Definition and Overview of the Massachusetts Form

The Massachusetts form is a specific document used for various purposes related to tax filings, legal matters, or other official state requirements. It plays a crucial role in ensuring compliance with state laws and regulations. This form may include tax return filings, legally binding agreements, or application submissions, depending on its intended use. Understanding its definition is essential for both individuals and businesses as it lays the foundation for the effective completion and submission of the document.

Common Types of Massachusetts Forms

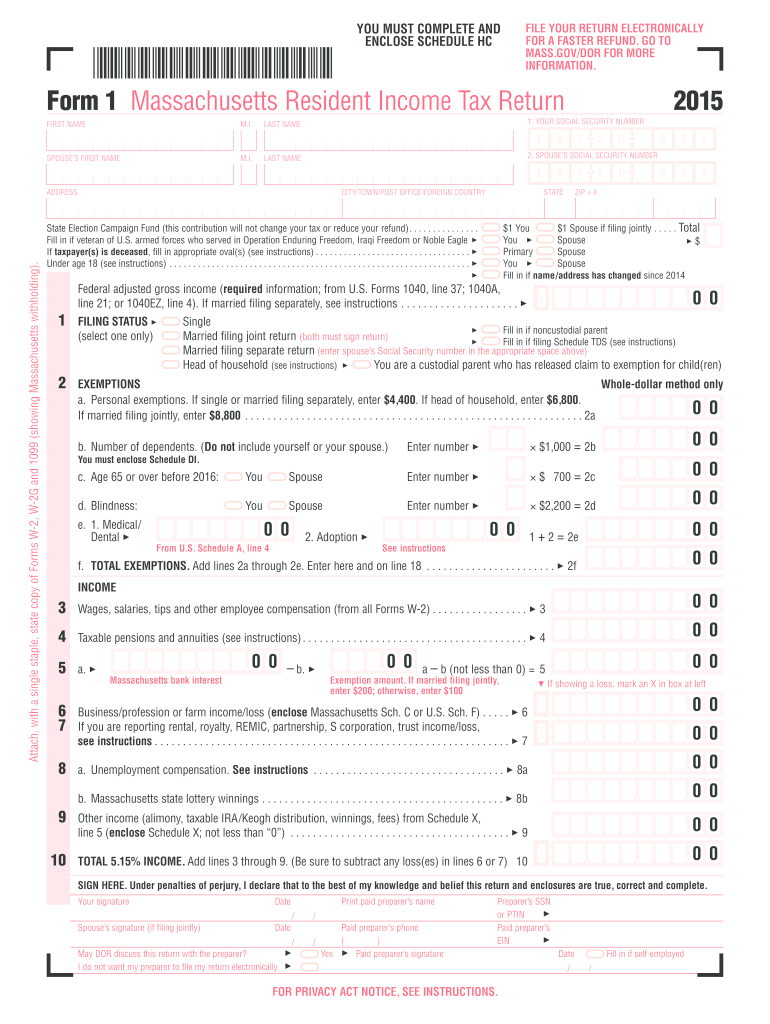

- Tax Forms: Used for filing state income taxes, including the Massachusetts Resident Income Tax Return.

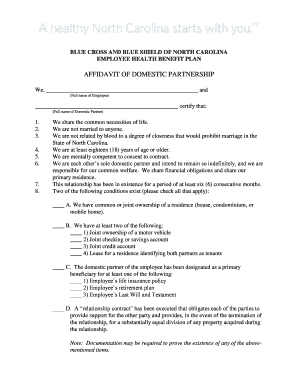

- Legal Forms: Documents such as wills or power of attorney which require adherence to Massachusetts state laws.

- Application Forms: Used for permits, licenses, or other official requests within the state's jurisdiction.

Steps to Complete the Massachusetts Form

Completing the Massachusetts form demands attention to detail and an understanding of the specific requirements that apply. The process generally involves several key steps that ensure accurate and compliant submissions.

-

Gather Necessary Information:

- Collect personal or business-related information, such as identification numbers, income details, and relevant documentation.

- For tax forms, gather documents like W-2s, 1099s, and other income statements.

-

Obtain the Correct Form:

- Access the appropriate Massachusetts form from official state websites or trusted tools like DocHub.

- Ensure you are using the most up-to-date version of the form relevant to the year and purpose.

-

Fill Out the Form:

- Carefully enter all required information, double-checking for accuracy.

- Utilize any tips or guidelines provided with the form to avoid common pitfalls.

-

Review and Verify:

- Once completed, review all entries for mistakes.

- Consider consulting a tax professional or legal advisor if the form is particularly complex.

-

Submit the Form:

- Follow the designated submission methods outlined for the form, whether online, via mail, or in-person.

- Confirm that any required documents are attached with the submission.

Important Terms Related to the Massachusetts Form

Understanding relevant terminology can help navigate the complexities of completing and submitting the Massachusetts form. Familiar terms include:

- Filing Status: Indicates the category under which a tax return is filed, such as single, married filing jointly, or head of household.

- Exemptions: Specific allowances that reduce a taxpayer’s taxable income based on personal circumstances or dependents.

- Deductions: Costs that can be subtracted from overall income to determine taxable income, which are often itemized on tax returns.

These terms, among others, frame the context in which the Massachusetts form is used, impacting both its completion and the subsequent legal or financial repercussions.

Filing Deadlines and Important Dates

Meeting deadlines is critical when it comes to the Massachusetts form. Filing deadlines can vary based on the type of form being submitted. These key dates are essential to ensure compliance and avoid penalties:

- Individual Income Tax Returns: Typically due on the fifteenth day of the fourth month following the end of the tax year.

- Extensions: Taxpayers may request an extension, which generally allows for an additional six months for completion.

Failing to adhere to deadlines can result in late penalties or interest charges, emphasizing the importance of staying informed about these critical dates.

Who Typically Uses the Massachusetts Form?

The Massachusetts form serves a wide range of individuals and organizations, each with specific filing requirements:

- Individual Taxpayers: Individuals filing personal income tax returns.

- Businesses: Corporations, partnerships, and LLCs filing state tax returns or other related documents.

- Attorneys and Legal Professionals: When processing legal documents such as wills or power of attorney.

Recognizing the diverse user base can help streamline the process, ensuring that each individual or entity has the necessary tools and information for timely and effective use.