011mass Schedule HC form is sanctioned by the Massachusetts Department of Revenue and is a legally mandated document for tax filings. Legal implications of accurate completion include:

- Tax Compliance: Failing to file the Schedule HC may result in penalties, which can increase financial burdens.

- Health Care Verification: The form acts as documentation to demonstrate compliance with state health care laws, which can be essential for legal and financial records.

Understanding the legal ramifications emphasizes the importance of thorough and accurate reporting on this form.